The innovative Bitcoin class has surged rapidly into becoming a global investor attraction. Since Bitcoin’s growth, investors now benefit from ETFs that offer unique exposure to Bitcoin through funds that bypass the need to hold or store Bitcoin directly. An article follows to explain Bitcoin ETFs fully from understanding their principles to understanding their advantage-security combinations and market effects.

What Is a Bitcoin ETF?

An Exchange-Traded Fund (ETF) devoted to Bitcoin enables investors to obtain Bitcoin-related investments without maintaining direct Bitcoin ownership. Through standard ETF mechanics, investors obtain Bitcoin price exposure by acquiring fractional shares. Investors who hold Bitcoin ETF shares trade them on standard stock markets while their value responds to Bitcoin market price fluctuations. Users through Bitcoin ETFs can access Bitcoin trading through regulated and secure investment vehicles that mimic digital currency models without needing to handle complex digital currency ownership.

How Bitcoin ETFs Work

Traditional ETF functioning applies to Bitcoin ETFs which specifically track Bitcoin as their underlying asset. The traditional mechanism for ETFs distributes a variety of assets across stocks bonds commodities into multiple tradeable shares available throughout the open market. The basic component of a Bitcoin ETF consists of actual Bitcoin either directly or through Bitcoin futures which function as its basis.

There are two primary ways that Bitcoin ETFs operate:

- Physically Backed Bitcoin ETFs: These ETFs directly hold Bitcoin. The fund purchases actual Bitcoin and stores it in a secure wallet, and the ETF’s value reflects the price of the underlying Bitcoin holdings.

- Futures-Based Bitcoin ETFs: These ETFs do not directly hold Bitcoin but instead invest in Bitcoin futures contracts. These contracts allow the ETF to speculate on Bitcoin’s future price without holding the actual cryptocurrency. The price of the ETF is influenced by the performance of Bitcoin futures, which can sometimes differ from the spot price of Bitcoin itself.

Regulatory Landscape of Bitcoin ETFs

Bitcoin ETFs struggle with complicated regulatory hurdles seeking official approval. The majority of regulatory bodies worldwide including those in the United States show reluctance in accepting Bitcoin products into their public market spaces. Regulatory caution exists because officials remain concerned about market price fluctuations threats to asset security and market deceptive practices.

Through multiple years of review, the Securities and Exchange Commission (SEC) in the United States examined multiple Bitcoin exchange-traded fund (ETF) proposals. The Securities and Exchange Commission (SEC) continually dismissed Bitcoin ETF applications because they wanted to protect investors along with market integrity. The Securities and Exchange Commission (SEC) has authorized Bitcoin futures ETFs to monitor Bitcoin futures contracts instead of Bitcoin’s actual spot price.

Types of Bitcoin ETFs

1. Physical Bitcoin ETFs

Complete Bitcoin ETFs operate through straight spot price tracking of Bitcoin. Managers of ETFs purchase physical Bitcoin before safely depositing it into a secure wallet or custodian services. Investors who choose to use physical Bitcoin ETFs gain Bitcoin price exposure because the fund mirrors Bitcoin’s actual value directly.

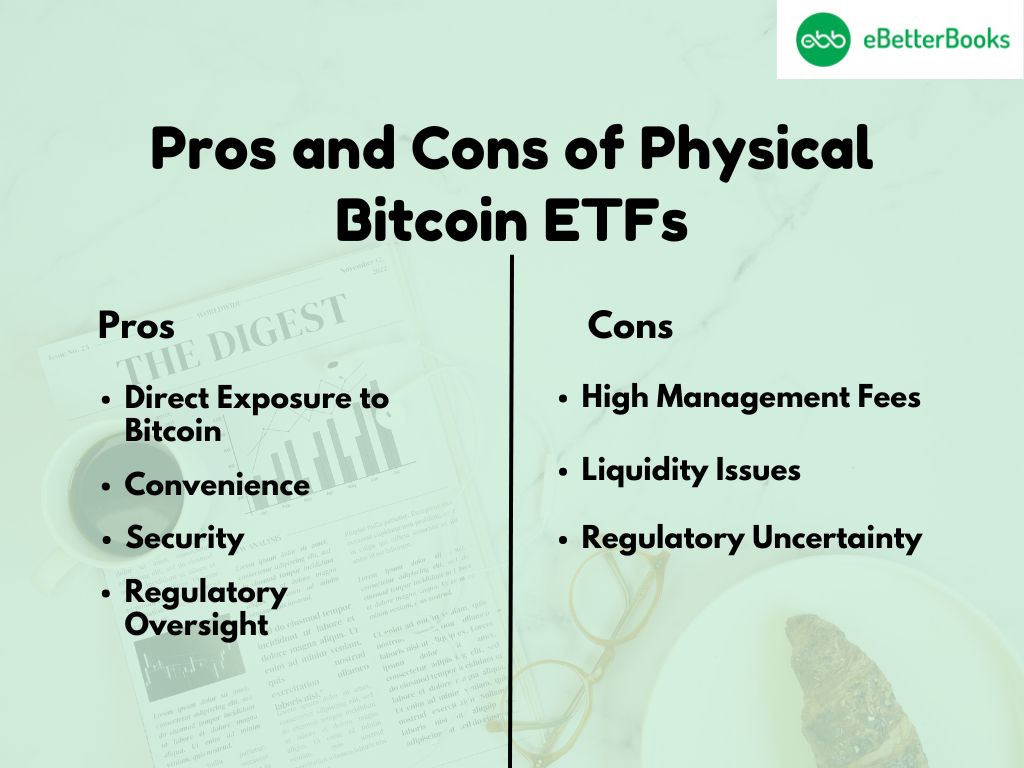

Pros of Physical Bitcoin ETFs

- Direct Exposure to Bitcoin: Physical Bitcoin ETFs let investors experience Bitcoin price changes through their investments without managing their own Bitcoins. Lottery fund users access Bitcoin price changes through this service without needing ownership or management of Bitcoin.

The value of a Physical Bitcoin ETF tracks Bitcoin’s market growth so investors can receive similar financial gains as those from holding Bitcoin directly. The accessibility of Physical Bitcoin ETFs draws investors who want Bitcoin market potential without the physical ownership responsibilities of the digital asset. - Convenience: Physical Bitcoin ETFs operate on traditional stock exchanges like New York Stock Exchange (NYSE) and NASDAQ according to the same trading rules that apply to regular ETFs and stocks. These products exist within traditional financial frameworks and enjoy simpler accessibility for investors who operate brokerage accounts and desire to bypass complex cryptocurrency wallet operations and exchanges.

Through brokerage platforms, investors can access Bitcoin ETFs just as they would regular market assets to trade them – the trading experience mirrors existing securities handling procedures. - Security: Having physical Bitcoin ETFs brings remarkable protection to users along with several other advantageous features. Being held at a regulated and insured custodial institution provides Bitcoin investors better safety than Bitcoin stored privately because custody operations follow rigorous security measures.

Bitcoin investors and other cryptocurrency users face elevated security risks from exchange providers and wallet companies since their platforms have been repeatedly targeted by hackers resulting in substantial financial losses. The protection offered by Physical Bitcoin ETFs means investors receive the benefit of institutional-grade custody services with insurance coverage against theft along with protection against fraud and losses. - Regulatory Oversight: Fund investors who select Physical Bitcoin ETFs face oversight through the regulatory scans applied by the U.S. Securities and Exchange Commission (SEC) and equivalent financial agencies worldwide.

The regulatory framework enables additional oversight to create enhanced investor trust and transparency by tracking both the Bitcoin position of the fund and its secure storage procedures. Established oversight mechanisms within physical Bitcoin ETFs help decrease market dangers from manipulation and fraud that commonly occur on crypto exchanges that lack regulation.

Cons of Physical Bitcoin ETFs

- High Management Fees: Running a Bitcoin security and management operation produces expenses that naturally accrue with the oversight of cryptocurrency. Physical Bitcoin ETFs must use special custodial services that charge storage fees to safeguard their cryptocurrency but these custodial expenses eat into fund management costs. Management fees imposed upon Bitcoin fund operations surpass traditional ETFs that track stock or bond assets because the fund must sustain Bitcoin position tracking while managing security expenditures for actual Bitcoin storage.

The management fees that accompany Bitcoin ETFs turn into a primary setback for investors who plan to keep their investments over extended periods since these expenses reduce actual ETF returns. Every Bitcoin ETF fund imposes management fees totaling between 0.5% and 2% per year while this cost surpasses normal ETF expenses for traditional assets. - Liquidity Issues: Physical Bitcoin ETFs might run into problems because of limited market liquidity. ETFs that maintain physical Bitcoin may experience problems with purchasing speed based on fund size and market fluctuations in Bitcoin value. The availability of Bitcoin within the market for institutional buying and holding may create difficulties for the ETF during substantial purchase or disposal transactions.

A lack of sufficient Bitcoin supply could produce price differences that might reduce the ETF’s capacity to lock onto Bitcoin’s real-time market value precisely. The ETF’s liquidity value and potential trading volume are adversely affected when Bitcoin market volatility reaches high levels since trading operations become more complex and possess more significant price impacts. - Regulatory Uncertainty: Although regulatory oversight brings mostly advantages to systems it sometimes creates operational hurdles. Governments worldwide hunt for optimal solutions for Bitcoin regulation as the regulatory framework for this cryptocurrency develops today. Classified changes in regulatory rules surrounding Bitcoin taxation together with modifications to bitcoin storage conditions or stricter Bitcoin-based financial product standards could negatively impact the operational outcome of Physical Bitcoin Exchange-Traded Funds.

Governments might control Bitcoin quantity within ETFs while adding new surveillance requirements which would elevate the resource expenses of reef management. Conditions created through regulatory policy pose significant risks to investors who choose Physical Bitcoin exchange-traded funds.

2. Futures-Based Bitcoin ETFs

The structural distinction between futures-based Bitcoin ETFs and Physical Bitcoin ETFs exists in how they avoid holding ownership of Bitcoin directly. Instead of owning Bitcoin the funds only invest in Bitcoin futures contracts that establish a purchase or sale agreement for Bitcoin with pre-set prices at specific future times. Futures of Bitcoin exist as traded assets through official exchanges including CME and their prices mirror Bitcoin’s market value changes. These particular Bitcoin ETFs connect their performance with Bitcoin futures prices instead of Bitcoin prices that exist in real time.

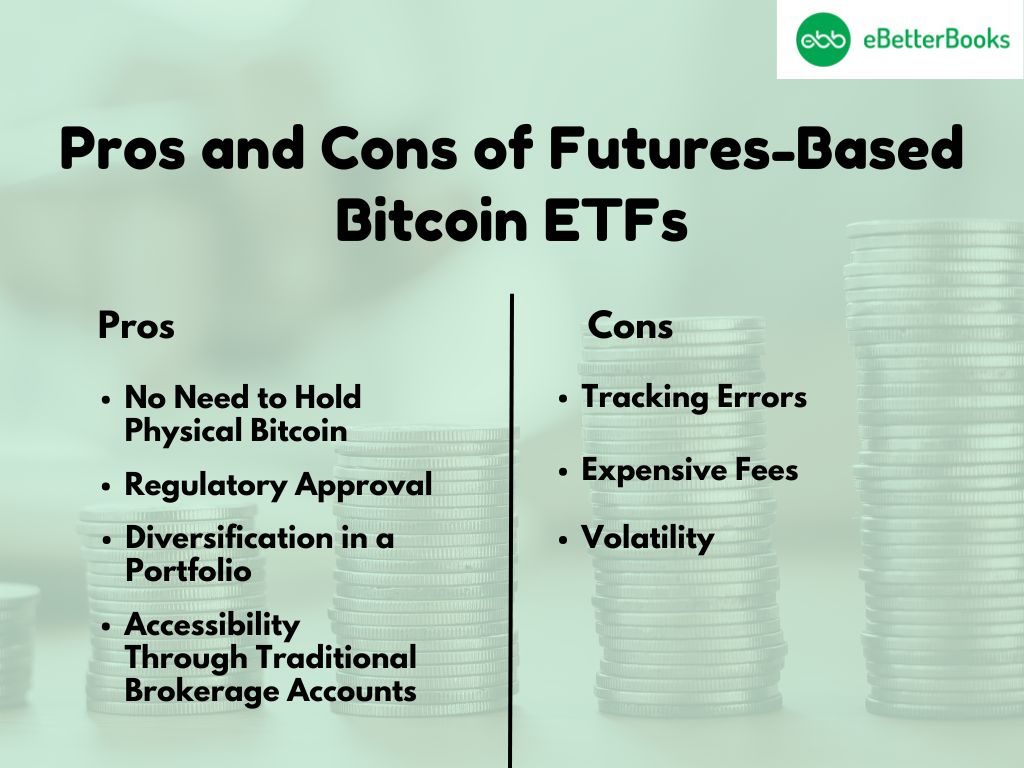

Pros of Futures-Based Bitcoin ETFs

- No Need to Hold Physical Bitcoin: The major benefit of Future-based Bitcoin ETFs means investors do not have to handle actual Bitcoin possession or maintain ownership security. The fund invests in Bitcoin futures contracts therefore eliminating the burden of running cryptocurrency wallets together with the need to locate a custodian to store actual Bitcoin. Investors access Bitcoin exposure through this ETF without having any need to handle Bitcoin ownership directly.

The ability to invest in currency futures through ETFs provides exposure to Bitcoin for investors requiring reassuring control over Bitcoin storage. - Regulatory Approval: The U.S. Securities and Exchange Commission (SEC) among other entities granted regulatory approval for Futures-based Bitcoin ETFs. The regulatory approval enhances accessibility by letting professional investors use standardized financial tools in which they feel secure.

Regulated exchanges where these ETFs trade provide vital oversight while delivering investor protection which traditional unregulated cryptocurrency trading lacks. - Diversification in a Portfolio: Through futures-based Bitcoin ETFs investors can access Bitcoin prices by diversifying across multiple investment assets. Virtual Bitcoin futures contracts enable investors to participate in Bitcoin without requiring any time commitment for their cryptocurrency investment.

Professionals who deal with Bitcoin may benefit from the futures-based exchange-traded funds which allow quick transactions for risk control and fast Bitcoin price speculation involvements. Traditional stock-bond-commodity portfolio holders can now invest in Bitcoin through futures-based ETFs to broaden their investment options while adding cryptocurrency to their asset mix. - Accessibility Through Traditional Brokerage Accounts: The accessibility of Futures-based Bitcoin ETFs mirrors the trading convenience of Physical Bitcoin ETFs on standard stock markets. Bias due to ease of access enables conventional brokerage account holders to purchase and sell shares of funds containing these assets.

People looking to enter the cryptocurrency market through diverse investments while avoiding direct usage of traditional cryptocurrency platforms can easily access Bitcoin futures through available ETFs.

Cons of Futures-Based Bitcoin ETFs

- Tracking Errors: Tracking errors represent one significant disadvantage of Futures-based Bitcoin ETFs because of their mismatches with Bitcoin’s spot values. Futures contracts experience imperfect alignment with the current market value of Bitcoin. These contracts create tracking issues because market conditions including contango and backwardation affect their price stability over time.

The Bitcoin futures market operates through two price movements termed Contango where contracts trade at higher rates than spot value and Backwardation which exists when future trade at lower rates than spot markets. Persistent price differences between Bitcoin futures contracts and the actual Bitcoin market can lower the effectiveness of ETF investment compared to direct Bitcoin price returns. ETF tracking errors become considerable during periods of market volatility which results in performance data that significantly diverges from Bitcoin’s actual price action. - Expensive Fees: Planning costs for futures contracts include three significant fees which consist of management and trading expenses coupled with contract rolling expenses. The ETF must engage in “rolling” when Bitcoin futures contracts approach expiry by liquidating expiring contracts to acquire contracts with extended expiration terms.

The fund performance becomes minimized because of additional expenses from this transaction procedure. Investors in futures-based Bitcoin ETFs need to understand the substantial expense structure when compared to conventional ETFs because both costs and trading expenses diminish profit potential during market upheavals. - Volatility: The speculative nature of Bitcoin futures produces a matching high level of price volatility that the futures-based Bitcoin exchange-traded funds necessarily inherit. Futures contracts experience rapid price shifts that primarily occur in markets characterized by excessive speculations.

Reckless usage of leverage by investors enhances Bitcoin’s typical price volatility in futures contracts which allows digital asset exposure. Valuation volatility in these investments creates price swings that experts believe are ideal for those who are comfortable with risk . The delivery of volatile futures-based Bitcoin ETF values produces short-term losses which negatively impact conservative investors

3. Hybrid Bitcoin ETFs

Some Bitcoin ETFs combine elements of both physically-backed and futures-based ETFs. These hybrid ETFs may hold a portion of Bitcoin directly while also utilizing futures contracts to gain exposure to the broader market. These ETFs seek to balance the advantages and disadvantages of both structures.

A few examples of Physical Bitcoin ETFs, along with other details:

| Name | Investment structure | Underlying Assets | Trading Exchange | Launch Year | Country | Management Fee |

| Purpose Bitcoin ETF | Direct Bitcoin holdings in a custodian | Bitcoin (physical) | Toronto Stock Exchange (TSE) | 2021 | Canada | 1.00% |

| Evolve Bitcoin ETF | Direct Bitcoin holdings in a secure wallet | Bitcoin (physical) | Toronto Stock Exchange (TSE) | 2021 | Canada | 0.75% |

| 3iQ The Bitcoin Fund | Holds Bitcoin in cold storage | Bitcoin (physical) | Toronto Stock Exchange (TSE) | 2020 | Canada | 1.25% |

| Grayscale Bitcoin Trust (GBTC) | Holds Bitcoin, traded like a stock | Bitcoin (physical) | OTC Markets (OTCQX) | 2013 | U.S. (OTC) | 2.00% |

| Bitcoin Tracker One | Holds Bitcoin in a Swedish-based custodial service | Bitcoin (physical) | Nasdaq Stockholm | 2015 | Sweden | 2.50% |

A few examples of Bitcoin Futures ETFs, along with other details:

| Name | Investment structure | Underlying Assets | Trading Exchange | Launch Year | Country | Management Fee |

| ProShares Bitcoin Strategy ETF | Invests in Bitcoin futures contracts | Bitcoin Futures | NYSE Arca | 2021 | U.S. | 0.95% |

| Valkyrie Bitcoin Strategy ETF | Invests in Bitcoin futures contracts | Bitcoin Futures | NASDAQ | 2021 | U.S. | 0.95% |

| VanEck Bitcoin Strategy ETF | Invests in Bitcoin futures contracts | Bitcoin Futures | CBOE Global Markets | 2021 | U.S. | 0.65% |

| Bitwise 10 Crypto Index Fund | Invests in Bitcoin and other crypto futures | Bitcoin Futures, Crypto | OTC Markets (Private) | 2021 | U.S. | 0.85% |

| Invesco Bitcoin Strategy ETF | Invests in Bitcoin futures contracts | Bitcoin Futures | NYSE Arca | 2021 | U.S. | 0.99% |

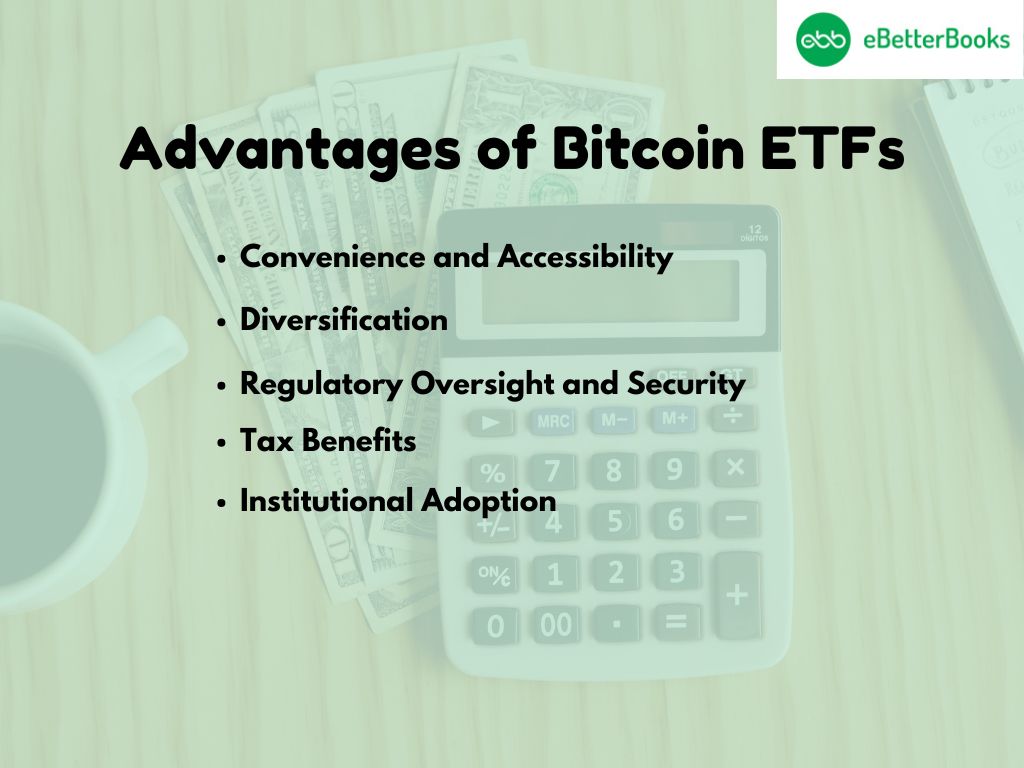

Advantages of Bitcoin ETFs

1. Convenience and Accessibility

Traditional investors find Bitcoin ETFs advantageous because they provide easy access to the Bitcoin market. Regular brokerage accounts allow investors to acquire Bitcoin ETF shares so they do not need to interact with cryptocurrency exchanges or control private keys. Bitcoin market accessibility has increased due to this step because it allows investment vehicles for professional asset managers and retirement funds and people unaccustomed to cryptocurrencies.

2. Diversification

Investors can achieve Bitcoin exposure through Bitcoin ETFs which serve as a diversification tool while allowing indirect Bitcoin purchases. An investor who owns stocks and bonds can use a Bitcoin ETF to introduce crypto characteristics to their financial assets through a hassle-free investment interface.

3. Regulatory Oversight and Security

Government agencies supervise Bitcoin ETFs to embrace oversight requirements that most individual Bitcoin exchanges lack. Government oversight of Bitcoin ETFs provides investors with enhanced security and trust which specifically benefits institutional investors who need assurance about volatile exchange risks.

4. Tax Benefits

Tax-friendly features of Exchange-Traded Funds (ETFs) provide better benefits than traditional Bitcoin ownership in multiple national markets. An ETF structure holding Bitcoin Valerie L. Weber Fund pays capital gains taxes rather than taxation rules from direct Bitcoin trading or transfers. Tax laws favor Bitcoin ETFs because they allow investors to gain tax advantages that minimize their total capital gains tax obligation.

5. Institutional Adoption

Bitcoin ETFs serve as a solution that enables institutional investors to obtain simpler entry into investing in Bitcoin. Historically institutions avoided purchasing Bitcoin as direct holdings because of uncertainties about laws and concerns regarding custody as well as liquidity distribution. Through Bitcoin ETFs, investors gain a premium-quality investment tool that eliminates these barriers to entering cryptocurrency markets at institutional levels.

Risks of Bitcoin ETFs

1. Volatility and Market Risk

The price volatility which Bitcoin is famous for also affects Bitcoin ETFs. The value of ETF shares faces substantial price changes because Bitcoin exhibits volatile market behavior. Investors who opt for Bitcoin ETFs instead of Bitcoin themselves encounter decreased price volatility yet must still prepare for substantial market fluctuations.

2. Tracking Errors

Futures-based Bitcoin ETFs can suffer from tracking errors due to the nature of the futures market. A futures contract’s price can differ from Bitcoin’s spot price, especially during times of high market volatility. As a result, investors in Bitcoin futures ETFs may not experience the same returns as if they had directly owned Bitcoin.

3. Regulatory Risk

Although Bitcoin ETFs are gaining regulatory acceptance, the regulatory landscape surrounding cryptocurrencies remains fluid. Governments worldwide are still debating how to handle Bitcoin and other cryptocurrencies. Future regulatory changes could impact the performance of Bitcoin ETFs or make them more difficult to access for certain investors.

4. Custody Risk

For physically-backed Bitcoin ETFs, custody risk remains a concern. Bitcoin is often stored in cold wallets, which are susceptible to hacking if not properly managed. If the custodian holding the Bitcoin for the ETF is hacked or experiences a security breach, investors could lose their exposure to Bitcoin.

5. Limited Product Offerings

While Bitcoin ETFs have become more widely available, the options remain limited. Futures-based Bitcoin ETFs are more common than physical Bitcoin ETFs, which could limit investors’ ability to gain exposure to Bitcoin in the way they prefer.

The Evolution of Bitcoin ETFs

The swift transition of Bitcoin from its position as an obscure cryptocurrency toward becoming a worldwide phenomenon precisely matched the development of Bitcoin ETFs. The financial industry has carried ETFs yet Bitcoin integration creates a new milestone for digital currency adoption. The approval of Bitcoin ETFs became the goal of both Bitcoin enthusiasts and institutional investors because they sought a conventional regulated method to invest in Bitcoin.

Bitcoin’s lack of central authority and uncontrolled settings stood in the way of traditional adoption because this made the system unaccepted by mainstream investors throughout history. Financial authorities particularly from the United States demonstrated their concerns about digital currency market security and transparency issues.

The combination of hacking incidents together with fraudulent and manipulative activities at Bitcoin exchanges led regulators to fail in providing traditional market protection. The approval of a Bitcoin futures ETF by the SEC in 2021 marked a crucial moment in Bitcoin ETF development history.

Bitcoin ETFs and Institutional Adoption

Investors through Bitcoin ETFs now find it simpler to access Bitcoin because of its recent rise in popularity. Hedge funds and pension funds together with family offices increasingly view Bitcoin as an inflation-fighting asset while also demanding it for value storage purposes. Institutional investors seek access to Bitcoin through BTC ETFs because these funds present highly secure regulated and liquid means to obtain Bitcoin ownership.

Through Bitcoin ETFs, institutional investors can access Bitcoin exposure safely and through traditional financial market structures. Institutions continue to adopt Bitcoin because of its rising demand and price. Mainstream financial institutions view Bitcoin ETF growth as vital to achieving Bitcoin acceptance within their realm.

The Future of Bitcoin ETFs

Bitcoin ETFs demonstrate favorable potential for the future because cryptocurrencies are expected to experience ongoing innovation and market expansion. Bitcoin continues its adoption growth which should lead to the emergence of additional Bitcoin ETF products extending beyond traditional products and entering specific Bitcoin market sectors (e.g. mining companies or blockchain-based projects).

Investors will access the cryptocurrency market growth through diversified portfolios by treating Bitcoin ETFs as essential investment elements when regulatory clarity advances.

The Challenges and Risks of Bitcoin ETFs

1. Market Volatility and Price Fluctuations

Financial markets recognize Bitcoin as one of their most unstable investment assets. The high level of market price fluctuations that drive Bitcoin growth creates significant dangers for investors. The market volatility affecting Bitcoin extends across all Bitcoin exchange-traded funds. Conservative investors may avoid Bitcoin ETFs because their prices experience significant changes due to the volatility of Bitcoin.

The connection between futures-based Bitcoin exchange-traded funds and Bitcoin’s current market value presents potential issues that need consideration. A phenomenon called contango produces higher future contract pricing than spot price but backwardation shows lower future contract pricing as compared to spot price. These conditions result in tracking errors for Bitcoin futures ETF performance.

2. Liquidity Concerns with Futures-Based ETFs

The units in Bitcoin futures ETFs maintain investments in futures contracts instead of Bitcoin physical assets. The value of Bitcoin futures-based ETFs depends on exchange-traded funds prices of Bitcoin futures while the Bitcoin market price operates independently.

Bitcoin futures contracts show performance changes based on numerous market condition elements that include investor sentiment together with Bitcoin supply/demand dynamics along with macroeconomic events.

The performance of futures-based ETFs may not show an exact match with Bitcoin price movements although they serve as indirect exposure vehicles for Bitcoin to investors.

3. Regulatory Risks and Future Legislation

Bitcoin ETFs operate under the changing regulatory frameworks for cryptocurrency institutions. These ETFs deliver regulated investment accessibility to investors yet disruptive legislative changes and tax updates as well as government policy modifications can lead to considerable market changes. Governments across the world along with those in the United States work to decide cryptocurrency standing within the overall financial framework.

Regulatory policies that impose new requirements for Bitcoin possession alongside modifications to taxation standards will substantially affect Bitcoin ETFs as well as their capacity to draw in new investor groups. Future regulatory modifications create dangers for investors because they remain uncertain about new laws affecting their investments.

4. High Fees and Expensive Management Costs

While Bitcoin ETFs provide exposure to Bitcoin without the hassle of direct ownership, they come with management fees that can eat into returns. The costs of securing and storing Bitcoin, coupled with trading fees, can make Bitcoin ETFs more expensive than holding Bitcoin directly. Investors should carefully evaluate the cost structure before investing in these products.

The Future Outlook for Bitcoin ETFs

Bitcoin ETFs are expected to thrive in the future despite being cautious due to their infancy in the market. Institutional participation in Bitcoin ETFs will increase market availability and induce structural changes toward new products with innovative features. The Bitcoin market’s development alongside improved regulatory standards will bring about more physical Bitcoin ETFs.

Another development opportunity arises from creating ETFs that concentrate on particular Bitcoin submarkets like Bitcoin mining and blockchain technology to enable investors to diversify their cryptocurrency investments.

Due to rising global Bitcoin adoption, more people will start investing in Bitcoin ETFs because they offer regulated access to cryptocurrency. Their capability to connect traditional financial systems with digital asset markets positions them as fundamental elements of future financial operations.

Conclusion

Bitcoin ETFs represent a significant step in the evolution of cryptocurrency investing. They provide an easier, more accessible way for traditional investors to gain exposure to Bitcoin, while also offering the benefits of liquidity, security, and regulatory oversight. While Bitcoin ETFs come with their own set of risks, including volatility and tracking errors, they remain a promising vehicle for gaining exposure to the digital asset class.

As the cryptocurrency market continues to grow, Bitcoin ETFs will likely play an important role in bridging the gap between traditional finance and the world of digital assets. With regulatory clarity, innovation, and institutional adoption, Bitcoin ETFs have the potential to become a key player in the future of financial markets.