What is Cryptocurrency Mining?

Cryptocurrency mining is the process of creating new digital money and verifying and including the transactions of a blockchain network. It uses high-powered computers to solve complicated mathematical problems, a process known as “Proof of Work.”

Each time one of these miners successfully solves the problem, he or she is granted the authority to add the next block of transactions to the blockchain and gain a reward from the flow of cryptocurrencies such as Bitcoin or Ethereum. This reward system encourages miners to contribute to supporting and improving the given network.

A significant reason for mining is decentralization, which enables participants globally to contribute to blockchains’ workings and protection. However, cryptocurrency mining is very competitive and also very costly in terms of resources, hardware, and electricity.

Purpose of Cryptocurrency Mining

The purposes of cryptocurrency mining are:

- Transaction Verification: This group is responsible for turning and verifying transactions in the blockchain to ensure their security and correctness.

- Decentralization: It supports a decentralized network because different participants are allowed to participate without central authority.

- Network Security: This safeguards the blockchain by making it unprofitable for a destructive party to attempt to modify transaction records.

- New Coin Generation: Actually, it produces new coins, which are given to miners to regulate the amount of cryptocurrencies.

- Incentivization: This motivates participants to contribute financially through their activities to the blockchain network in the form of cryptocurrency.

The Technical Aspects of Mining

The technical aspects of cryptocurrency mining include:

- Hashing Algorithms: Players of a small game solve cryptographical problems with a certain type of algorithm (for instance, SHA-256 for Bitcoin) to check the transaction and integrate new blocks. These algorithms guarantee the privacy and authenticity of the data stored on the blockchain.

- Proof of Work: The majority of cryptocurrencies utilize PoW as their consensus algorithm, which demands that miners solve mathematical puzzles. This helps prevent invalid blocks from being added to the blockchain, but it requires high processing power.

- Mining Hardware: Faxing for specific cryptocurrencies includes GPUs (Graphics Processing Units), ASICs (Application-Specific Integrated Circuits), or CPUs. All are different in terms of computing power, with ASICs generally considered to be the most efficient in terms of highly demanding jobs regarding mining.

- Mining Software: Software programs are responsible for managing all the hardware, connecting them to the blockchain network, and availing tools to check on performance. There are open-source ones, including CGMiner and BFGMiner, amongst others.

- Mining Pools: Mining alone is a problem because of the many participants, so miners collaborate in pools, merge their resources, and receive payment for this.

- Energy Consumption: Electricity is used extensively in mining and even more so for PoW mining. This can lead to high operational costs and has raised much concern about the state of the environment at the international level.

- Difficulty Adjustment: When more miners are connected to the network, mining difficulty is adjusted upward to ensure that blocks are produced at a steady rate and hence require more computational power as time passes.

Types of Cryptocurrency Mining

- Solo Mining: In solo mining, a miner performs the jobs alone for mining and gets paid after verifying the transactions. It is a prospective strategy to earn money when realizing that it works against big networks. However, it is difficult for an individual because it demands large computational capacities and means.

- Pool Mining: It is a mining process where multiple people with multiple computers come together to work on something in an attempt to get a block. They are then distributed depending on each member of the pool in proportion to the work done by that miner. Now, pool mining is still popular among people because it provides more amounts per time, though less frequently.

- Cloud Mining: Cloud mining is the process by which individuals purchase mining equipment or hash power from remote data centers without a physical asset. Cloud mining is an agreement where users submit money to a cloud mining provider and get a share of the rewards they produce. While not a bad choice, it is less exclusive and can have implications such as unreliable providers or lower levels of profit because of rentals.

- CPU Mining: This type of mining involves the use of your computer’s processor, commonly known as a central processing unit (CPU). Through previously useful, CPU mining is often slower and less profitable at the moment as many cryptocurrencies consume more energy than CPUs are capable of delivering.

- GPU Mining: Cryptography mining using GPUs is more efficient than doing it with CPUs and is suitable for mining almost any type of cryptocurrency. GPU mining rigs are a favorite among amateurs and can mine several coins with fairly potent hashing capability.

- ASIC Mining: The Application-Specific Integrated Circuit, commonly referred to as ASIC, is unique general-purpose hardware built to mine only a specific coin. ASICs are fast and efficient, particularly for coins with high hashing demands, such as Bitcoin; they are accommodating to other algorithms and are expensive.

- Mobile Mining: A few cryptocurrencies can be mined via smartphones, although it’s generally not very lucrative because of the lower computing power of mobile devices. Mobile mining activity is much less common, is more exploratory, and may be better suited for small-scale or sample networks.

How is Cryptocurrency Mining Done?

Mining requires some specific hardware and software to ensure a smooth workflow.

Here’s a breakdown of how it’s done:

Mining Hardware:

- CPUs (Central Processing Units): Initially, mining was performed with the help of CPUs, but they are ineffective when it comes to contemporary cryptocurrencies.

- GPUs (Graphics Processing Units): These are believed to be used for mining even some of the other altcoins such as Ethereum. GPUs are more powerful with regard to processing and efficient for those particular algorithms.

- ASICs (Application-Specific Integrated Circuits): These are unbuilt hardware designed for the mining of specific virtual currencies such as Bitcoin. They are very efficient but expensive and integrable with specific algorithms only.

- FPGA (Field-Programmable Gate Arrays): A reconfigurable hardware solution that is less efficient than GPUs but more efficient than ASICs. Flexible, but not popular with practitioners because of the high degree of setup difficulty.

Mining Software:

- CGMiner: Used for ASIC and GPU mining; flexibility of protocols; support multiple algorithms; high degree of configurability.

- BFGMiner: It is just like CGMiner but with considerable enhancements such as fitted temperature; therefore, it is suitable for complicated mining systems.

- NiceHash: Easy to use and perfect for newcomers who want to help miners sell hash power. It allows many cryptocurrencies and the ability to switch through the algorithms automatically.

- EasyMiner: Further, it has a graphical interface that is the simplest for the user and enables the mining of several coins at a time in pools and solos.

- Joining a Mining Pool: Because of the fierce competition, many miners enter pools as they can combine their computational power to earn more often. FPU mining pool is an excellent option for people with suboptimal equipment.

- Internet Connection: Again, for constant mining and pool mining, a stable internet connection is highly recommended. Bandwidth is not an issue. However, low latency is compulsory in order to remain connected to the network.

- Energy Supply and Cooling: Mining takes a lot of electricity, mainly in the case of multiple GPUs or ASICs. Stable electricity supply and condenser systems are crucial for miners since overheating will result in the degradation of their hardware.

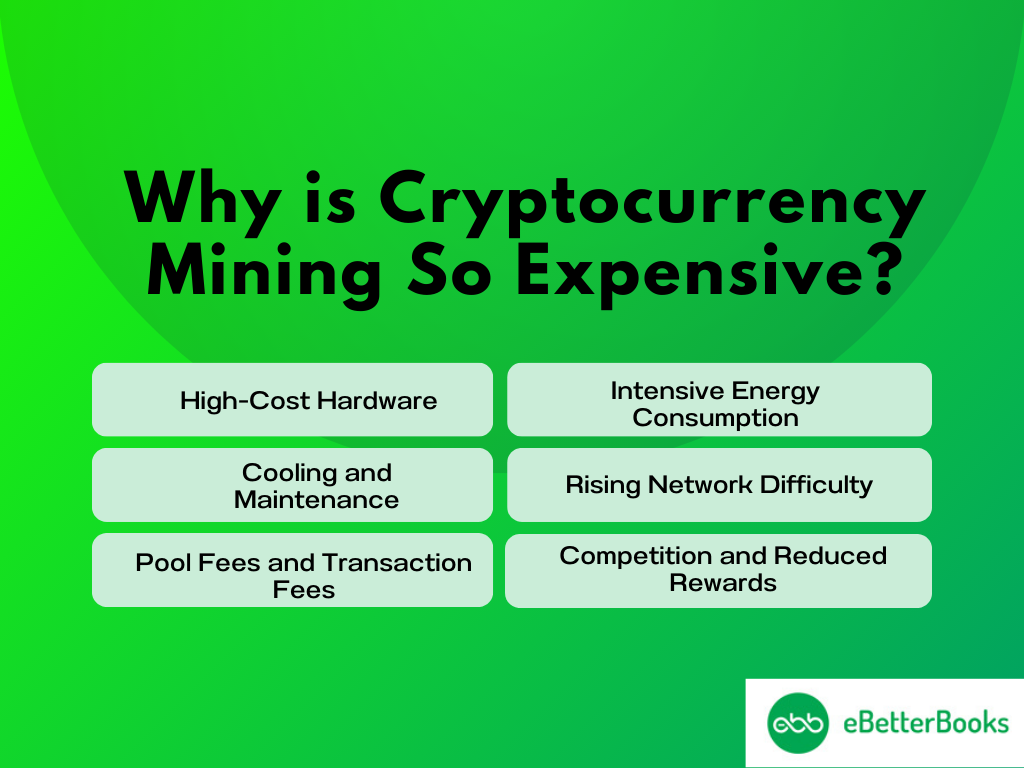

Why is Cryptocurrency Mining So Expensive?

Cryptocurrency mining is costly by virtue of hardware, electricity, competition, and hardware maintenance.

Here’s a breakdown of why mining is so costly:

- High-Cost Hardware: Mining is efficient when done using GPUs or ASICs, which shoot up costs. Individual ASIC miners in use for Bitcoin, for instance, can be thousands of dollars each. Also, mining hardware is a relatively fixed investment that depreciates very fast due to innovation; hence, miners often require frequent upgrades.

- Intensive Energy Consumption: Cryptocurrencies through PoW are energy-intensive; mining is an energy-intensive process. The mining of ASICS and large Graphic Processing Units requires consistently high power to solve cryptographic problems, and this results in the consumption of electricity. Recent predictions show that the energy consumption of those processes could be greater than in some states, where only Bitcoin mining requires more electricity than in countries such as Norway or UAE.

- Cooling and Maintenance: As we know, mining hardware is an electronic device that produces heat and, therefore, might require cooling devices for maximum performance and longevity. Cooling systems contribute to electric expenses; modifications or repair work to gear (such as fans or power travelers) also costs cash.

- Rising Network Difficulty: More participants in mining means that solving several puzzles may take a shorter time, so the rate at which the blocks are developed is adjusted by an increase in difficulty. This means that a miner needs more computational power over time, often leading to additional equipment or a better one.

- Pool Fees and Transaction Fees: Most individuals involve themselves in pools so that they can have higher probabilities of earning rewards. Still, pool masters ask for their commissions, which decreases the gains obtained. Furthermore, in some other virtual money types, the fees also affect the potential for revenue within the mining process.

- Competition and Reduced Rewards: As for Bitcoin and many other well-known cryptocurrencies, mining rewards are changed with a reduction of half every few years, also known as halving, which, in turn, reduces the amount miners are paid for each block. It is somewhat hard for independent miners to generate profits, especially without cheap power sources and efficient mining machinery.

These make the mining of cryptocurrencies a costly affair, thus requiring counterbalancing by the miners through frequent earning or access to cheap sources.

The Rise of Cryptocurrency Mining Startups and Companies

The main idea of crypto mining startups and companies is to meet the demand for cryptocurrency users and the need for decentralized financial solutions.

Here are some key reasons and trends driving the emergence of crypto-mining businesses:

- High Demand: Mining as a business venture has been realized since many individuals have ventured into the use of cryptocurrencies. Cryptomining organizations can earn lots of revenues just by cryptomining top-liked cryptocurrencies such as bitcoin or ether, particularly if the country jurisdictions’ electricity tariffs are low.

- Cryptomining for Institutional Investors: Funders of crypto mining now include institutional investors and large technology companies, making crypto mining capital an attractive asset class for crypto mining startups. Investment has enabled certain companies to turn into big mining houses with the aid of efficient equipment and installations.

- New Technologies of Mining: Companies are developing improved mining equipment like the ASICS, which can operate at a very high level of efficiency compared to their predecessors. This emphasis on advanced technology is allowing new mining firms to challenge incumbent firms effectively.

- Renewable Energy Solutions: One important trend is the use of renewable energy sources for mining, where startups from Iceland and Canada utilize geothermal and hydroelectric power to cut expenses and greenhouse emissions. This approach assists mining firms in working with environmental issues while being lucrative.

- Cloud Mining Services: Some firms have come up that enable people to mine without having the equipment in a process referred to as cloud mining. Users purchase mining capacity, which means that miners are available to a much larger population, and startups can sell the power to mine for constant income.

- Proof of Stake (PoS): With some mainstream networks altering their PoW to PoS, startups are expanding their portfolios. That is why many people are turning to staking services in addition to mining: they want to contribute to blockchain validation without using a lot of energy.

In conclusion, participants active in crypto mining startups and organizations are employing technological advancements, choice of physical locations, and the shared economy as some of the key success factors amidst growing competition.

Can Individuals Still Participate in Cryptocurrency Mining?

Ideally, people can still engage in cryptocurrency mining, but this has become somehow cumbersome and, at times, less rewarding, especially for everyday miners who cannot afford to invest heavily.

Here are the main considerations for individual miners:

- Choice of Cryptocurrency: As a lone wolf, it is unprofitable to mine Bitcoin directly due to competitive pressure and specialized mining hardware (like ASICs). However, some altcoins are harder at similar power, like ETC, RVN, and MONERO, and can be mined with regular GPU.

- Mining Pools: Smaller miners can belong to mining pools; miners jointly work together and share the results for bigger rewards. This approach guarantees a frequent harvest, like getting more peanuts, instead of a less frequent but larger large harvest, like getting a large bar of chocolate.

- Cloud Mining: Some people prefer internet-based mining, where they acquire hashing power without having to own a piece of equipment. Still, cloud mining brings certain costs with it, and, as a rule, the revenues are not very high, so choosing a provider is a rather important task.

- Access to Low-Cost Energy: In some cases, road construction, electricity, and fuel are cheaper for miners, and that will make mining profitable. High costs, in turn, can result in high electricity costs, which, as for high-consuming coins like Bitcoin, can overshadow any given profit.

- Alternative Consensus Mechanisms: As more networks shift from Proof of Work (PoW) to Proof of Stake (PoS), individual miners may turn to staking as an opportunity. PoS does not demand extreme hardware and enables people to contribute to transaction authentication by holding and staking coins.

Of course, in today’s day and age, people can still mine crypto. Still, it is highly recommended that they first weigh out the initial investment, the costs of maintenance, and the revenue yielded by the results, as the market has developed significantly over the years and issues barriers to entry to cryptocurrency mining.

Cryptocurrency Mining: Risk vs Reward

Cryptocurrency mining is a risky and profitable opportunity.

Here’s a closer look at the risk vs. reward factors in crypto mining:

| Rewards of Crypto Mining | Risks of Crypto Mining |

| Financial Gain: Mining can eventually be lucrative if the value of the coin increases or if the miner can acquire a cheap power supply. The rewards are received in the form of mined coins, which can be sold, or Ice. Asset Accumulation: Coins that are stored have the potential to appreciate, although this may be slower than Alts, top coins such as BTC or ETH. A major advantage of holding onto mined coins is that in the long run, if prices do appreciate, this results in higher revenues. Decentralized Network Participation: A surprising fact that might interest tech-savvy individuals is that miners are critical for keeping blockchains secure and sound. Such participation generally corresponds with the ethos of supporters of blockchain and those interested in Crypto. Passive Income Potential: With reliable hardware and software equipment, mining operations can make passive income, especially when large and efficient mines commence with rewards. |

High Initial Costs: Mining involves enormous expenditures towards machines (either ASICs or GPUs), as well as investment in structures and energy to cool them. In particular, for individuals or firms that are not large-scale miners or have otherwise limited business, these costs may not be justified. Energy Expenses: Mining, particularly the Proof of Work (PoW) type, consumes extensive electricity. High energy costs erode the margin and create negative effects when electricity prices increase or low-cost power is not available. Market Volatility: The digital currencies market is volatile. A sharp increase in coin price significantly reduces mining profitability since it will lead to either low earnings or the ability to meet operation costs. Mining Difficulty and Competition: There is an increase in the difficulty level of mining as more and more miners join a particular network. This makes it more and more complex to be rewarded. This increasing competition implies that, for most miners, the only option is to upgrade or expand in order to remain profitable. |

Cryptomining is very profitable only if the operation is well managed in terms of costs, technology procurement, and training on changed regulations. Essential factors influencing mining include the availability of cheap electricity, quality hardware used in the mining process, and flexibility to endorse to market conditions.

How to Participate in Cryptocurrency Mining Businesses?

- Direct Hardware Investment: Avail mining hardware so that you can perform mining by yourself and own the entire mining procedure and the profits.

- Cloud Mining Contracts: Invest in cloud mining contracts to enable you to mine cryptocurrencies through the use of a hash rate without owning the equipment.

- Mining Pools: It is recommended to join a mining pool, which is the participants’ association; their resources or hash power are joint, and the profits are distributed among the participants so that the income will be more stable and the risks will be less.

- Investment in Mining Companies: Buy stocks in mining companies or other companies involved in the blockchain business so as to earn profits from Crypto mining indirectly through the stock exchange.

- Collaborative Mining Farms: Join other large and small-scale miners on a mining farm so that the parties can combine resources in a bigger and more productive mining pool to earn more substantial profits.

- Staking in POS Cryptocurrencies: Engage in staking services for POO/in POE different cryptocurrencies where you hold coins to get paid without the use of hardware for mining.

Famous Cryptocurrency Mining Businesses

Here are some well-known Crypto-mining businesses recognized for their scale, technology, or influence in the cryptocurrency-mining industry:

- Bitmain Technologies: Headquartered in China, Bitmain is the manufacturer of ASIC mining hardware and runs mining pools such as Antpool and BTC.

- Genesis Mining: As a Hong Kong-based cloud mining firm, this platform enables ordinary enthusiasts from across the globe to mine without having to acquire actual hardware devices. Genesis Mining offers mining contracts for different coins, starting with Bitcoin and extending to Ethereum and Zcash.

- Riot Platforms: Originally called Riot Blockchain, this is an American mining company that specializes in Bitcoin mining and runs one of the biggest mining farms in Texas, thanks to cheap electricity rates.

- Hut 8 Mining Corp: Hut 8 is based in Canada, is a Toronto Stock Exchange-listed mining company, realizes enormous Bitcoin mining infrastructure, and utilizes inexpensive, green electricity to contribute immensely to the North American hashing rate.

- Marathon Digital Holdings: Another American mining company, Marathon Digital, is listed on the NASDAQ and has recently rapidly grown its Bitcoin mining, both in intensity and geographic location, throughout the United States.

- Argo Blockchain: Argo Blockchain is a UK-based mining firm whose securities float in the London Stock Exchange market; currently, they mine Bitcoin and Zcash with an emphasis on renewable power.

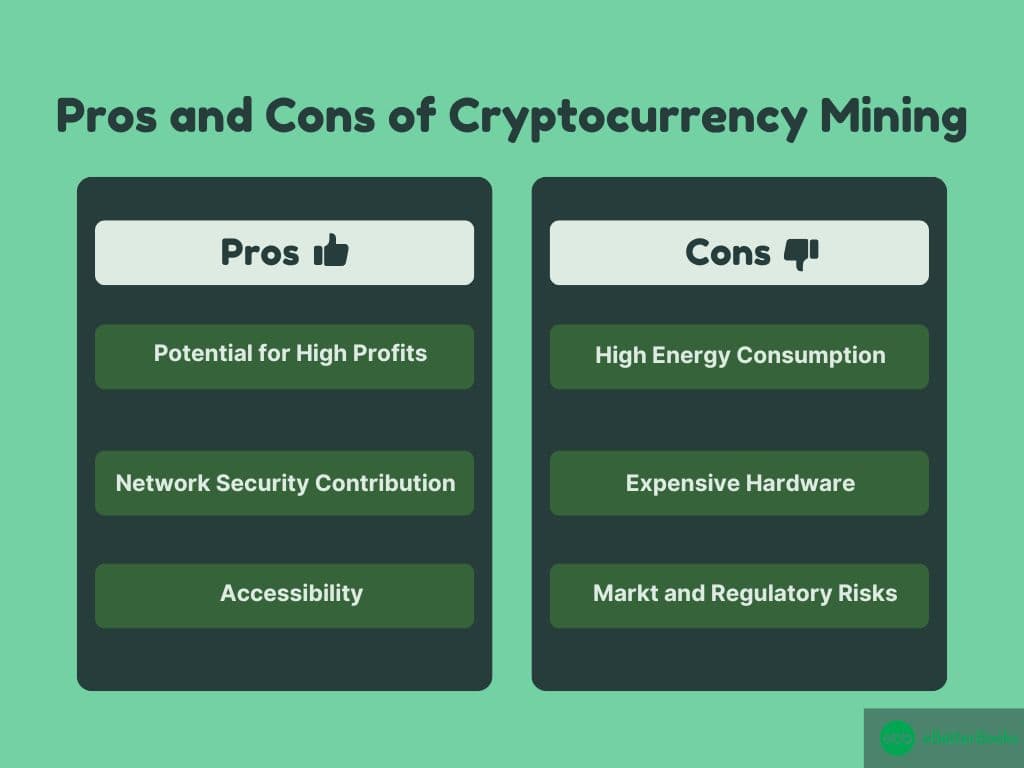

Pros and Cons of Cryptocurrency Mining

Pros

- Potential for High Profits: It is quite possible that mining can be very profitable, especially when the prices for individual cryptocurrencies are high.

- Network Security Contribution: Transaction validators in a blockchain network receive support from miners in the aspect of network security and decentralization.

- Accessibility: Such arbitrage opportunities as cloud mining exist to enable users to mine without necessarily requiring enriched hardware.

Cons

- High Energy Consumption: Mining uses a lot of electricity to produce the necessary power to carry out operations and is generally very expensive in regard to the environment.

- Expensive Hardware: ASIC and GPU-based mining equipment are expensive and need frequent replacement.

- Market and Regulatory Risks: As many of you already know, mining for cryptocurrencies is profitable if the price of the Cryptos fluctuates and is unfavorable in regions where there are stringent laws regarding mining activities.

Conclusion

Overall, cryptocurrency mining has a significant responsibility for creating an additional layer of security for transactions and developing a decentralized system for using cryptocurrencies. The advantages associated with it include profit potential and technology improvement, but on the other hand, we have disadvantages such as high energy costs, regulatory concerns, and intense rivalry.

There are emerging trends within the industry with a focus on sustainability and exploitation of mineral resources. This is especially important for participants so as to make appropriate decisions regarding the risks and rewards attached to them, given the ever-emerging technologies.

FAQs

What is the Most Efficient way to Mine Cryptocurrency?

The most efficient way to mine depends on the cryptocurrency. For Bitcoin, ASIC miners are typically the best option due to their high processing power. For altcoins, GPU mining is a good choice, offering flexibility and efficiency for multiple cryptocurrencies.

Is Cryptocurrency Mining Still Profitable in 2025?

Cryptocurrency mining can still be profitable, but it requires significant investment in specialized hardware and access to low-cost energy. It’s essential to consider factors such as energy consumption, hardware costs, and mining difficulty before deciding to mine.

Can I Mine Cryptocurrencies Without Owning Hardware?

Yes, you can participate in cryptocurrency mining through cloud mining services or by joining mining pools. These options allow you to mine without needing to own expensive hardware, though they may come with lower profits and added risks.