What are Crypto ATMs / Bitcoin ATMs?

Crypto ATMs, also known as Bitcoin ATMs or BTMs, are electronic kiosks that allow customers to make financial transactions, but they’re designed for cryptocurrency rather than cash. In contrast with conventional terminals that are linked to a bank for traditional money to be cashed out and deposited, the cryptocurrency terminal is directly connected to blockchains.

These machines let users purchase cryptocurrencies like Bitcoin, Ethereum, Litecoin, Ripple etc. using cash or a card and some models of bitcoin machines allow you to sell cash for Bitcoin. Crypto ATMs are owned and operated by third-party companies, with the two largest networks being Coinhub and Coinme. Being user friendly and compatible with multiple languages they are created to meet the need of novices as well as experienced traders in the sphere of cryptocurrency.

The first Bitcoin ATM was launched in 2013 in Vancouver of Canada. Since then, the average of Bitcoin ATMs globally has risen worldwide due to the popularity of the decentralized financial application (DeFi) and the expansion of cryptocurrency usage in daily operations.

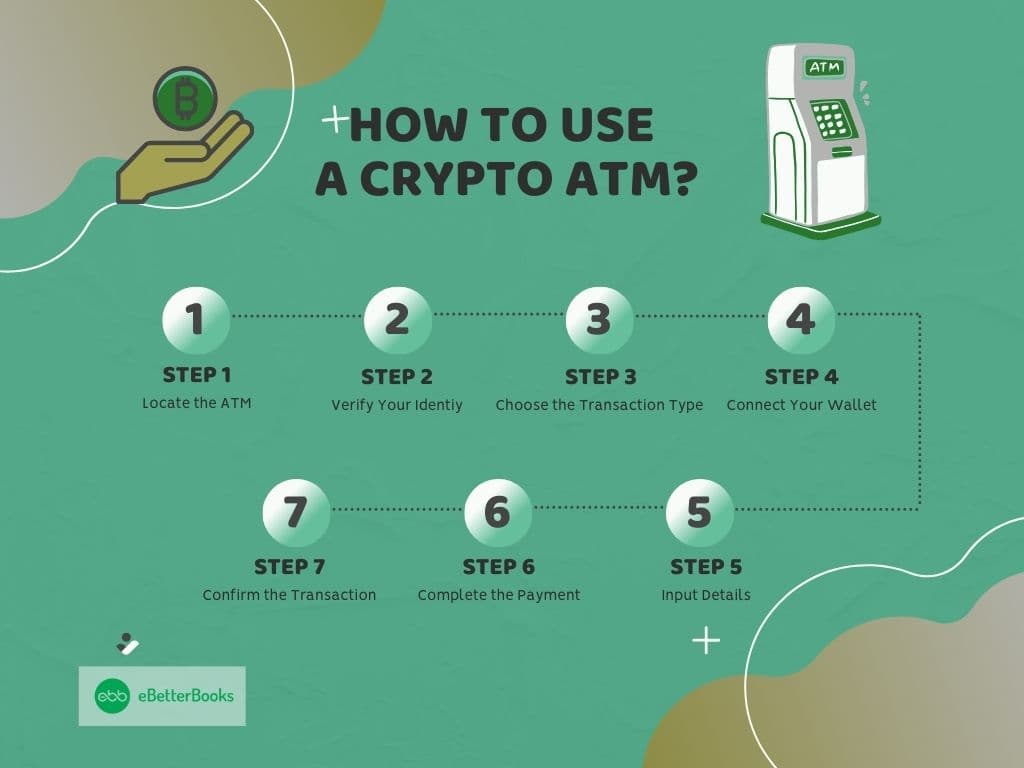

How to Use a Crypto Automated Teller Machines (ATMs)

Using a Crypto ATM / Bitcoin ATM is simple and typically involves the following steps:

- Locate the ATM: Search for a nearby crypto ATM in directories or applications on the Internet. Find out if the specific machine supports the kind of cryptocurrency transaction you are interested in.

- Verify Your Identity: Concerning the local laws, most of the crypto ATMs ask the users to prove their identity through an ID, phone number, or in some cases, biometrics.

- Choose the Transaction Type: Choose if you wish to go long or short on a particular cryptocurrency.

- Connect Your Wallet: Before that you have to link it for the transaction, the scan the crypto wallet’s QR code that is available on the ATM scanner.

- Input Details: To do this enter the amount of money you want to transact on then verify that it falls within the limits of the ATM limit.

- Complete the Payment: For purchases, pay cash or using a debit/credit card to make further payments. As for sales, the ATM is going to take the cryptocurrency from your wallet and then dispense the cash.

- Confirm the Transaction: The buyer approves the transaction once all the details recorded on the screen are correct. A receipt may be offered and replayed if needed for record purposes.

Some Bitcoin ATMs are bidirectional, allowing users to both sell and purchase Bitcoin and other cryptocurrencies. Users can also use their mobile devices to find Bitcoin ATMs near them.

Buying and Selling Cryptocurrencies

Crypto ATMs allow users to buy and sell various types of Bitcoin and other cryptocurrencies including Ethereum and Litecoin. The transaction speed depends on the traffic of the blockchain network and the capacity of the ATM.

Buying Cryptocurrency

- Slide in the money or pay through a credit/debit card.

- Type the amount of specified cryptocurrency that one wants to get.

- Also, like most other wallets, you can scan the QR code to get the bought cryptocurrency.

Selling Cryptocurrency

- Choose the next option “Sell” to be displayed on the ATM interface.

- Select which type of cryptocurrency to sell and the quantity you want to sell as well.

- Transfer the Cryptocurrency from your wallet to the address of the ATM.

- Get your cash as soon as the transaction is recorded on the blockchain system.

While using the ATM cards, the sales may be effected immediately, through the other cases the card will need confirmation time before the cash is disbursed out.

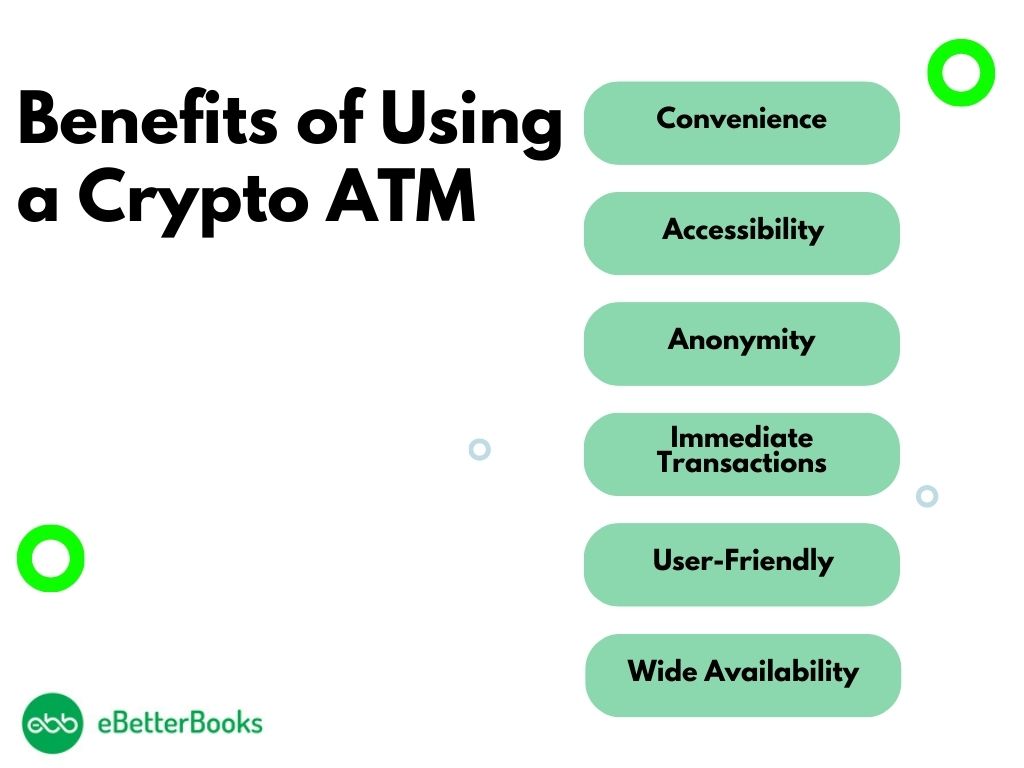

Benefits of Using a Crypto ATM

Crypto and bitcoin ATMs are a great option for those who want to use cash to either buy bitcoin or sell cryptocurrency.

Below are the benefits of using Crypto ATMs/ Bitcoin ATMs:

- Convenience: Cryptocurrency ATM s are a convenient solution to getting your hands on cryptocurrencies within a matter of minutes without the need to know how blockchains operate or create an account on an exchange.

- Accessibility: Most of the cryptocurrency ATMs are open all times of the day and users are allowed to exchange their cryptocurrencies as may be preferred.

- Anonymity: However, most machines still need some identification to proceed, but in the general sense, transactions can be slightly more private than using an exchange.

- Immediate Transactions: Users get cryptocurrencies in their wallet or cash from sales quickly hence making waiting time very minimal.

- User-Friendly: The layout as simple and user-friendly that helps newcomers to interact with the structure of cryptocurrencies.

- Wide Availability: There are thousand of crypto ATMs in operation, and this figure makes it possible for people in even less technologically developed areas of the world to become exposed to this means of getting an assortment of cryptocurrencies.

Risks and Limitations of Using a Crypto ATM

There are very few risks associated with using a Crypto ATM. Users should also be aware of the risks associated with cryptocurrency, such as market volatility, limited options, etc.

Here’s the breakdown:

- High Fees: Cryptocurrencies accepted by the Crypto ATMs can also be bought for a much higher rate of between 5% and 20% per exchange as compared to the online exchanges.

- Regulatory Compliance: Lack of standardization and rules in diffferent countries of the world can also mean that some cryptocurrencies, or even all of them, are unavailable or may not work optimally on the ATMs.

- Limited Cryptocurrency Options: Many machines offer limited cryptocurrencies such as Bitcoin, Ethereum, and Litecoin thereby limiting people’s access to other cryptocurrencies.

- Security Concerns: Public selections inside crypto ATMs can lead to one or many misfortunes, such as actual theft, and scams amongst others.

- Transaction Limits: A lot of machines come with strict control on how much cryptocurrency one can buy or sell within a single transaction which can prove shameful for large amounts.

- Dependency on Wallet Compatibility: Users need to have compatible digital wallets as not all digital wallets will be compatible with the crypto ATMs.

- Slow Confirmation for Sales: Crypto coin selling entails waiting for the block’s confirmations before cash is released which can be somehow demanding.

Crypto ATMs are still a great way to introduce people to more cryptocurrencies. However, they have to consider some of the problems that may occur or the price that they have to pay for the convenience of the transaction. Some great tips to work on it include research on fees, wallet compatibility, and using ATMs in safe areas that would improve the fee-related user experience.

Crypto ATM Fees

Crypto ATMs are said to be almost as convenient as traditional ATMs, but they usually charge more than internet-based cryptocurrency exchanges.

These fees generally fall into two categories:

Transaction Fees

A percentage of the transaction value, which normally should lie within 5% – 20%. For instance, if you purchase $500 of Bitcoin, and the fiat has a 10% trading fee, you stand to part with an additional $50.

Crypto ATMs have been criticized for charging high transaction fees, as online cryptocurrency exchanges often have transaction fees of less than 1 percent. Some Crypto ATM operators may also charge a variable miner fee to pay cryptocurrency miners.

Spread Fees

This means the gap between the existing market price of that cryptocurrency and the rate at which the Bitcoin ATM is ready to sell. Speed may fluctuate or rates may be changed to give an explanation related to volatility or costs of operation.

Despite these fees appearing high they are quickly offset by convenience when undertaking the transactions and quick access to the cash. However the user should always make sure to read the account display on the ATM before proceeding on to the next step.

Crypto ATM Locations

Crypto ATMs can be found in various locations, including shopping malls, convenience stores, and airports. Users can find Crypto ATM locations near them by searching online directories or apps.

Crypto ATM locations are increasing globally, with over 31,000 Bitcoin ATMs and tellers across the United States, according to CoinATMRadar.com.

Popular locations include:

- Shopping Malls: They are especially effective for use in areas with high traffic levels of feet making it ideal for users with normal traffic foot usage.

- Convenience Stores and Gas Stations: These make sure that the user of the crypto services can get the service at late hours.

- Airports: Applying to tourists who might urgently require employing cryptocurrencies.

- Standalone Kiosks: Located in cities or close to transport networks.

Crypto ATM Security

Crypto ATMs are designed to be secure and provide a safe way to buy and sell cryptocurrency. They use advanced security measures, such as encryption and two-factor authentication.

Even though there are safeguards built into crypto ATMs, users must be vigilant.

Key security features include:

- Encryption: Public key encrypting is employed by the machines to protect the transaction data.

- KYC and AML Compliance: They bolster identifications so that fraudsters and other needy individuals can be avoided or eliminated besides meeting the legal requirements.

- Surveillance: Some of the machines are located in monitoring sections with cameras, to prevent cases of sabotage or theft.

Finding a Reliable Crypto ATM

Users can find a reliable Crypto ATM by researching the operator and reading reviews. They can also check if the operator is licensed and registered with the relevant authorities.

It’s essential to use a reputable Crypto ATM operator to ensure a safe and secure transaction. It is important to note that wallet credentials should be protected and wallet address must never be shared with other people.

Transaction Limits and Restrictions

- Crypto ATMs have daily limits on the amount of cryptocurrency that can be bought or sold in a single transaction that respect the anti-money laundering laws and regulations to reduce danger.

- These limits depend with the operator and the region though the average limit ranges between $100 to $15000 for a single transaction.

Restrictions:

- Daily Limits: Some of the machines limit the number of transactions allowed in a single day to conform to regulatory orders.

- ID Verification: Any transaction over a certain amount can often involve extra steps in the identification process, such as a scan of a driver’s license or through fingerprint scans. Users can also be restricted from using a Crypto ATM if they do not have a valid government-issued ID or bank account.

Clients are advised to check these limits before approaching the ATM because going beyond them could lead toe either the delay of the transaction or an outright rejection of the same.

Crypto ATM Maintenance

Crypto ATMs need to be managed well to function effectively and efficiently. Operators perform regular maintenance tasks, including:

- Software Updates: Simply, checking that the firmware is up to date provides security for the machine and better usage.

- Hardware Checks: Make sure all the cash dispensers, QR scanners, as well as the touchscreen are responsive enough to facilitate transactions that won’t take much time.

- Cash Replenishment: This is usually for withdrawal transactions to be made and the cash reserve to be restocked here.

- Network Monitoring: Access more information on how to tackle connectivity problems to avoid interruptions.

Some times the machines may not be in operation maybe due to a technical hitch or lack of cash, among others. Professional machine operators take care of this issue to ensure that minor operations are done promptly so that the machine’s working is not interrupted.

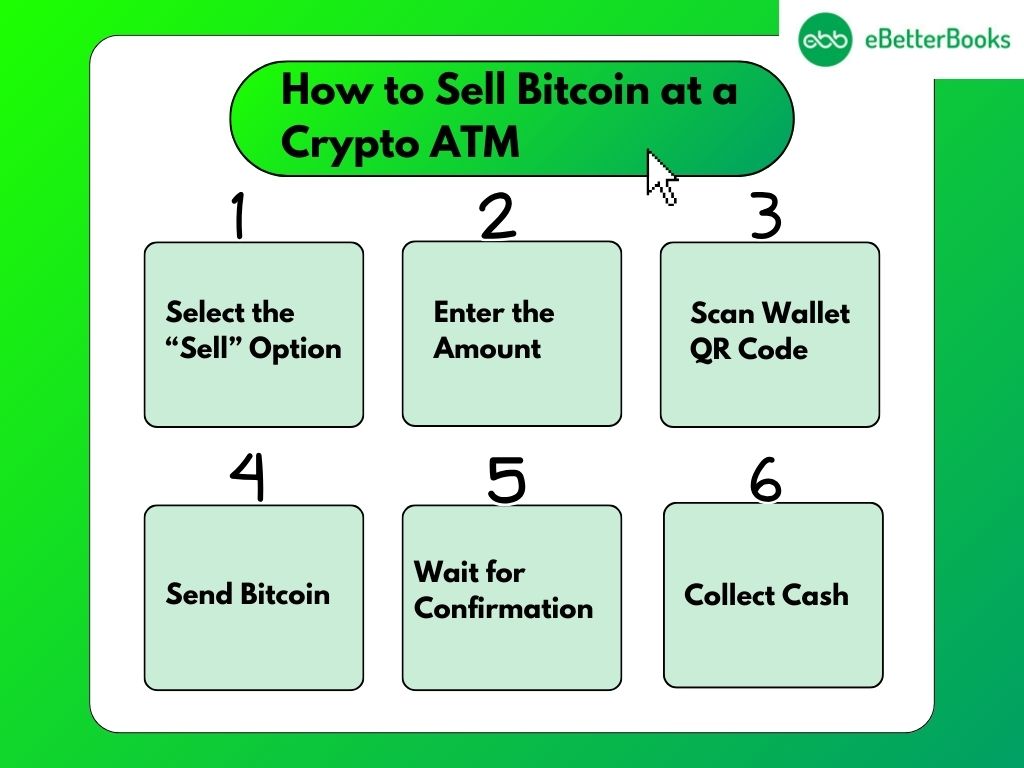

How to Sell Bitcoin at a Crypto ATM

Selling Bitcoin at a crypto ATM is a straightforward process:

- Select the “Sell” Option: Enter the ATM interface and select the option to sell Bitcoin at the beginning of the transaction.

- Enter the Amount: Determine the quantity which will be available for sale within the ATM transactional capacities.

- Scan Wallet QR Code: Scan the QR code on the other using the scanner of the machine and connect your Bitcoin wallet.

- Send Bitcoin: Enter the said Bitcoin amount in the ATM and transfer the funds to the given Bitcoin address.

- Wait for Confirmation: The confirmation may take a few minutes based on the traffic in the blockchain.

- Collect Cash: After the transaction is approved, the ATM automatically pays out cash equivalent of the Zhang value.

There is little that users need to do beyond making sure they are using a compatible digital wallet and having enough tokens to pay for the gas fees during the sale.

Conclusion

Cryptocurrency ATMs have come as a solution to the problem of how people can connect the traditional concept of using money with new opportunities given by Blockchain. The operational aspect helps the users to know more about the fee structure of a crypto ATM, how it is to be maintained or the procedures involved when the ATMs are put up for sale.