Introduction to the Ripple System

Ripple is an open-source, distributed payment protocol that utilizes distributed ledger technology based on the blockchain architecture to support fast, secure, and cheap cross-border payments. As opposed to Bitcoin, for example, which is a physical or virtual asset aimed at local or P2P exchanges, Ripple’s fundamental feature is to improve the experience of money transfers between banks.

After going through its function description, one learns that Ripple uses blockchain technology to reduce transaction costs and time caused by intermediaries. Ripple’s main focus is as a payment settlement asset exchange and remittance system, similar to the SWIFT system for international money and security transfers used by banks and financial intermediaries.

Ripple is a well-established company linked to its digital asset, XRP, which works similarly to bridge currency within the network. Most blockchain platforms require mining to verify transactions.

Ripple’s products serve as a temporary global settlement layer for businesses and individuals. However, Ripple has a consensus model that allows verifications to occur without mining. In addition to scalability, security, and interconnectivity, Ripple is known as one of the companies redefining conventional financial systems.

History and Leadership

Ripple was founded in 2012 by Chris Larsen, David Schwartz, Author Britto, and Jed McCaleb. Their vision was a payment system that would allow Gauntlet to avoid regular bank problems like high costs and long delivery times.

That same year, the company rebranded from Opencoin to Ripple Labs, a sign that it had scaled up its goal of a global remittance system overhaul. Ripple’s current leadership is comprised of Chris Larsen and other experienced professionals in the financial technology industry.

In the two and a half years since Garlinghouse took over the company, Ripple has made considerable progress in its strategic partnerships and in the courts. He has been at the forefront of the fight for Ripple to become mainstream.

Ripple has signed more than 300 partners, including Santander and American Express, underlining its role as a mover of blockchain technology for payments.

XRP Ledger

The XRP Ledger, also known as XRPL, is a blockchain engineered by Jed McCaleb, Arthur Britto, and David Schwartz. It is a public database that is distributed in nature and is used by Ripple.

Intended for large and fast operations, the XRPL can handle up to 1,500 TPS compared to Bitcoin, which can only handle around 7 TPS. The XRPL is a decentralized ledger that allows for the creation of digital tools such as stablecoins, NFTs, and Central Bank Digital Coins. Tokens other than XRP can be created on the XRP Ledger, called IOUS.

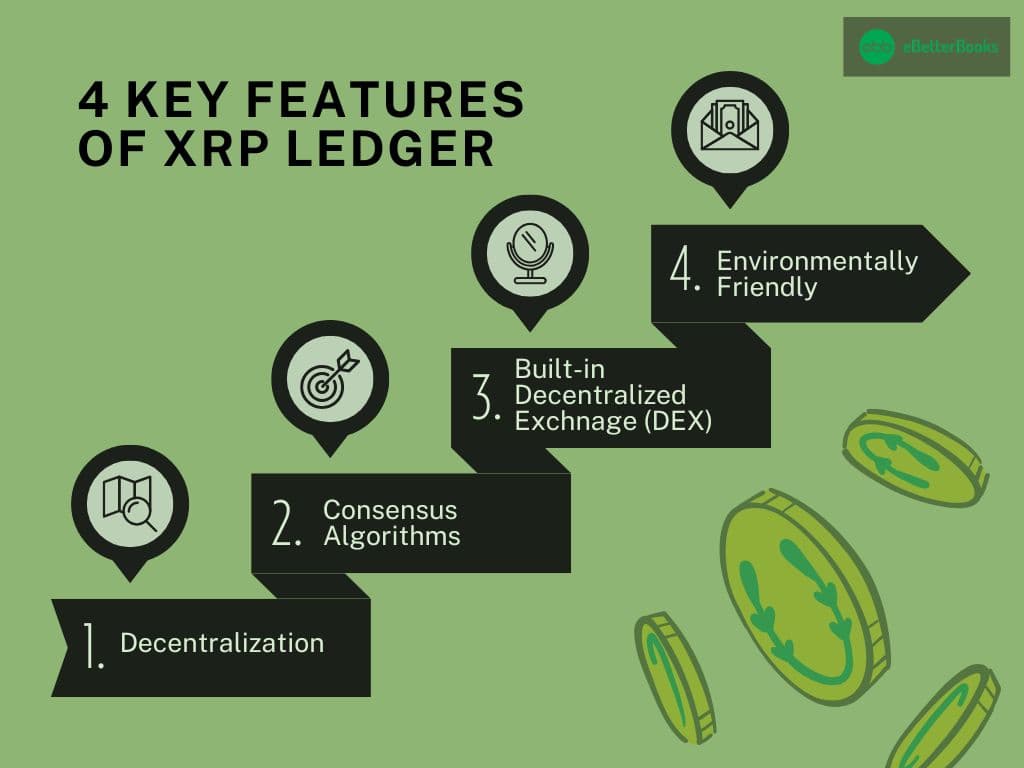

Key Features of XRP Ledger

- Decentralization: It is important to note that although Ripple Labs own XRPL, it is decentralized, and validators are located worldwide.

- Consensus Algorithms: The XRPL applies the Ripple Protocol Consensus Algorithm, under which independent nodes make decisions on the order and legitimacy of actions.

- Built-in Decentralized Exchange (DEX): The XRPL also contains its built-in decentralized exchange through which people can exchange their digital assets.

- Environmentally Friendly: The XRPL’s consensus algorithm is not mineable and, therefore, consumes less energy than the PoW blockchains.

The XRPL is incorporated into Ripple’s objective of opening global financial systems, facilitating functions like creating tokens, and opening unique payment pipelines.

Cryptocurrency XRP (Ripple)

XRP is an independent digital currency that provides and functions as the digital asset native to the XRP Ledger within the Ripple network.

Unlike Bitcoin or Ethereum, the XRP cryptocurrency has not been mined since its issuance of 1 trillion coins. Many XRP tokens are owned by Ripple Labs, which sells a percentage to ensure the market’s stability.

Functions of XRP

- Bridge Currency: Cross-border payments are made using XRP, which acts as a middle ground between fiat currencies.

- Liquidity Provision: Banks and payment providers that offer XRP can instantly access their funds without having to open nostro accounts in advance.

- Low Transaction Costs: This possibility can drastically increase the speed of transactions, as transaction fees are less than one penny with XRP.

XRP is not only associated with Ripple, as developers build applications on the XRPL intending to use them in DeFi and tokenization. Also, due to Ripple’s ownership of considerable amounts of XRP, there has been a lot of controversy regarding its nature being a security or a currency.

How Ripple Works

Ripple operates under a very distinctive business model based on RippleNet, which is an existing network of other banks and financial companies meant to perform cross-border transactions easily. Another important aspect is that Ripple needs to work on the Proof of Work or Proof of Stake model consensus algorithms which are commonly used for cryptocurrencies like Bitcoin and Ethereum.

However, it uses its own consensus mechanism for confirming transactions, the Ripple Consensus Protocol Algorithm (RCPA). Transactions on the Ripple network run through validating servers, which constantly compare the information they receive and process with a common ledger.

RippleNet serves as a messaging and settlement platform, providing Real-time Gross Settlement (RTGS), foreign exchange, and overseas remittance. Ripple’s validating servers use a consensus mechanism called HashTree.

Here’s how it works:

- Transaction Initiation: A payment is made through RippleNet after the sender enters the amount, type of currency, and the recipient.

- Bridge Currency (XRP): When the sender and the recipient’s bank have no direct liquidity link, XRP functions as an intermediary to help complete the transaction.

- Settlement: Payments are completed in 3-5 seconds, while SWIFT, the regular system, takes much more time, for instance, days.

Ripple’s cost-effectiveness and low fees are the main reasons banks, payment processors, and remittance companies will want to deploy Ripple.

Ripple’s Controversy: In the News

Ripple has been involved in regulatory controversies, including a lawsuit by the US Securities and Exchange Commission for selling unregistered securities.

The lawsuit between the regulator and Ripple is still being battled in court. The United States Department of Justice has also fined Ripple for violating regulations under the Bank Secrecy Act.

Timeline of Key Events

- December 2020: The SEC sues Ripple Labs, explaining that XRP is an unregulated security. The allegations are that Ripple sold XRP in violation of U.S. securities laws, which creates uncertainty about XRP’s position.

- 2021: Ripple equalizes the SEC’s claims by stating that XRP is a form of virtual currency, not a security. The case received a great deal of publicity, and other firms in the industry supported Ripple on the issue.

- 2022: Ripple has a few pyrrhic victories: access to internal documents that demonstrate that the SEC is either confused or unfair to cryptocurrencies.

- July 2023: An impact is made when a U.S. court declares that XRP is not a security when sold in public exchanges, but Ripple’s sales of XRP to institutions may not be free from the scrutiny of the SEC. That being said, this partial victory increased XRP’s market capitalization and strengthened its position in public markets.

- October 2024: Ripple to file a cross-appeal on the ongoing case with the SEC.

However, Ripple has not sat idle while this has occurred and continues to develop and deploy new strategies and expand partnerships. It seems the company is rather prepared to bear with the legal crises.

Ripple’s Role in Cross-Border Payments

Ripple has portrayed itself as a disruptive technology in cross-border payments since it provides a more effective solution than SWIFT. High costs, long durations, and poor enshrinement of the process usually characterize these traditional approaches.

The Ripple network can process transactions globally, and its standard fee is set at 0.00001 XRP, which is minimal compared to the large fees charged by banks for conducting cross-border payments. The problems mentioned are solved in Ripple thanks to the blockchain algorithm and the payment platform RippleNet.

It is different from most approaches where settlement is based on nostro accounts that are funded in advance, while Ripple allows financial institutions to use XRP for immediate liquidity. For example, Ripple has cooperated with various institutions such as Santander and American Express to improve efficient payment systems. This means that transactions in terms of the settlement of cross-border payments can be facilitated within seconds, making Ripple among the best solutions.

Ripple Network Security

Security is a fundamental component of any blockchain system, in addition to its functionality, and Ripple has been keen to incorporate measures that enhance the network’s integrity. Interestingly, governance through the Ripple Ledger occurs through the Ripple Protocol Consensus Algorithm (RPCA), as opposed to PoW/PoV or PoS. This approach reduces the utilization of energy needed for lighting and, at the same time, offers high security.

In RPCA, such transactions are approved by a group of independent nodes that agree with each other’s decisions. Decentralizing the process makes the network good and safe to use and puts checks in place to prevent some individuals from controlling the ledger.

Even in its XRP Ledger, Ripple takes security measures through cryptography where all data within the ledger cannot be changed. These measures make Ripple’s network secure from cyber attackers, hence ensuring positive operations for its users.

More criticism has been associated with Ripple Labs’ Decentralized structure, as it is believed to operate from a single point——from the aspect of blockchain. However, it remains partial centralization, which enables Ripple to secure enhanced security features and address potential vulnerabilities that threaten the application’s integrity and performance, especially in use cases such as mission-critical payments like the cross-border one.

Digital Assets on Ripple

Because of the XRPL, many other digital assets can be transacted on Ripple’s network in addition to XRP. The XRPL allows for issuing, transferring, and trading tokenized assets, including fiat currency, commodities, and other cryptocurrencies. This capability makes Ripple a versatile and all-in-one solution for multiple forms of value.

One of them is the ability to promote the establishment of stablecoins, which are cryptocurrencies backed by fiat money. Ripple’s network has all the tools needed to create and maintain stablecoins, making the company appealing to banking institutions seeking blockchain services.

Moreover, Ripple has also started working on CBDC, which is a central bank digital currency. Ripple seeks to develop these assets as safe, efficient, and integrated with other digital tools on the XRPL. This proves that Ripple can determine the future of digital finance through this move.

The fact that multiple assets can be hosted on the XRPL adds value to Ripple beyond simple payment utility and opens up other use cases, including but not limited to decentralized finance (DeFi), tokenized assets, and so on.

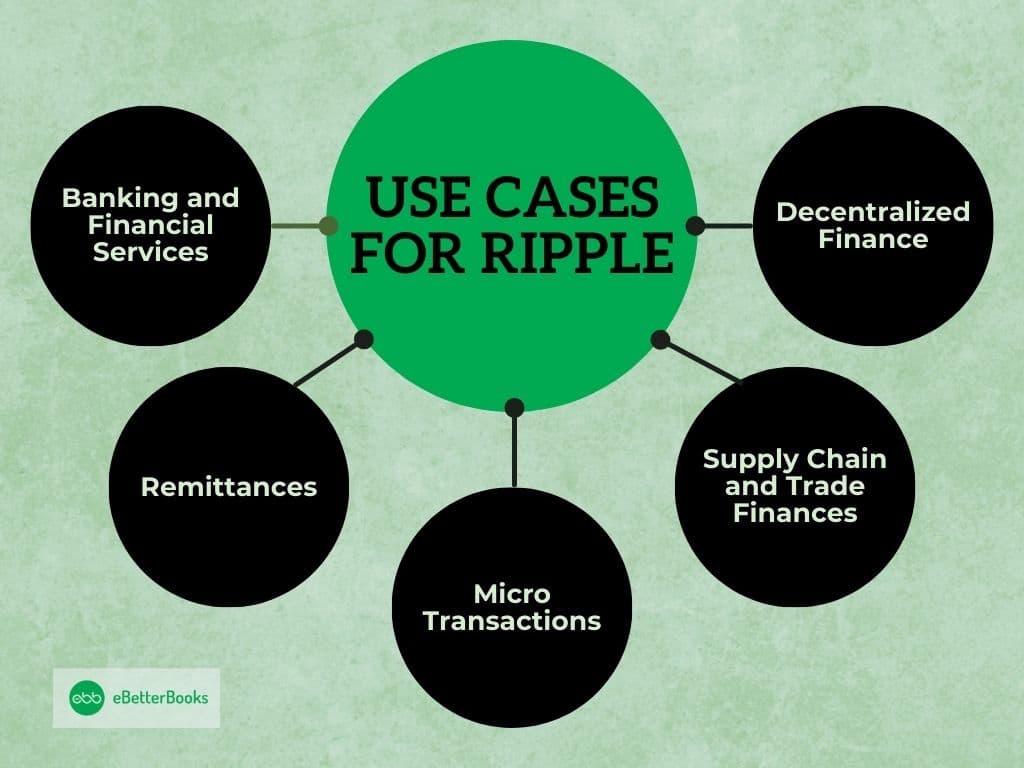

Use Cases for Ripple Network

Ripple’s primary use cases are cross-border payments, crypto liquidity, and CBDC services. Ripple is primarily geared towards offering solutions to businesses, governments, and institutions.

Some of the most prominent applications include:

- Banking and Financial Services: With Ripple, banks facilitate cross-border payments within seconds, with fewer transaction fees and shorter clearing times. It goes without saying that giant financial organizations are using RippleNet for payments across borders.

- Remittances: Ripple helps people and corporations complete inexpensive and rapid money transfers. This is especially so when conventional money transfer solutions in that part of the world are costly and slow.

- Microtransactions: Ripple has low fees and is highly swift, making it ideal for microtransactions in digital goods and game platforms. It allows for easy charging for small token products.

- Supply Chain and Trade Finance: In this case, it is clear that through asset tokenization and efficient payment, Ripple can enhance transparency and decrease the time spent in supply chains, hence allowing more cross-border trade.

- Decentralized Finance (DeFi): Using this technology, developers build decentralized financial solutions on the XRP Ledger, including lending and borrowing, decentralized applications, and decentralized exchanges.

The specified use cases show that Ripple is not only a payment protocol but can also solve problems in many fields.

Industry Impact

XRP solutions revolutionized the financial sector by making transactions secure and efficient. Through its technology, Ripple has surpassed traditional remittance approaches by making them efficient, cheaper, and transparent.

Another success of Ripple is that it has engaged more than 300 partners, including big players such as Santander, American Express, and MoneyGrams. These partnerships underscore Firebird’s ability to complement rather than disrupt traditional and modern forms of financial services.

Through its Ripple CBDC platform, Ripple has helped countries create their own central bank digital currencies (CBDCs). Ripple has been expanding its capabilities by acquiring companies involved in cryptocurrency and technology that complements it.

Future Prospects

It is clear that Ripple’s future is promising; however, it is accompanied by certain difficulties, specifically the issues discussed in the section on regulatory challenges.

Also, in its growth strategy, Ripple plans to direct its efforts towards emerging markets, mostly due to heightened demand for affordable and fast payment systems. Ripple’s stablecoin, RLUSD, is awaiting regulatory approval and will be available on major global exchanges once approved.

Regarding future activities in front of Ripple, the company is aiming to shift its attention to CBDCs. However, for Ripple, the end goal is even greater, and it is becoming one of the main driving forces behind central banking’s move into the digital age.

Conclusion

Ripple presently occupies a niche in the burgeoning industries associated with blockchain technology, especially with respect to payment settlement across borders. Ripple’s one-of-a-kind application of blockchain technology combined with the effectiveness of XRP and the XRP Ledger has allowed Ripple to point out and resolve issues predominant in conventional financial systems.

As the advancements of CBDCs, the use of smart contracts, company prospects, and global partnerships continue to unfold, Ripple is ready to define the future of digital finance. With the right focus on the actual day-to-day use cases and the ways in which the blockchain sector develops, Ripple will continually stay relevant within the financial system.

FAQs

What is Ripple, and How Does it Work?

Ripple is a decentralized payment protocol that uses blockchain technology to enable fast, low-cost cross-border transactions. It allows banks and financial institutions to settle payments instantly without intermediaries, using its XRP token as a bridge currency.

What is XRP, and How is it Different from Bitcoin?

XRP is Ripple’s native digital currency, used to facilitate transactions on the Ripple network. Unlike Bitcoin, which requires mining, XRP was pre-mined, meaning all tokens were issued at once. It is specifically designed to enable fast, cost-effective cross-border payments.

What Industries Benefit from Ripple’s Technology?

Ripple’s technology is widely used in banking, financial services, remittances, microtransactions, and decentralized finance (DeFi). Its ability to provide real-time payments and reduce transaction costs has led to partnerships with major institutions like Santander and American Express.