The peculiarities of the financial world in 2025 include fluctuating unpredictability and numerous opportunities for investors. Of these, the two most discussed and invested commodities are cryptocurrencies and gold. Whereas gold remains a traditional safe-haven commodity, Bitcoin and other digital currencies are considered highly risky yet potentially highly profitable investments in a digital world.

It dissects the merits and demerits of investing in gold and crypto, analyzing their performance, volatility, and relevance to the current climate. By the end, you will be able to determine which of the two assets is right for your investment plan.

Gold As An Investment

For centuries, gold has been associated with richness and solidity. The very nature of the product as being limited and having a physical form makes it a safe bet for anyone seeking to store wealth.

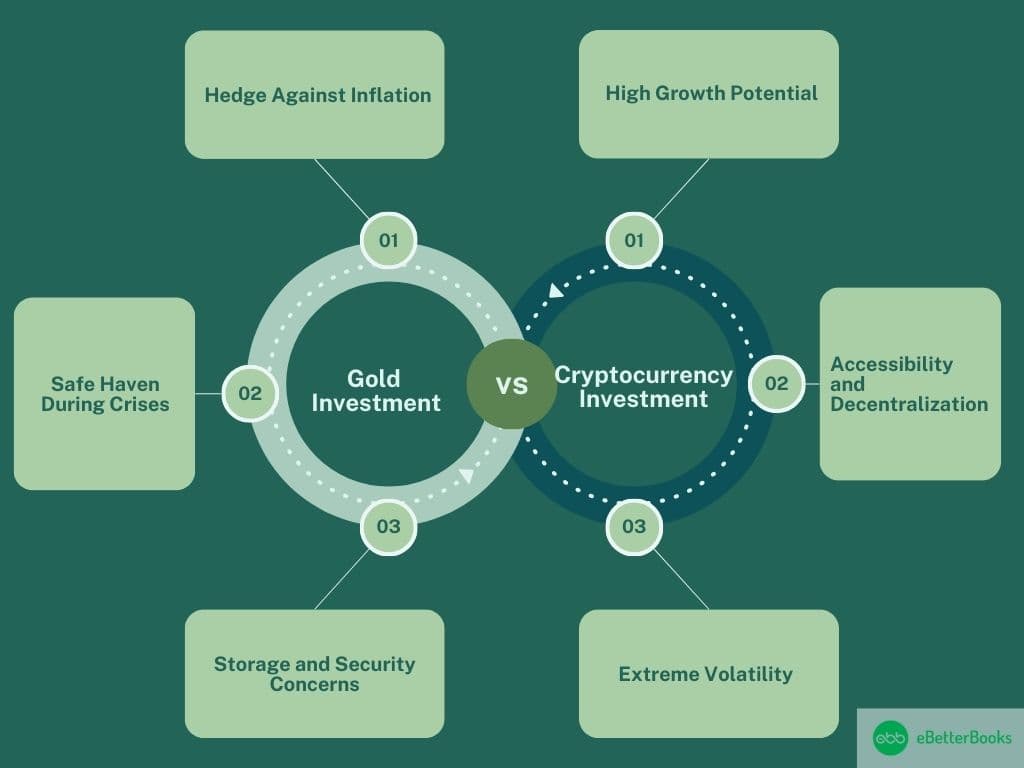

Benefits of Gold Investment

- Hedge Against Inflation: The price of gold is normally high during inflationary periods. For example, in the 1970s, when inflation rates were rising, gold almost tripled in price.

- Safe Haven During Crises: Gold is also considered a “safe-haven” asset. During any period of increased tension in international relations or economic downturns, such as the credit crunch phase of the global economic crisis in 2008, its price will increase as more investors seek to acquire it.

- Diversification: Holding gold in one’s investment portfolio may actually decrease overall risk, as gold moves in the opposite direction of equities most often.

Limitations of Gold Investment

- Limited Growth Potential: Unlike stocks or cryptocurrencies, gold doesn’t produce income or dividends. Therefore, its returns are purely capital gains. For instance, gold has seen trending values over the past decade, although it has lagged far behind the growth Bitcoin experienced in the same time frame.

- Storage and Security Concerns: Physical gold requires storage, which can be expensive. It is also associated with the danger of theft.

Cryptocurrency As An Investment

Cryptocurrencies have introduced a new form of exchange in the financial market; decentralized digital currency categorized by the use of blockchain technology. Starting with Bitcoin in 2009, the market has grown to comprise over a thousand assets for various purposes.

Benefits of Crypto Investment

- High Growth Potential: Cryptocurrencies have indeed returned unprecedentedly high and unpredictable returns. For instance, BTC went from $1,000 in 2017 to nearly $69k in 2021, becoming one of the best-performing assets in financial market history.

- Accessibility and Decentralization: Unlike conventional investment assets, crypto can be bought, sold, and traded in a fashion where it is opened for business. It is a direct business and, thus, ideal for those interested in managing their financial destinies.

- Diverse Applications: In addition to currency, blockchain offers many opportunities for smart contracts, NFTs, decentralized finance, and DeFi.

Limitations of Crypto Investment

- Extreme Volatility: Cryptography currencies are well known for fluctuations in their prices. For example, the value of Bitcoin declined more than 50% from November 2021 to June 2022, and therefore, the risks that investors expose themselves to.

- Regulatory Uncertainty: People all around the world are still unclear about cryptocurrencies and their legal status, which is why governments try to decide the problem. For instance, China has limited the operations of crypto mining, whilst the U.S. has put measures in place to help collect taxes from digital asset operations.

- Security Concerns: Though blockchain is safe, investors are at risk of hacking, phishing, and losing wallet keys.

Key Comparison Factors – Gold Vs. Cryptocurrency

- Risk and Volatility: As we know, gold is ranked among the safest-haven instruments as investors are willing to pay more or less the same price for this precious metal at different periods. For instance, when COVID-19 hit the market, gold prices were recording an upward trend because investors wanted security. On the other hand, goodwill has a stable value, while cryptocurrencies are extremely volatile. Its value experiences drastic fluctuations within a single day, which means that Bitcoin’s price rise and fall is characterized by high volatility, allowing one to either rapidly inflate their wealth or vice versa.

- Liquidity and Accessibility: Gold and cryptocurrencies are both quite liquid, but this liquidity measures two very different things. Jewelers, banks, and gold dealers can sell gold to each other, but physical transactions may sometimes be slow. Cryptocurrencies, on the other hand, are much easier to trade instantly on a digital platform such as Binance or Coinbase than traditional equities.

- Long-Term Value: Historical data shows that gold remains one of the most preferred forms of investment, as its appreciation demonstrates. Cryptocurrencies, on the other hand, are relatively new and famous and do not have such a record. However, critics’ claims regarding digital assets’ status are countered by proponents of the idea, who state that as adoption skyrockets, for instance, during the 2022 market crash, the price of Bitcoin went down despite the fact that cryptocurrencies might even surpass or match gold.

- Effect of Macroeconomic Variables: Gold’s price generally increases during inflation or geopolitical instabilities because it is a hedge. Cryptocurrencies, being a rather unproven asset type, respond erratically. For general inflation rates, which proved the cryptocurrency’s reliance on markets’ moods rather than stability.

Investment Suitability

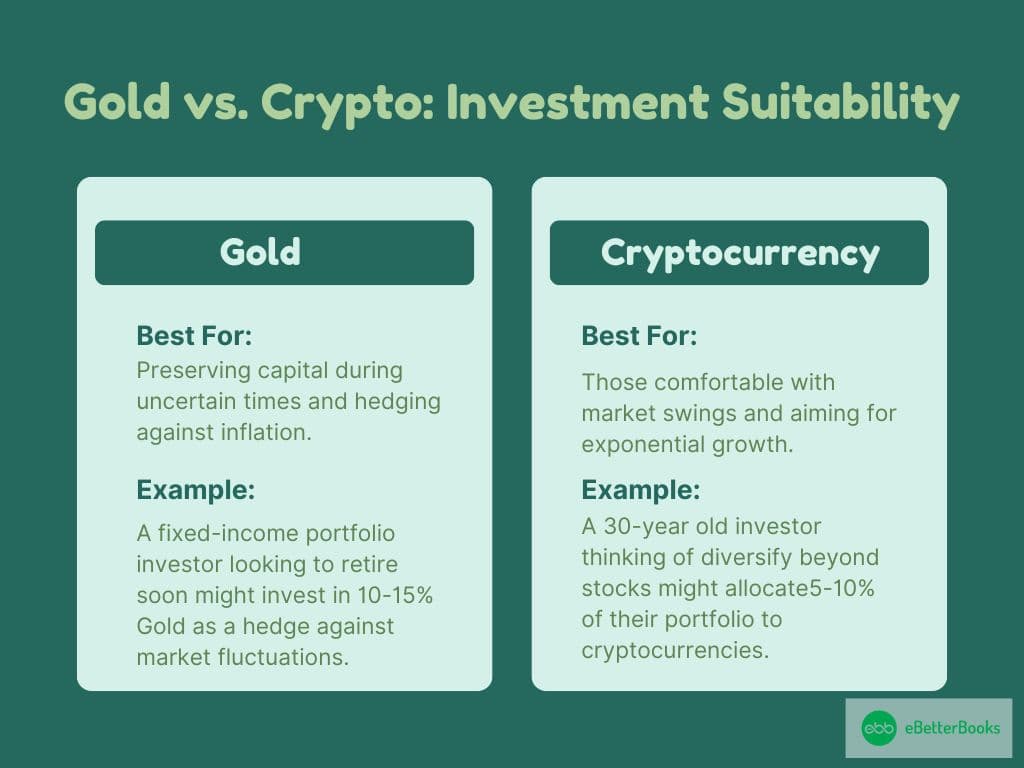

The decision to invest in gold or cryptocurrency depends on the investor’s objectives and attitude to risk. Thus, one asset is suitable for one type of investor while the other is suitable for another.

Gold: Best for the Conservative Investor

Gold is much more appropriate for people who need a predictable and almost unchanging market and to keep their assets in sight for a long time. As such, gold is preferred by retirees or anyone who wishes to avoid any volatility in the price of their investments. For instance, during the financial year ending September 30, 2008, the price for gold rose by nearly 25%, a sure bet for investors.

Best for: The ability to preserve capital at such times while combating inflation is another reason that growth and other factors sometimes become less important.

Example: A fixed-income portfolio investor looking to retire soon might invest in 10-15% gold as a hedge against market fluctuations.

Cryptocurrency: High Risk, High Reward

Cryptocurrencies attract the new generation of IT professionals who are ready to invest their money in digital currencies that may increase more than they are willing to give. A good example is an individual who bought Ethereum for $140 in the year 2020 and sold it in the year 2021 for $4,000, which makes a 2700% rise.

Best For: It is best for those who are not affected by negative market changes and expect many-fold increases.

Example: A 30-year-old investor thinking of moving away from the purely stock-based portfolio might be okay with investing as little as 5% but as much as 10% in bitcoins.

Diversification and Portfolio Strategy

Investing in diversified portfolios often means investing across different asset classes, and using gold and cryptocurrencies is a perfect example.

Why Diversification Matters?

Diversification helps to minimize negative effects due to a particular asset in the overall portfolio. Typically, gold and cryptocurrencies, since they possess different attributes, provide the advantages that complement each other.

- Gold’s Role: Gold is useful during periods of low economic activity and market decline. When equity markets declined in 2020, gold set a record high of $2,067 an ounce.

- Cryptocurrency’s Role: It helps expose investors to innovation and growth. Cryptocurrencies such as Bitcoin and Ethereum, together with other blockchain technologies, remain innovative and may still deliver superior performance to other investments.

Balanced Portfolio Example

A hypothetical diversified portfolio could include:

- 50% Equities: For long-term growth.

- 20% Bonds: For stability.

- 20% Gold: For people’s safety during economic collapse situations.

- 10% Cryptocurrencies: For high-growth potential.

Such a mix allows for some safety from gold, but the returns of cryptocurrencies make the whole portfolio neither very safe nor very risky.

Technology and Related Market Trends

Gold

Gold has been clearly understood as an actual commodity, yet technological progress has changed the nature of investing in gold. Many online gold trading platforms, including Paytm Gold India and Vaulted in the United States, grant consumers rights to gold but do not require physical possession of it. Gold Exchange-Traded Funds (ETFs) have also been bought into, as they provide investors with a simple and cheap method of investing in gold through following changes in its price.

For instance, SPDR Gold Shares, or GLD, is one of the largest-traded gold ETFs globally. It is available to investors who prefer the digital world to physical gold. These ETFs ensure that gold remains relevant and sustainable in an economy driven by technology.

Cryptocurrency

The market for cryptocurrency is growing rapidly, and several factors have contributed to this. New forms of financial services and products, sometimes called Decentralized Finance (DeFi), such as Uniswap or Aave, enable people to lend and borrow assets and trade without involving other parties. Tokenized assets, on the other hand, refer to digital assets such as real estate or art.

Another important innovation is institutional adoption. BlackRock and Fidelity have started selling crypto products, while Visa and Mastercard are incorporating blockchain services. All these trends show that cryptocurrency is no longer an exotic market but a constantly emerging factor in the mainstream financial market.

Environmental and Ethical Considerations

Gold

Gold mining activities create several environmental issues, including deforestation, soil erosion, and water pollution due to the use of chemicals such as mercury and cyanide. Illegal gold mining has adversely affected Many South American rainforests, including the Amazon.

Also, regarding ethics, labor practices in gold mines are an issue. Moyo finds disturbingly that child labor and unsafe working conditions prevail in artisanal gold mining in Africa. This discovery should concern any socially responsible investor looking at gold as an investment.

Cryptocurrency

Mining activities, especially for virtual money such as Bitcoin, were criticized for their energy demands. A Bitcoin transaction requires as much electricity as one U.S. household uses in a whole month. However, the industry is striving hard to achieve sustainability. The switch from PoW to PoS in Ethereum in 2022 also reduced the entity’s energy consumption by more than 99%.

Further, programs such as the selection of renewable energy sources for mining and carbon offset programs are emerging. This is perhaps because as with many other emerging industries, it will, in the future, experience increasing pressure on its environmental profile.

Real-Life Investment Case Studies

Most central banks worldwide have significant gold stocks as part of their monetary stock. For instance, the United States Federal Reserve possesses gold reserves greater than 8,000 metric tonnes; it is the biggest gold reserve holder globally. China and India have recently been buying gold to hedge against economic risks, diversify their foreign exchange reserves, and reduce their reliance on the dollar.

One obvious example of a company accepting cryptocurrencies is Tesla, which invested $1.5 billion in BTC in early 2021. Years later, the company sold some of these holdings; however, the decision signaled the acceptance of Bitcoin as a corporate treasure.

On a personal level, consider Laszlo Hanyecz, who purchased two pizzas using 10,000 Bitcoins in the same year. Today, Bitcoins would be valued at hundreds of millions of dollars, a prediction and example of the (high) risks of early cryptocurrency investments.

Tips for Beginner Investors

Gold

- Understand Your Options: Learn whether you must buy physical gold in the form of bars, coins, or jewellery or invest in digital gold through gold ETFs, mutual funds, and other online-based gold investment instruments.

- Focus on Storage: If you prefer physical gold, consider storing it in a safe deposit box.

- Monitor Prices: Like any precious metal, gold is affected by certain trends in the world economy, so be aware of these trends before investing in large quantities of gold.

Cryptocurrency

- Choose Reputable Exchanges: Companies such as Coinbase, Binance, or Kraken are reputable, well-protected trading platforms that are easy to navigate.

- Use Secure Wallets: To reduce your vulnerability to hackers, keep your crypto in hardware wallets such as Ledger or Trezor.

- Start Small: Cryptocurrency price fluctuation is volatile; therefore, put into trading what you can afford to lose. To start with, it is suggested that you invest a tiny portion of your investment portfolio, say 5%.

Gold and cryptocurrencies can both be great investments, but it’s important to do the right analysis and understand your risk profile.

Conclusion

Cryptocurrencies are also independent instruments with some strengths and weaknesses that make them useful in an investment portfolio based on certain objectives. Gold is a metal with historically proven records of investment security during very volatile fiscal periods.

It thus is most appropriate for investors willing to avoid any risks or those who wish to protect their wealth against inflation. Cryptocurrencies, on the other hand, stand for the future of the development of digital finance, even though they are still rather issuing significant returns to people for managing various risks.

The decision is thus informed by your investment goals, tolerance to risk, and expected market conditions. Whereas gold conserves money, crypto can double it. Still, an opportunity to start investing in both of them at once will provide the best of both worlds – growth and relative security.

FAQs

Which Has More Value, Gold or Bitcoin?

Gold and Bitcoin, as we identified, have different type of value. Gold should retain its value and this has demand due to the physical presence, industrial applications and investors’ long-standing trust in owning gold as a hedge during crises. It normally costs between $1,900 to $2,000 per ounce.

Bitcoin has value because of its limit to twenty-one million and because it is an electronic currency that is different from traditional money. Its price is very unpredictable; for example, in the last few years, the price per car has been between $20,000 and $60,000. Gold is much more stable and is good for storing money, but Bitcoin will yield a much higher return in case if a person is ready to take risks.

Can Bitcoin Overtake Gold?

Bitcoin can compete with gold assets due to the possibility of transferring it digitally, as well as the lack of divisibility. An issue increasingly discoursed as an asset of value, especially by millennials and institutional investors.

Nevertheless, gold is irreplaceable when it comes to stability, industrial consumption and general confidence. Despite its frail volatility and regulatory uncertainty, Bitcoin still has the potential to replace gold since it can work alongside gold as a modern form of investment asset.

Which Crypto is Best to Invest in Today?

The most popular coins for investment are Bitcoin because of its adoption as a store of value, Ethereum due to the use of smart contracts, Binance coin due to its utility in the Binance ecosystem, Solana due to its scalability and Ripple due to cross-border payments. Both has it own advantages and disadvantages.

Bitcoin and Ethereum are more secure for the long term than other coins, but projects like Solana provide greater possibilities of making more money but are riskier. Investing should be done after careful diversification and carrying out some research.