Non-fungible tokens (NFTs) are unique tokens stored on a blockchain that can be easily used to issue, manage, and trade digital assets. Presently, NFTs are common in digital art, real estate, and in-game assets, and they can revolutionize traditional monetary habits as technology and regulations change in the field.

What Are Non-Fungible Tokens (NFTs)?

NFTs are digital tokens created in the blockchain, crafted as digital certificates for the ownership of an original piece. While cryptocurrencies are typical tokens called fungible, which means that one token is equal to another, NFTs are unique tokens that are considered different and distinguishable from each other. That makes them most appropriate for things like artwork, music, or collectibles where ownership is of the essence.

For instance, when a person buys an NFT, he is actually buying a digital asset, considering he is buying the token that issues him a certificate of ownership of that particular asset. The record of an NFT is kept on the blockchain, making it possible to track who owns what, thereby eradicating forgeries and making transfers easier.

How Do NFTs Work?

NFTs are made through a process known as ‘minting,’ which involves encrypting the information of the asset in a blockchain. At the macro level, the minting process involves the generation of a new block, the NFT information being verified by a validator, and the block is full. This minting process usually involves integrating smart contracts, which define ownership and control the process of transferring tokens.

- Creating an NFT: The term “minting” originated from the concept of coining to create a monetary asset or object. This means that when an artist or a creator wishes to produce an NFT, he or she mints it.

This means they convert their digital item into an item represented on the ledger, known as the blockchain. This process creates a string identifier (or a token) for that item, thus making the token the only one of its kind.

- Buying and Selling: NFTs can be bought with cryptocurrencies on respective sites such as OpenSea or Rarible. When an NFT is sold, the particular digital asset is registered on the blockchain and newly assigned to the buyer.

- Ownership: You can own your collections through NFT. That means a record of an item or digital asset proves its authenticity and ownership, but the NFT holder does not own the copyright or reproduction rights of the piece. It is like owning a valuable trading card; you own the card but cannot make photocopies of it.

The Technology Behind NFTs: Blockchain Technology

NFTs are based on blockchain technology, a decentralized and distributed digital ledger that records transactions across several computers. The majority of NFTs are built on the Ethereum blockchain, which is well-known for its smart contract functionality. Smart contracts are self-executing contracts in which the agreement’s provisions are directly encoded into code, allowing transactions to be executed automatically when predefined circumstances are satisfied.

Other blockchains, such as Binance Smart Chain, Flow, and Tezos, all enable NFT creation and trading with their own set of features and benefits.

Standards for NFTs

NFTs follow strict criteria that govern how they run on the blockchain.

The most frequent standards for NFTs are:

- ERC-721: This was the first and most extensively used standard for establishing NFTs on the Ethereum blockchain. It lets developers generate unique tokens and transfer ownership without losing the token’s unique attributes.

- ERC-1155: A cutting-edge standard that enables the production of both fungible and non-fungible tokens within the same contract. This standard improves efficiency and decreases transaction costs when working with numerous token kinds.

Use Cases of NFTs Beyond Art: Real Estate, Gaming, and Music

NFTs were initially popular among artists creating digital art, but due to their characteristics, they are now used in other industries like real estate, gaming, and the music industry. As a means to facilitate the management and ownership delegation of belongings digitally, NFTs also enhance the efficiency and flexibility of transactions in these industries. In the following sections, we will discuss how NFTS are utilized in each of them with examples.

- Real Estate: Unconventional Possession Ideas

Real estate is also experiencing a digital shift. Real estate is then divided into NFTs to be sold in the market. This new concept offers fractional ownership and the ease of selling items without returning them to auction.

Examples:

- Propy: This real estate platform allows buyers to make direct purchases of properties using cryptocurrency. In 2021, the company helped sell a luxury home in California as an NFT, thus enabling the buyer to purchase the house virtually. This process eliminated much unnecessary paperwork and helped facilitate the transaction.

- Real Estate Investment Platforms: Companies such as Harbor and RealT are integrating NFTs for real estate assets, and numerous users can have a stake in properties by buying fractional tokens. This brings real estate investment for private persons, and the whole making of real estate investments is achieved without requiring a lot of cash.

- Gaming: Secure Digital Assets Of Real Value

The gaming industry is considered one of the prominent segments using NFT for various activities. In the game, players can freely purchase, sell, and trade goods with real cash value. They can actually possess the items and may even sell them.

Examples:

- Axie Infinity: is currently one of the most famous blockchain games. It enables users to collect unique virtual animals named Axies, breed them, and battle them. Axie is fully decentralized, and every character you see is an NFT, which means the players actually own them. They can make income through battles and Axie sales on marketplaces, with some Axies being so rare that they can be sold for thousands of dollars.

- Decentraland: In this aspect, players can own, trade, and expand zones of the metaverse as individual lots of virtual properties, called NFTs. Some people have bought plots in Decentraland to host a given event or to develop an experience that will take place in the virtual space. Firms like Atari and Sotheby are already invested in Decentraland, which makes a good point that virtual real estate investment is possible there.

- The Sandbox: It is an open and fair platform for users to build, own, and earn income from their gaming environment. These can be purchased as NFTs, and the properties are then used to build games or experiences, giving players a strong feel for the actual economy. Prominent partnerships with brands such as Snoop Dogg have gained attention, which confirms that NFTs have a place in gaming.

- Music: Empowering Artists and Fans

NFTs are reviving the music industry by empowering musicians to sell digital assets without intermediaries controlling a large portion of profits.

Examples:

- Kings of Leon: This band made the news in 2021 when they released their album When You See Yourself through a process known as NFT. In addition to music, the release also offered other benefits related to NFTs, such as sitting in the first rows during concerts and unique art pieces. This new approach was clearly a way for fans to sink money into the band’s music.

- Grimes: The musician and visual artist has sold a series of NFT artwork related to her music for close to $6 million back in early 2021. Her collection comprised musical tracks and animations, which explained the likelihood of artists using NFTs in a highly valuable experience.

- Shawn Mendes: The pop star has been experimenting with NFTs by releasing exclusive content attached to his songs, allowing fans a chance to own something of his through NFTs.

Pros and Cons of NFTs and Tokenized Assets

| Pros | Cons |

| Verifiable Ownership: Ownership recorded on blockchain. | Legal Uncertainty: Ownership and copyright issues exist. |

| Accessible Investment: Fractional ownership opens access. | Complexity: Tech barriers limit some participants. |

| Continuous Revenue: Creators earn royalties on resales. | Speculative Market: Risk of financial losses. |

| Market Liquidity: Easily bought and sold on platforms. | Volatile Prices: Dramatic fluctuations. |

| Transparent Transactions: Blockchain ensures visibility. | Lack of Regulation: Leads to fraud risks. |

| Enhanced Security: Protected against fraud. | Security Risks: Susceptible to hacks and scams. |

| Global Audience: Reaches buyers worldwide. | Environmental Impact: Energy-intensive processes. |

| Exclusive Experiences: Unique perks like VIP access. | Uncertain Value: Long-term value may decline. |

Pros of NFTs and Tokenized Assets

- True Ownership: NFTs offer ownership protection through the use of blockchains, which creates indisputable proof of the ownership of those digital assets. It is especially important to collectors and artists since it gives them a valid right to belong to their possession.

- Fractional Ownership: Tokenization allows for fractional ownership of large-value assets, such as property. It increases the number of people who can invest in shares in the market without a huge sum of money, hence unlocking access to valuable resources.

- New Revenue Streams: Each time an NFT is resold, creators can enjoy the potential of automatic royalty income. This feature ensures the regular replenishment of income and encourages artists to work more.

- Liquidity: NFTs can not only be purchased and sold in a digital marketplace, which provides more ease of traceability as compared to other tangible assets. It is, therefore, beneficial for those intending to sell or purchase other securities in the market in the shortest time possible.

- Transparency: With blockchain, the ownership and history of the related NFTs are clear and documented in every financial transaction. This brings about trust between buyers and sellers since both parties can see what the other party is doing.

- Enhanced Security: The incorporation of blockchain technology to prevent fraud and counterfeiting also defends sustainability. This is important for collectors, particularly, to have confidence in the validity of their investments.

- Global Reach: Businesspeople can make transactions of NFTs worldwide because there are no restrictions based on geography. This means new possibilities for sales in new markets for artists and assets simultaneously.

- Innovative Experiences: Non-fungible tokens create opportunities for fans and collectors to receive additional benefits or proudly own items that grant them special privileges, like content access or tickets to a show. Such possibilities can improve activity and establish better relations between authors and their viewers.

Cons of NFTs and Tokenized Assets

- Volatility: NFTs are vulnerable to market swings, and their price swings can be rather high. This leads to fluctuation, and after some time of hype, investors may lose their investment money.

- Environmental Concerns: In addition, most NFTs are built on the blockchain, and, for the most part, blockchain technology’s energy consumption sparks heated debates about its ecological effect. This has led to criticism of the sustainability of NFT technology as miners will operate it.

- Legal Ambiguities: Unfortunately, so far, legal work related to NFTs has also raised questions about their ownership and problems with copyright. This is sometimes a question for creators and buyers, and it creates certain difficulties.

- Speculation and Hype: The market is often up and run on speculation and FOMO (fear of missing out) to the extent that some purchasers have little knowledge of the underlying asset. This makes the system speculative, and it can lead to the formation of a bubble that may soon burst.

- Accessibility Issues: NFTs expand access to investment products; however, the technology may be challenging for many users to navigate. This could reduce the participation levels for some users, mainly because of the technical nature of the options.

- Security Risks: However, misuse, hacking, phishing, or scams are still possible with NFT as long as the users do not employ standard security precautions when using digital products.

- Lack of Regulation: The lack of regulations for NFTs creates opportunities for cheaters and manipulators, with no protection for the buyer when purchasing NFTs. It also creates a dangerous position for new investors to venture into, especially in the stock market.

- Sustainability of Value: Some people also raise arguments over the durability of NFTs, for instance, whether they will hold value in the future if the trend slows down or completely fades. The market penetrations may not fully support the investors due to its tendency to reduce its growth rate in the near future.

Digital Ownership and Its Impact on the Economy

Digital assets and tokenization through NFTs and other methods are revolutionizing ownership and ways we can view value.

Below, we explore the key economic implications of digital ownership:

- New Investment Opportunities

NFTs allow people to invest in assets like art, real estate, and collectibles that were once hard to access. This has increased the opportunities to invest in something of high value, and everyone can get at least one share of it.

- Income for Creators

Traditional art forms allowed artists to make money in ways not possible earlier, like royalty, every time an art piece is sold again. This type of income is much different from the traditional model of sales, in which creators earn money once.

- Liquidity and Market Growth

As NFTs can be bought and sold through marketplaces, they raise the probability of liquidity, making it easy to sell assets. This also assists in the development of other digital markets and increases the exposure to digital products.

- Potential for Price Volatility

Like most digital and art market commodities, the price of Anchor’s NFTs is not determined by their exceptionality or desirability; rather, the price change influences trends and popular demand. This can mean big profits, but it also includes positions that can lose their value quickly in case the hype around them cools off.

- Global Market Access

Through the adoption of NFTs, users can purchase or sell any particular asset regardless of their location. This achieves an expansive market that was previously restricted by geographic location and, therefore, creates more economic policies for both buyers and sellers.

Environmental and Ethical Implications of the NFTs

Thus, as non-fungible tokens gained popularity, their sustainability and, in particular, their ethical aspects were questioned. Experienced principals, these digital assets are mainly developed on some blockchain platforms such as Ethereum, which is very power-consuming and thus raises issues of sustainability.

In addition, practical issues like the manipulation of the particular market and conflicts of the intellectual property matter add more complexities. In order to simplify the explanation, we will use the term “NFT” to also encompass other similar items like ordinals (NFT-like items on chains like Bitcoin).

Environmental Effects of NFTs

NFT transactions mostly employ high-energy blockchains, especially the Ethereum and Bitcoin blockchains.

Here’s a breakdown of how each stage in the NFT lifecycle contributes to environmental impact:

- Creation (Minting): The creation of NFT entails submitting a digital asset to the blockchain and going through a process of tokenization that entails the production of new keys as well as data immutability on the blockchain. NFT projects require minting, which is very energy-consuming and makes a significant contribution to energy consumption.

- Marketplace Listing: After creation, NFTs are normally sold on marketplaces (like OpenSea or Magic Eden), which, in turn, also consumes energy as they’re displayed or people can see or purchase.

- Buying and Selling: In every buy or sell process, there must be a blockchain transaction to validate who transfers the ownership, and the process takes a lot of energy, especially on older blockchain systems like Ethereum’s PoW.

- Storage of Assets: NFTs, such as images, files, etc., are generally linked to and usually hosted off-chain by decentralized means, such as IPFS. This storage also calls for infrastructure that adds to energy usage in other ways or as part of other processes.

Uninterrupted Electric Consumption and E-Waste Issues

- Non-Transactional Power Consumption: Traditional blockchains are always on and utilize power regardless of the amount of traffic on the network. This baseline energy usage, especially on the highly energy-demanding networks, contributes to the country’s overall environmental impact.

- Electronic Waste: Cryptocurrency mining hardware and high-performance computing systems that validate blocks are highly utilized and have short service lives. The disposal of these devices produces one kind of e-waste, which, if treated improperly, may increase the emission of toxic chemicals and further degradation of the environment.

Measures Towards Achieving Sustainable Model for NFT

In order to deal with the environmental issue, the industry is keen on the following solutions: clean energy and blockchain systems.

- Least Cost Option for Trading Renewable Energy for Blockchain Power

Renewable energy is a significant component of addressing the environmental impact of NFTs since shifting the energy source makes up an essential component.

Here’s how each type of renewable energy could support blockchain networks:

- Solar Power: The use of solar panels in the production of energy is another useful method to provide power for blockchain systems with the energy derived from the sun.

- Wind Power: Wind turbines tap kinetic energy to produce electricity, hence making wind energy ideal for normal energy resources.

- Hydropower: Hydroelectric power is generated from water sources such as rivers or dams,s which can be directed toward blockchain energy requirements.

- Geothermal Energy: Geothermal energy derived from heat from various services like geothermal hot sources like volcanoes, hot springs, and many other services can be harnessed in order to produce electricity, and this forms a natural source of energy that could be used to fuel blockchain solutions.

- Biomass: Using organic feedstocks, such as plants or agricultural residues, it is possible to generate biofuels that can power blockchain operations cleanly.

- A Paradigm Shift Towards Efficiency in Blockchains

Currently, proponents of NFTs and other blockchain-based assets are working to bring about efficiencies to lower energy consumption, especially through transitioning from PoW models to the more efficient PoS models that consume much less computational resources.

Below are a few PoS blockchains that support NFTs:

- Ethereum: Thanks to its transition to PoS in recent days, Ethereum has become much more energy efficient and works with large-scale marketplaces such as OpenSea.

- Solana: As fast as it is, Solana uses PoS and supports popular NFT platforms such as Magic Eden, which contributes to reducing overall consumption.

- Algorand: Energy efficient, scalable, and secure; Algorand is a PoS blockchain that hosts NFT marketplaces such as Aorist.

- Cardano: This PoS blockchain is adopted by several NFT platforms, such as Galaxy of Art, and is more environmentally friendly than PoW networks.

- Tezos: Tezos, as a hosting platform for NFTs, is a blockchain that is friendly to the environment and others for creating NFTs and performing transactions.

Ethical Issues in the Novelty Financial Technologies or NFTs

Thus, apart from environmental attitudes, NFTs raise questions about ethical behaviors for the market, ownership, and accessibilities.

- Speculation and Price Manipulation: The rise of NFTs has also been characterized by speculative prices, which, rather than offering intrinsic value, impose financial risks on new consumers.

Selected fraudulent activities such as pump-and-dump schemes can actually influence prices and raise ethical concerns about equality in a market.

- Intellectual Property (IP) and Ownership Rights: The ownership of NFT serves as the assurance of the ownership of the ‘Asset’ but does not make the ‘Asset’ holder a holder of Intellectual Property or Copyright.

In some cases, some ‘buyers’ make a mistake and think they have a monopoly on copies or distribution of the asset. Another concern has been parasitic minting of art—where one’s artwork is created into an NFT without the artist’s consent.

- Exclusivity and Economic Inequality: Gurween et al. (2021) pointed out that NFTs, due to their high costs, are frequently out of reach of many people, thereby deepening the economic divide.

Perhaps this exclusivity may serve the purpose of enriching other wealthy investors at the expense of a small number of artists or collectors.

- Lack of Market Regulation: The markets of NFTs are free from regulatory control, and there are high possibilities of fraud, no protection for the consumers, and infringement issues of copyright.

There are no laws concerning this, and this is a weakness that hinders the toppling of any controversy, and the buying and creating public is vulnerable to exploitation.

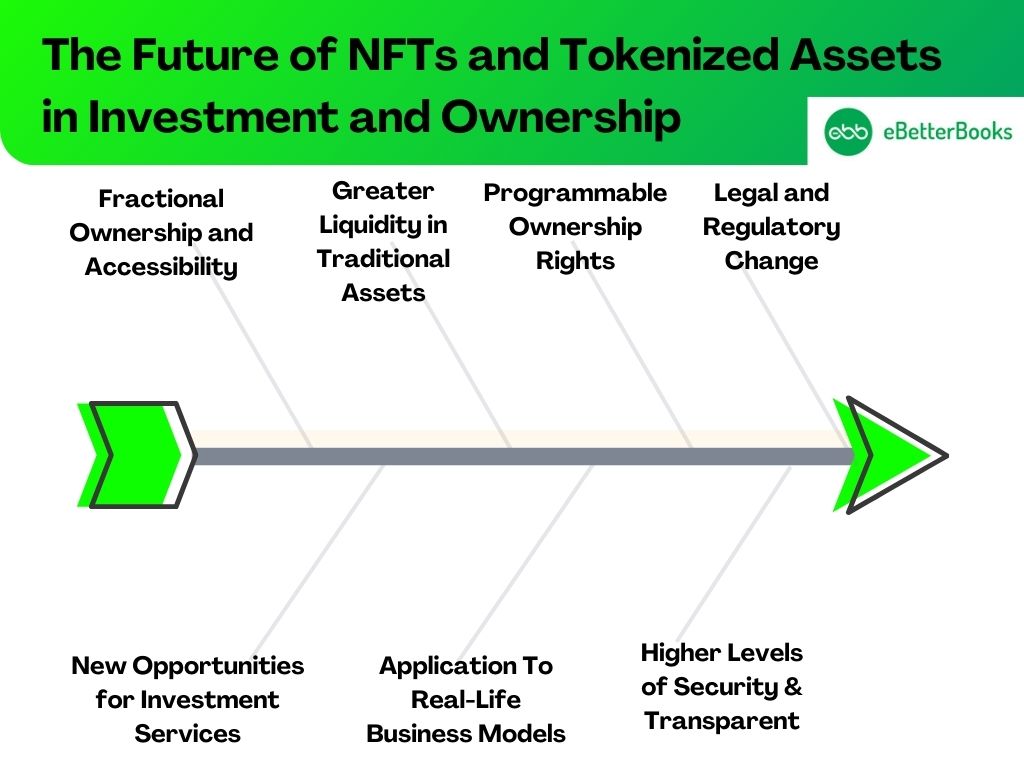

The Future of NFTs and Tokenized Assets in Investment and Ownership

With time, NFTs and tokenized assets act as progressive forms of digital assets and investments that are already poised to revolutionize the management of various forms of assets. They offer various forms of ownership schemes and facilitate fractional ownership, and they create possibilities for investors and creators as well as businesses.

01. Fractional Ownership and Accessibility

- Expanding Access: By having tokens, there is an opportunity to own parts of a valuable object, be it an apartment or an artwork. It reduces the costs of participation for small and unsophisticated investors and allows more people to trade in assets hitherto restricted to the well-heeled.

- Real Estate & Fine Art: Financial vehicles such as tokens on a blockchain offer the investor fractional investment rights in real estate, collectibles, and other assets that are generally not easily liquidated through entities such as RealT and Maecenas.

02. Greater Liquidity in Traditional Assets

- Increased Market Efficiency: The tokenization of real-world assets and being able to sell and buy these tokens on the blockchain makes it easier for investors to acquire liquidity. It could also make possible the trading of assets that inexperienced people commonly trade frequently and quickly, which are illiquid and hence require a lot of time to trade, such as real estate and other valuable collectibles.

- Asset Portfolios: Tokenized assets can be included in a portfolio of the future, and therefore, the portfolios can be composed of both digital and physical tokens.

03. Programmable Ownership Rights

- Smart Contracts: NFTs and tokenized assets incorporate the use of smart contracts, which bring programmed conditions about royalties, resale percentages, or access rights. It does this by guaranteeing that creators or owners are paid on the sale or transfer of their assets, thus establishing an income-generating system.

- Automatic Royalties in Art and Music: For example, musicians get royalties without bargaining for them, again ensuring a fairer earnings model set up by NFTs.

04. New Opportunities for Investment Services

- Tokenized Funds and Commodities: Apart from securitizing individual assets, asset funds, also known as funds, can be tokenized, making it easier to sell funded securities that move in large lots, such as gold, oil, or securities.

- Alternative Investment Portfolios: Tokenization could lead to new investment products that would have investors holding diversified arrays of assets such as tangible, intangible, digital, and real ones that are all managed on blockchain platforms.

05. Application To Real-Life Business Models

- Supply Chain Transparency: They can be employed to identify ownership and other production stages of products in a production chain. For instance, it is possible to have the fashion brands work on certifying that the luxury items offered through NFT platforms are originals and were obtained ethically.

- Verified Ownership in Real Estate and Vehicles: In real estate, NFTs could serve as property deeds since using tokens makes it easy to transfer property and creates an auditable chain of events. Likewise, vehicle ownership could be in the form of NFTs, making registration and transfer easier and more efficient.

06. Higher Levels of Security & Transparent

- Immutable Ownership Records: The security that blockchain provides is that owners can set up uncontestable evidence of ownership, which minimizes fraudulent cases, especially with valuable assets.

- Regulatory Compliance: The record of ownership could help with the regulation; asset tracking can be easier and clearer for the regulatory government. It can help in the auditing process, due diligence, and the evaluation of the risk associated with doing business.

07. Legal and Regulatory Change

- Standardization: It is expected that standard rules and laws will be enacted as NFTs and tokenized assets gain utility to enhance the legal recognition of token ownership and rights to transfer these tokens.

- Consumer Protections: Future regulations may include explicit consumer protection measures to shield buyers from fraud and entitle them to protection; this may become necessary as NFTs expand their appeal to ordinary consumers.

Challenges Ahead for the Future of NFTs and Tokenized Assets

| Challenges | Description |

| Regulatory Uncertainty | The lack of consistent global regulations creates legal complexities and risks for investors, especially in cross-border transactions. |

| Market Volatility | NFTs and tokenized assets are prone to rapid price fluctuations, leading to speculative risks and potential financial losses. |

| Scalability Issues | Many blockchains face limitations in handling large volumes of transactions, which can lead to slower processing times and high fees. |

| Environmental Impact | The high energy consumption of certain blockchains, especially proof-of-work systems, raises sustainability concerns. |

| Security Vulnerabilities | Smart contracts and blockchain networks are sometimes targeted by cyberattacks, posing risks to asset security. |

| Technology Reliance | Dependence on blockchain technology requires continuous innovation, and any issues with the technology can disrupt the market. |

| Intellectual Property Risks | Unauthorized tokenization of art, music, or other assets can lead to disputes and challenges in enforcing ownership rights. |

The Bottom Line

Non-fungible tokens represent a significant shift in how we interpret ownership and value in the digital age. NFTs, by permitting unique digital assets, have created new opportunities for artists, collectors, and investors. As technology progresses and applications grow, NFTs are set to become an essential part of our digital world, altering businesses and reinventing how people engage with art, music, gaming, and other fields. Understanding the complexities of NFTs is critical for anybody wishing to traverse this new frontier of digital ownership.