Cryptocurrencies have evolved into a $1.50 trillion business and are bringing disruption with blockchain across the globe. The most important similarity between crypto exchanges and traditional stock and commodities exchanges is that in the same way, they are a means for users to buy and sell digital assets.

What are Cryptocurrency Exchanges?

A cryptocurrency exchange platform operates like stock exchanges which helps the investors to buy and sell in digital currencies like Bitcoin, Ethereum, or Tether. These operate on digital marketplace like through mobile apps or as part of the desktop functions just like e-brokerages. They also offer different trading and investing tools to some of its users.

The crypto exchange also allows trading of many cryptocurrency such as lending trading or margin, and future and options trading.

To give their customers these countless offerings, the crypto exchanges charge some type of fee for your transactions that can be either based on the volume of your transaction or dependent upon which kind of trade you carried out. Before crypto exchanges, the investors were only receiving crypto via mining or by organizing transactions in many online and offline forums. But now, there are hundreds of cryptocurrency exchanges available that are operating worldwide and offering many digital currencies with varying levels of fee structure and security.

Unlike any other traditional stock or commodity markets, where crypto exchange fees have been reduced in the last few years, crypto trading usually costs more.

Note: The ideal cryptocurrency exchange will make everything easy for you like trading currencies that you wish with truncated fees structure and reliable security features.

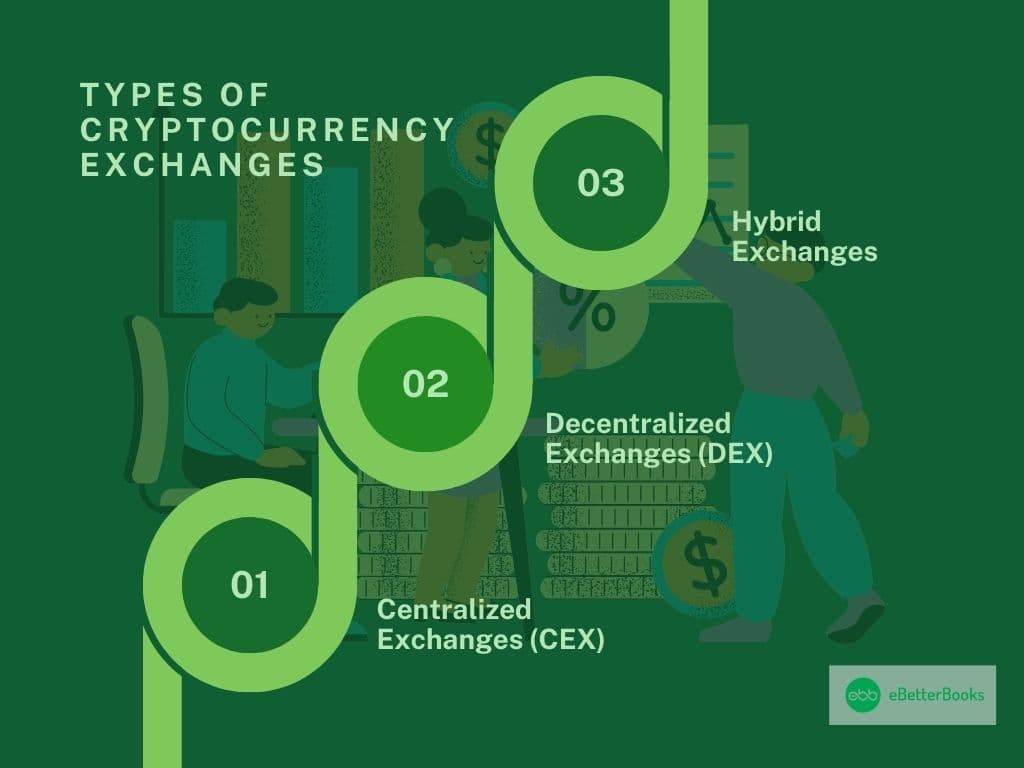

Types of Cryptocurrency Exchanges

1. Centralized Exchanges (CEX)

Centralized exchanges perform as an intermediary between a seller and a buyer and make money via commissions and transactions fees. You can think of a centralized exchange to be as similar as a stock exchange but for digital assets.

Some of the leading crypto exchanges are Coinbase Exchange, Binance, KuCoin and Kraken. Similar to the stock trading websites or apps, all these exchanges allow the investors of cryptocurrency to buy and sell digital assets at the prevailing price, known as spot, or to leave orders which get executed when the assets reach the investor’s desired price target, known as limit orders.

Centralized exchanges work using an order book system, which means that buy and sell orders are sorted and listed by the intended buy or sell price. The matching engine of the exchange then matches the buyers and sellers based on the best executable price given the desired lot size. Therefore, the price of the digital assets will depend on the demand and supply of that asset versus another, whether it be cryptocurrency or fiat currency.

Centralized exchanges choose on which digital asset they will allow trading in, which gives a small measure of comfort that unscrupulous digital assets might get excluded from the CEX.

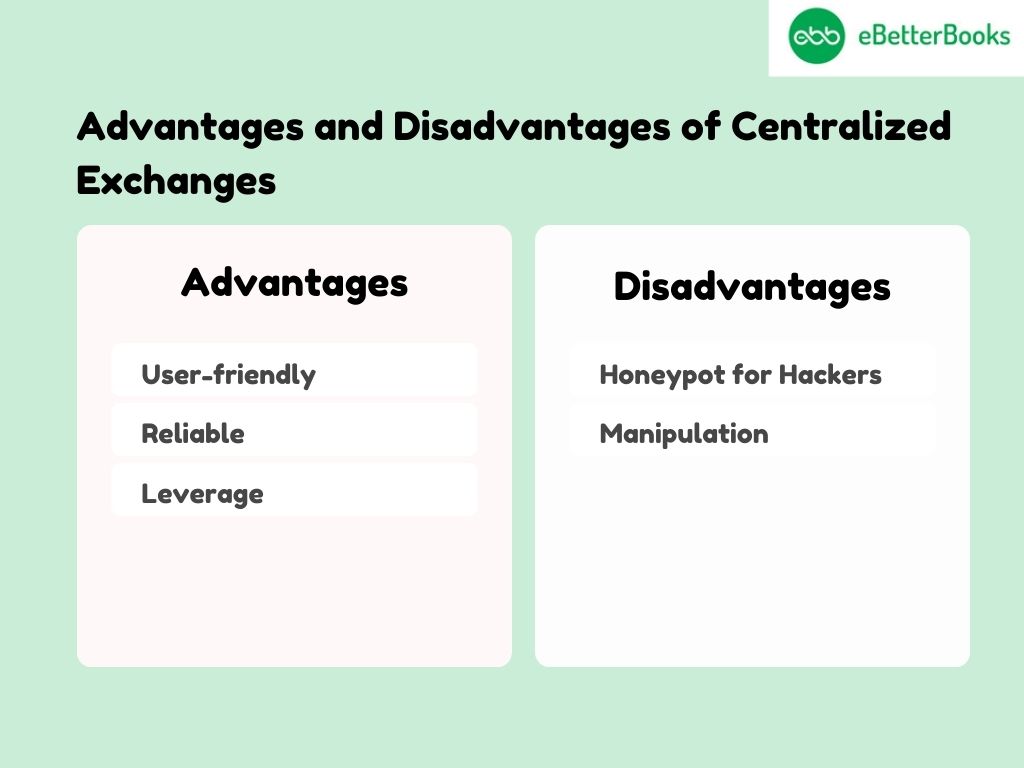

Advantages of Centralized Exchanges

1. User-friendly

Centralized exchanges provide beginner investors a familiar way of trading and investing in cryptocurrencies. As opposed to using crypto wallets and peer-to-peer transactions, which can be difficult, users of centralized exchanges can log into their accounts, view their account balances, and make transactions via applications and websites.

2. Reliable

Centralized exchanges provide high security and reliability when it comes to transactions and trading. By facilitating the transaction via a developed, centralized platform, most centralized exchanges offer a higher level of comfort.

3. Leverage

Another benefit of some centralized exchanges is the option to leverage your investment using the borrowed money from the exchange, known as margin trading. It allows investors to reap higher returns, but all the losses can be amplified.

Disadvantages of Centralized Exchanges

1. Honeypot for Hackers

CEX is accountable for billions of trades per day and stores all the valuable user data across centralized servers. Hackers choose them over other types of cryptocurrency trading platforms for this reason alone – the most well known hacks have been aimed at centralized exchanges, including BitFinex, Mt. Gox, and Cryptopia.

2. Manipulation

There are certain centralized exchanges that have been accused of manipulating trading volume, participating in insider trading, and performing other acts of price manipulation.

2. Decentralized Exchanges (DEX)

Unlike Centralized exchanges, decentralized exchanges (also called DEX) function as self-driving smart contracts that operate on real public ledger infrastructure. They let users engage in direct trade of cryptocurrency without involving central authority.

Centralized exchanges are often exclusive to participants within certain jurisdictions, require licensing, and ask participants to verify their identity (KYC: know your customer). Unlike the centralized ones, decentralized exchanges are fully autonomous, anonymous, and have no need for those things. Several decentralized exchanges exist today, which we can categorize into three types: On-chain order books, off-chain order books, and automated market makers.

Advantages of Decentralized Exchanges

1. Custody

The users of decentralized exchanges do not have to move their assets to another third party platform. In such a case, a company or an organization cannot be hacked, and users shall enjoy even more security against hacking, failure, fraud, or theft.

2. Market Abuse

Since decentralized exchanges grant buying and selling of cryptocurrencies directly from one peer to another, it eliminates cases of market manipulation such as fake trading and wash trading.

3. Less Censorship

Most decentralized exchanges do not force customers to complete know-your-customer (KYC) forms unlike the traditional centralized exchanges. DEXs do not have filter mechanisms, so there are many more cryptocurrencies and digital computational assets than CEX. It is a fact that most Altcoins are only traded on DEXs.

Disadvantages of Decentralized Exchanges

1. Complexity

Something that users of decentralized exchange have to deal with is remembering their keys and passwords to wallets or otherwise their assets are lost forever and cannot be gotten back. If you want to make a trade, you have to first learn and get acquainted with the trader and the process, while centralized markets provide a more convenient and easy way for the exchange.

2. Lack of Fiat Payments

DEXs are best suited for investors who are searching to convert from one digital asset to another and it is not for someone who are searching to buy or sell digital assets with fiat currency, called on and off-ramping. It became less convenient for the users who do not already have cryptocurrencies.

3. Liquidity Struggles

99% of the crypto transactions are facilitated by centralized exchanges, which define that they are responsible for the majority of the trading volume. Because of lack of volume, decentralized exchanges frequently lack liquidity, and it gets very difficult to find buyers and sellers when the trading volumes are low.

3. Hybrid Exchanges

A hybrid exchanges combines all the strengths of CEX and DEX. They give the convenience of centralized exchanges while keeping the privacy of decentralized exchanges. All these are new concepts which are still gaining transactions among the crypto investors.

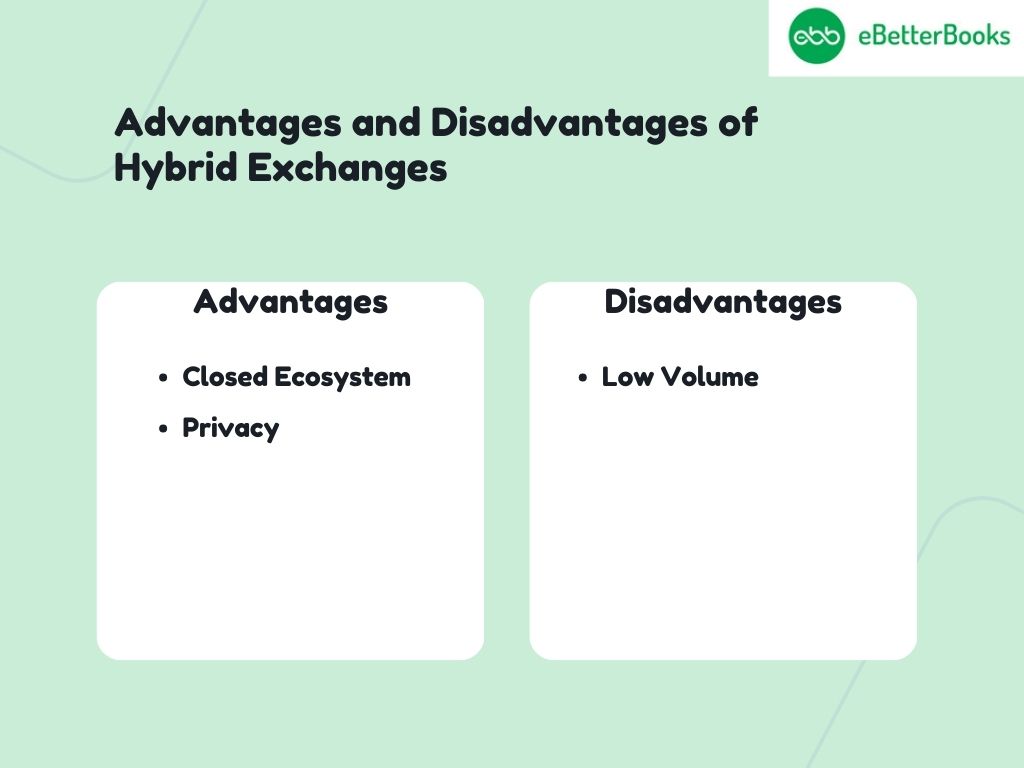

Advantages of Hybrid Exchanges

1. Closed Ecosystem

A hybrid exchange has the ability to work in a closed ecosystem. Organizations can be assured of the privacy of their information while taking the advantage of blockchain technology.

2. Privacy

Private blockchains are majorly used for privacy-related use cases in trade for limiting communication with the public. Through hybrid exchange the privacy of a company can be protected while allowing it to communicate with shareholders.

Disadvantages of Hybrid Exchange

1. Low Volume

Hybrid exchanges have been around for a short while now. They still don’t have the required volume to become the go-to platforms for buying and selling digital assets. Having low volume makes them a very easy target for price manipulation.

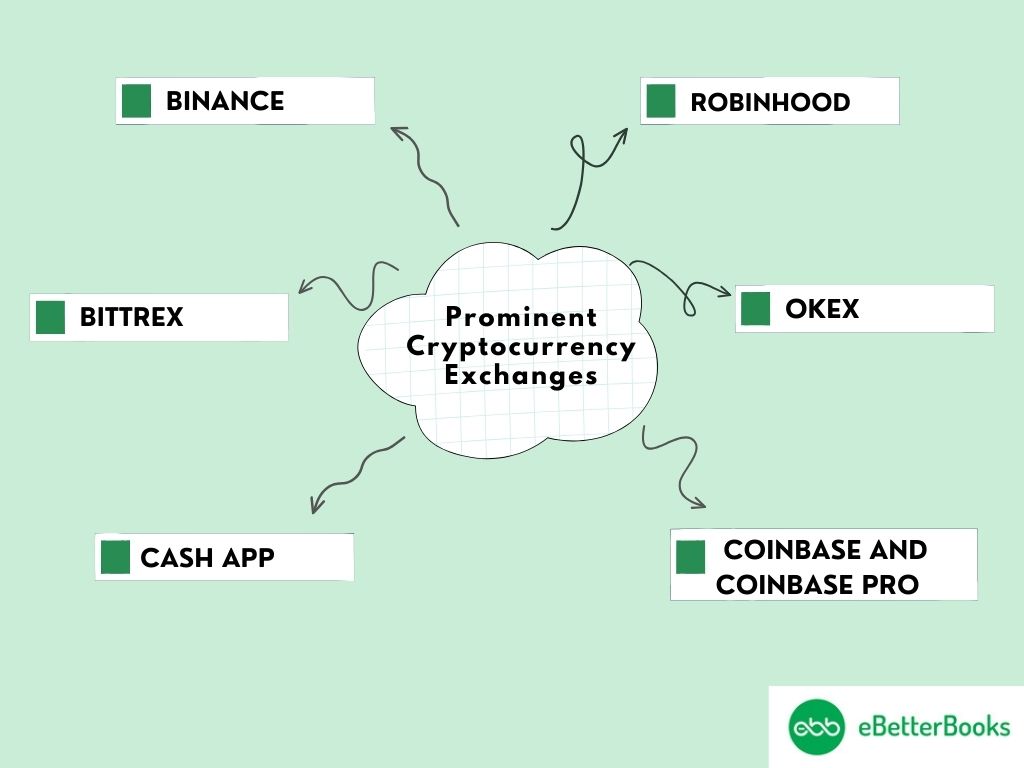

Prominent Cryptocurrency Exchanges

Below given are some prominent crypto exchanges, according to liquidity, traffic, and trading volumes:

1. Binance

Binance is Changpeng Zao’s brainchild, he is a developer who holds an experience in building trading systems which was used in the Tokyo Stock Exchange. Binance mostly holds crypto-to-crypto trades, which states that only a limited number of cryptocurrencies can be bought utilizing the fiat currencies. Currently, Binance takes over the exchange space with over $72.63 billion USD of the daily crypto trading volume.

The exchange has a different branch for U.S. customers, that is known as the Binance U.S. It authorizes U.S. citizens to make trades for specific approved cryptocurrencies. It also has a native $BNB token which is utilized for transactions on the platform that can significantly lower the cost of trading.

Binance Fee: Binance charges a taker and maker fee around 0.015% to 0.75% and a trading fee of 0.01%

2. Bittrex

Bittrex is a small to mid-sized exchange situated in Washington State, USA, that accepts fiat withdrawals and deposits. The platform is known for its security. This is due primarily to the founding team’s competence in information technology, which includes Bill Shihara, Richie Lai, and Rami Kawach. Bittrex has partnered with Jumio, an identity verification solution provider that serves over 200 countries.

The exchange is one of the main platforms for bitcoin asset support, allowing customers to convert fiat dollars into a wide range of cryptocurrencies. Bittrex serves as both an exchange and an online wallet for a variety of cryptocurrencies.

Bittrex Fee: The exchange charges a taker and maker fee, which is between 0.08% – 0.20%.

3. Cash App

Cash App is part of Square, Inc. It began as a money transfer network, comparable to PayPal or Venmo. The platform grew to include financial services, allowing users to invest in stocks, ETFs and cryptocurrencies. Cash App is available in two countries: the United States and the United Kingdom, and it solely supports Bitcoin.

Cash App’s user-friendly layout makes it perfect for beginners and first-time investors. Cash App allows users to withdraw cryptocurrency investments to their wallets, which is not available on services such as Venmo or Robinhood.

Cash App Fee: The platform charges a service fee for each transaction, as well as an additional cost based on price volatility among US cryptocurrency exchanges.

4. Robinhood

Robinhood is well-known for providing commission-free trades of stocks and exchange-traded funds through its mobile app.The company’s name is derived from its objective to provide everyone with access to the financial markets, not just the wealthy. On January 25, 2018, Robinhood established a queue for commission-free cryptocurrency trading, and the platform currently supports trading of over 5 cryptocurrencies, including Ethereum, Bitcoin, Dogecoin, and others.

Robinhood Fee: The platform does not charge any fee for buying and selling cryptocurrency.

5. OKEx

OKEx is a Malta-based cryptocurrency brokerage and trading platform that lets customers buy and sell cryptocurrency. Additionally, it provides a variety of cryptocurrencies for trading on several spot and derivative markets. Along with lending and borrowing cryptocurrency, the exchange also offers mining pools and staking services.

With a few noteworthy exceptions, OKEx serves major nations, including Malaysia, the United States, Hong Kong, and 10 other nations. To facilitate user-to-user trading, OKEx also operates a C2C (Customer to Customer) trading system.

OKEx Fee: The platform works on a taker and maker fee that fluctuates between 0.060% and 0.100%

6. Coinbase and Coinbase Pro

Coinbase is considered as one of the most popular and best crypto exchanges in the United States. This cryptocurrency exchange is a fully regulated and licensed platform for cryptocurrency trading that can function in more than 100+ countries. It is easy to navigate, and Coinbase significantly reduces entry hindrances, unclear and complex for newbies and experts alike.

However, over the years investors have experienced awful fraudulent exchanges and even Ponzi coins in the crypto market whereas Coinbase has not been involved in most of these issues. It also has insured custodial wallets to ensure the trader and investor investments are safe from vulnerabilities.

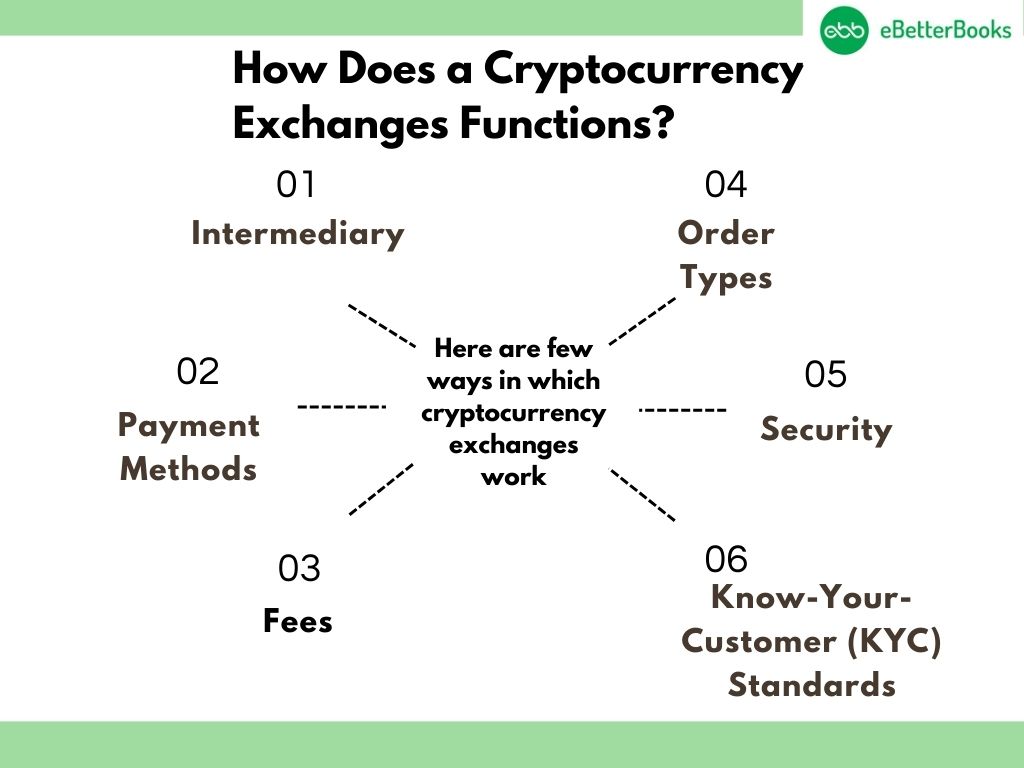

How Does a Cryptocurrency Exchanges Functions?

Here are few ways in which cryptocurrency exchanges work:

- Intermediary:

Exchanges connect buyers and sellers, facilitating the exchange of cryptocurrencies and fiat money.

- Payment Methods:

Credit cards, wire transfers, and bank transfers are all acceptable payment options at exchanges.

- Fees:

Exchanges may charge fees for their services, including transaction charges and currency conversion costs.

- Order Types:

Market orders execute trades instantaneously at the current market price, while limit orders define a price at which to transact.

- Security:

To protect customer cash offline, reputable exchanges store the majority of them in cold hardware wallets.

- Know-Your-Customer (KYC) Standards:

To open an account, exchanges need users to give personal information as well as evidence of identity.

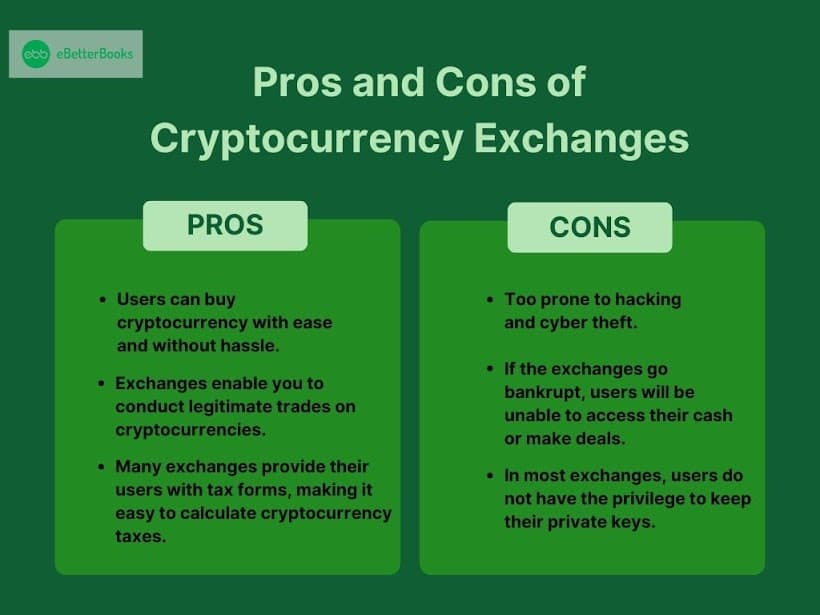

Pros and Cons of Cryptocurrency Exchanges

Pros:

- Users can buy cryptocurrency with ease and without hassle.

- Exchanges enable you to conduct legitimate trades on cryptocurrencies.

- Many exchanges provide their users with tax forms, making it easy to calculate cryptocurrency taxes.

Cons:

- Too prone to hacking and cyber theft.

- If the exchanges go bankrupt, users will be unable to access their cash or make deals.

- In most exchanges, users do not have the privilege to keep their private keys.

Are there Red Flags to Watch Out For?

Yes. The following could indicate that a cryptocurrency exchange provides a considerable degree of danger to a potential customer.

The exchange is incorporated or based outside of the United States. This may make it difficult for you or the authorized authorities to investigate the exchange or take legal action against it.

The exchange is not a registered securities broker, depository, or money transmitter. It is important to note that registration does not ensure the exchange’s safety or stability. For example, FTX is registered as a money transmitter.

To learn more about registrations, check out the following resources:

- FINRA Broker Check to discover whether a specific firm is a registered securities broker.

- Federal Financial Institutions Examination Council National Information Center: to determine if an exchange is registered as a depository institution.

- Only registered money transmitters are legally permitted to conduct money transfers or other financial transactions in the United States. Check the Financial Crimes Enforcement Network to see if an exchange is registered as a money transmitter.

- The exchange does not disclose what it does with your assets. If the exchange lends your money to high-risk businesses, there may be serious consequences. Risky lending contributed to the failure of FTX and Voyager. If the exchange rehypothecates or commingles your assets, you may be unable to reclaim your funds if the exchange goes bankrupt.

- The exchange has a little web or social media presence. This could indicate that it was set up swiftly by scammers. It could also be a red flag if the exchange’s website contains mistakes or misspellings.

- Someone you don’t know approached you on social media about investing in cryptocurrencies through the firm. Scammers frequently approach their intended victims on social media, pitching bogus cryptocurrency investment schemes.

- The firm’s wallets cannot be easily found on the blockchain. Solvent exchanges will occasionally provide verification of their bitcoin reserves. If an exchange conceals its wallet addresses or reserves, it could indicate that it is undercapitalized or illegal.

- The exchange has previously stopped or halted consumer withdrawals. While a withdrawal freeze may be a technical issue, exchanges that have liquidity difficulties (such as corporations running out of the assets required to honor consumer withdrawals) sometimes block withdrawals. For example, claims revealed that the bitcoin exchange Voyager had suspended customer withdrawals around a week before filing for bankruptcy. It was generally reported that FTX banned customer withdrawals prior to filing for bankruptcy.

- The exchange either lacks a customer care department or makes it difficult to contact customer service.

Bottom Line

The simplest and efficient means for the exchange of cryptocurrency involve the use of a cryptocurrency exchange. Although it might seem very convenient \ there are more than 200 exchanges globally, which are into business, and it may not be easy to identify the exchange that will suit your needs.