Crypto exchange traded funds, or Crypto ETFs are investment products that allow you to gain exposure to Crypto through a conventional brokerage account without having to deal with the digital assets directly.

Cryptocurrencies like Bitcoin, Ethereum and Dogecoin have been dominating headlines around the world for many months. A surge of new crypto ETFs have been launched to make it easier for investors to buy cryptocurrencies without the headaches, security risks and complexity of setting up and managing crypto wallets and keys.

What is a Crypto ETF?

A crypto exchange traded funds is an investment fund which is meant to track the spot market price which is the price that is visible on the crypto trading platform or the futures price for one or more Cryptocurrencies.

A crypto exchange-traded fund is an investment fund whose value corresponds to the spot market value of cryptocurrency, or to the value of a futures contract for at least one crypto currency. Crypto ETFs are easily recognizable because they are quoted on traditional stock exchanges – this provides exposure to cryptocurrencies without owning them.

A crypto spot price ETF actually holds the stock, such as Bitcoin or Ethereum, and the fund issues shares to the investors. These are meant to let shareholders own a fraction of the cryptocurrencies, which make up the ETF.

Crypto ETFs investing in cryptocurrency exposure contracts for differences provide the value of these crypto futures contracts instead of any coin’s price. Normally, the futures contract ETFs are exchange-traded notes ETNs that offer indirect, derivative access to digital assets only.

Crypto ETFs can apply strictly to Bitcoin, strictly to Ethereum or a combination of the two:

- Bitcoin ETFs: When Bitcoin was finally taken up in 2024, spot price Bitcoin ETFs dominated the headlines, but you can also buy Bitcoin ETFs linked to futures. Traditional equity ETFs are currently listed on major stock exchange, and so are the Bitcoin ETFs.

- Ethereum ETFs: Futures contract ETFs based Ethereum had already appeared several years before one of the U.SS Securities and Exchange Commission (SEC), gave the green light for ETFs linked to the ETH spot price only in July 2024.

- Mixed Cryptocurrency ETFs: Some crypto ETFs also offer such an approach, offering investors access to a combined portfolio of Bitcoin and Ethereum except that the ETF only holds futures contracts.

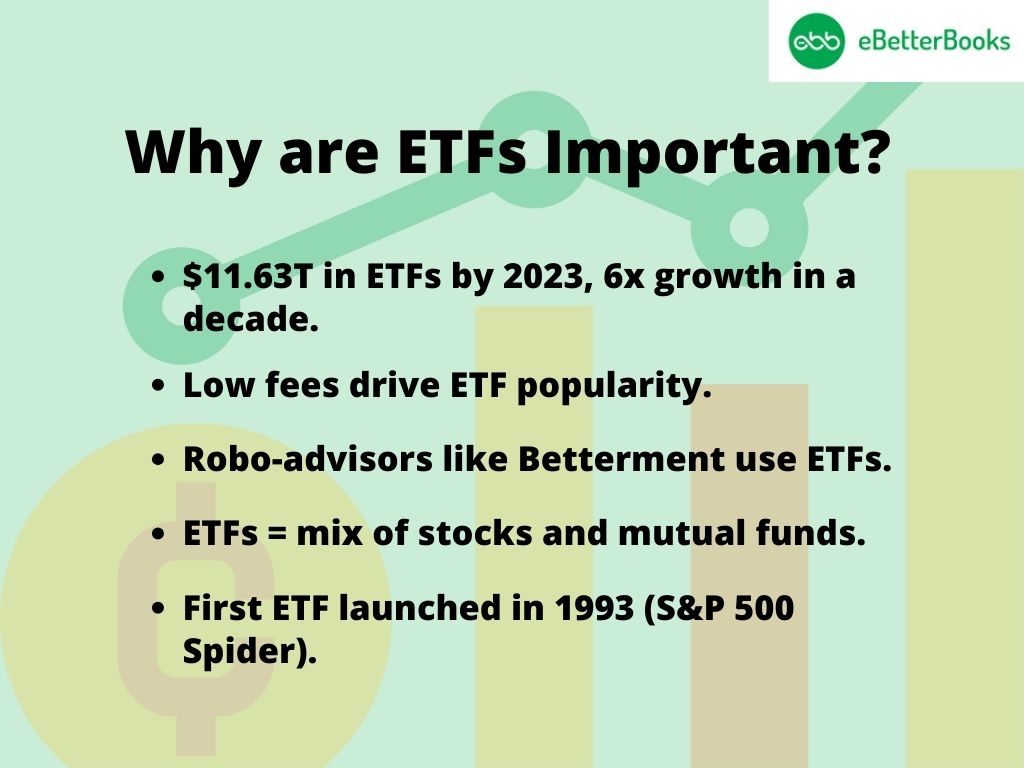

Why are ETFs Important?

ETFs are hugely popular. Globally, more than a decade later at the end of 2023, there was $11.63 trillion invested in the ETFs, more than six times more than a decade ago. And thanks to an explosion of interest in low-fee index investing, ETFs have spawned an entirely new category of financial companies: such so-called roboadvisors like Betterment and Wealthfront that invest in ETFs almost exclusively.

Well, it is most likely high time that you found out what they are. One could therefore capture the essence of ETFs by imagining them as a stock and a mutual fund. While mutual funds have been around for nearly a century, ETFs only arrived in the US in 1993 in the form of State Street Capitol, an S&P 500 monitoring ETF, which is still traded today and is referred to as the spider.

How Do Crypto ETFs Work?

Crypto ETFs, on their part, work by benchmarking on the price of cryptocurrencies. For instance, the actual ETF such as the bitcoin ETF, tracks the bitcoin’s price. Similar to common stock types, these Crypto ETFs are also bought and sold on a stock exchange. For this reason, they are particularly popular with investors, especially those who are familiar with the stock market but want to invest in the crypto-market without necessarily having to do without the traditional uses of cryptocurrency.

It is more or less standard in a given cryptocurrency for the prices to fluctuate greatly, which is often referred to as volatility. The over-concentration of funds on this aspect is not so new to the exchange-traded funds (ETFs), although more extraordinary in this connection.

On this basis, ETFs may sometimes be bought or sold at a price higher or lower than the current market value of the shares it represents. These performances create a divergence between the price of an ETF and the actual value of the assets they hold in the market.

Understanding Cryptocurrency Futures ETFs: How Bitcoin and Ether Strategy Funds Work

The actual crypto futures ETFs works by focusing on the ProShares Bitcoin Strategy ETF, the first ETF of the crypto type in the United States’ markets. The fund holds on average about 50 percent of bitcoin futures trading on the Chicago Mercantile Exchange expiring at the end of the current month, and another half of bitcoin futures trading on the CME that expires at the following month.

The fund seeks to reprocess the investments by liquidating the contracts in the portfolio and acquiring options for the subsequent month as the contracts in the portfolio come expiring. Some of the variations in the ETFs performance compared to the cryptocurrencies may also be due to the cost incurred during contract renewal.

ProShares also has Ether Strategy ETF (EETH) like it has the bitcoin ether futures ETF. It uses futures to track the price of ether. For investors seeking exposure to several cryptocurrencies, ProShares has ETFs that comprise an equal Bitcoin to Ether combination or those based on the Market capitalization.

There are inverse ETFs, we also have such products as the ProShares Short Bitcoin Strategy ETF. This employs futures to produce the opposite of bitcoin’s returns and open a claim to investors on days of decline in cryptocurrencies.

Spot Cryptocurrency ETFs: SEC Approvals, Bitcoin & Ether ETF Developments in 2024

Cryptocurrencies can also be bought and held by investment funds. Spot Crypto ETFs stand for exchange traded funds that invest in cryptocurrencies and provide security to them. Despite this, investors are allowed to trade in shares as they wish in the same way as a traditional ETF would. A spot crypto ETF is redeemable and the fund can create and sell its shares that provide an exposure to the crypto market to the retail investors and others.

From 2014, asset managers have proposed to the SEC to approve spot bitcoin ETFs. Within October 2022 to October 2023, the SEC was able to receive more than 3,500 crypto fund applications. In January 2024, SEC approved the first eleven spot Bitcoin ETFs and paved more spot cryptocurrency ETFs.

In May 2024 the SEC also began to open the way for spot ether ETFs as well. The SEC gave the nod to a change of rule with the potential of filling the list and trading of eight spot ether ETFs.

Before this approval, the SEC raised concerns over Ethereum staking and previous concern with Bitcoin for fraud, volatility and low investor protection in crypto marketers.

Staking, which is a service to generate income by freezing them to contribute towards verifying transactions on the Ethereum network, is a fundamental component of Ethereum’s validation mechanism.

This income-generating feature that was adopted on the ether platform in 2022, brings a new challenge on how staking rewards should be taxed and reported. This was another basis for the SEC not to be quite keen on approving spot ether ETFs, considering that there is still no clear law on how they would be taxed.

However SEC approves spot ether ETFs that suggests that the trading of ETFs can commence does not mean this will happen. The requests from the investment managers require some form of consideration while additional approvals are required.

How to Invest in Crypto ETFs

The growing list of available investments has provided significant opportunities for new and experienced investors as a result of the crypto ETF fund. These ETFs are of great interest to those who want to invest in the constantly evolving technology of cryptocurrency but do not wish to be troubled with the regular management of such money.

That being said, it is necessary to know your local market rules and whether you are allowed to invest in these types of products. One must be from a certain region to invest in these products. For example, there are specific limitations in the EU to invest in them, mainly because the stock is open only to professional investors, whereas in other markets, everyone can invest in them.

Sometimes, trading of cryptocurrencies is impossible in certain markets. In these markets, an opportunity to touch the crypto space somewhat is through the ETFs linked to related fields, for instance, blockchain.

For investing in crypto ETFs, you can choose from different ETFs, and ETNs which base their market valuation on cryptocurrencies. These can be bought through regular brokerage accounts, like any other stock or an ETF. Huge market incumbents such as BlackRock and ARK have launched products that offer the possibility of investing in cryptocurrencies, backed by tried-and-tested ETFs.

As a response to this new reality, Saxo has created an investment theme around spot bitcoin ETFs for its clients. Saxo’s investment themes are put together by our own research team and are based on the instruments preferred by them in selected investment topics and segments.

These low-expense ratio bitcoin ETFs give European professional investors, and those overseas eligible to invest outside the EU, an effective way to diversify and improve their portfolio. However due to the extreme fluctuation that comes with every digital currency it is wise to be cautious when investing in crypto currencies.

Since this industry is still relatively young it is crucial to remain as up-to-date as possible so as to properly capitalize on the opportunities these revolutionary means of investing offer. Saxo’s has a research and news feed on its platform which assists the clients in keeping abreast with these changes. Investors use these resources to optimize these new instruments in their investment portfolio.

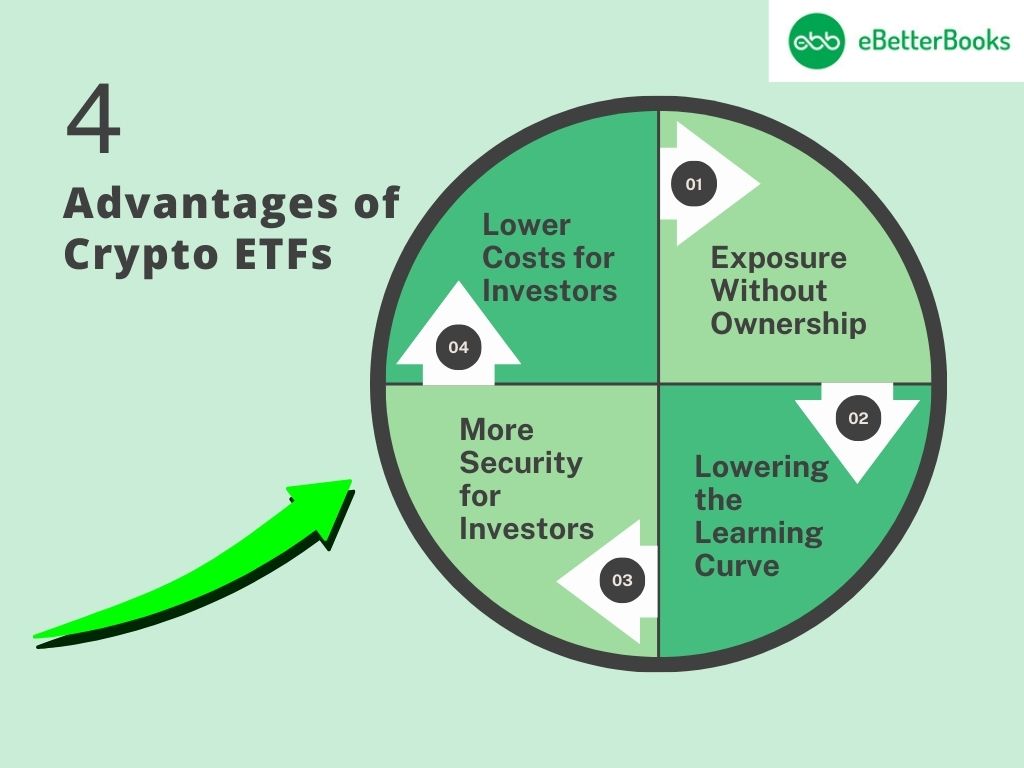

Advantages of Crypto ETFs

Cryptocurrency EFTs are known as the developing asset class, and providing the regulatory uncertainty, the market might look different in the future. However, there are many advantages of owning shares in cryptocurrency ETFs when accessing the crypto markets.

Exposure Without Ownership

The biggest advantage of cryptocurrency ETFs is that they enable investors to invest in cryptocurrencies to gain exposure to owning physical crypto without incurring other expenses of ownership or direct exposure to owning them in a crypto wallet. For instance, there are custody charges for storing virtual currencies, and, in some cases, some secure digital wallets impose an annual fee.

These charges may sometimes accumulate without much realization. Cryptocurrencies also have transaction and network fees, which are borne by the ETF providers for you although you pay indirectly through the fund’s expense ratio.

Lowering the Learning Curve

Currently, understanding its central terminology involves a great deal of language barriers since most terms are derived from the underlying technology. Potential investors as shorthanded in the traditional sense often struggle to comprehend the scope and roles of cryptocurrencies. Also, these investors might barely know about networking technology thus the terms like halving and blockchain just makes it even more unwelcome. Purchasing shares in a cryptocurrency ETF means that learning enough to get into crypto is far less strenuous.

More Security for Investors

Cryptocurrency exchanges, storage devices, wallets, and some poorly designed blockchains have been hacked since they were launched, leading to constant worries in the crypto world about security. Cryptocurrency security can be a tall order for individual investors, who may not be familiar with the required methods. A cryptocurrency ETF takes care of this for you.

Lower Costs for Investors

The availability of cryptocurrencies in the trading market worldwide is more that 9,000 as of January 2024. The system to trade them is getting built more solidly but it is still relatively the wild west versus securities markets.

For instance, some tokens can be traded somewhere and some tokens and crypto exchanges cannot operate in certain jurisdictions. They also involve such additional expenses as fees for the securities and exchange commission purchasing cryptocurrencies. ETFs in the cryptocurrency markets enable you to diversify your investment without the costs and the inconvenience of acquiring and swapping the tokens yourself.

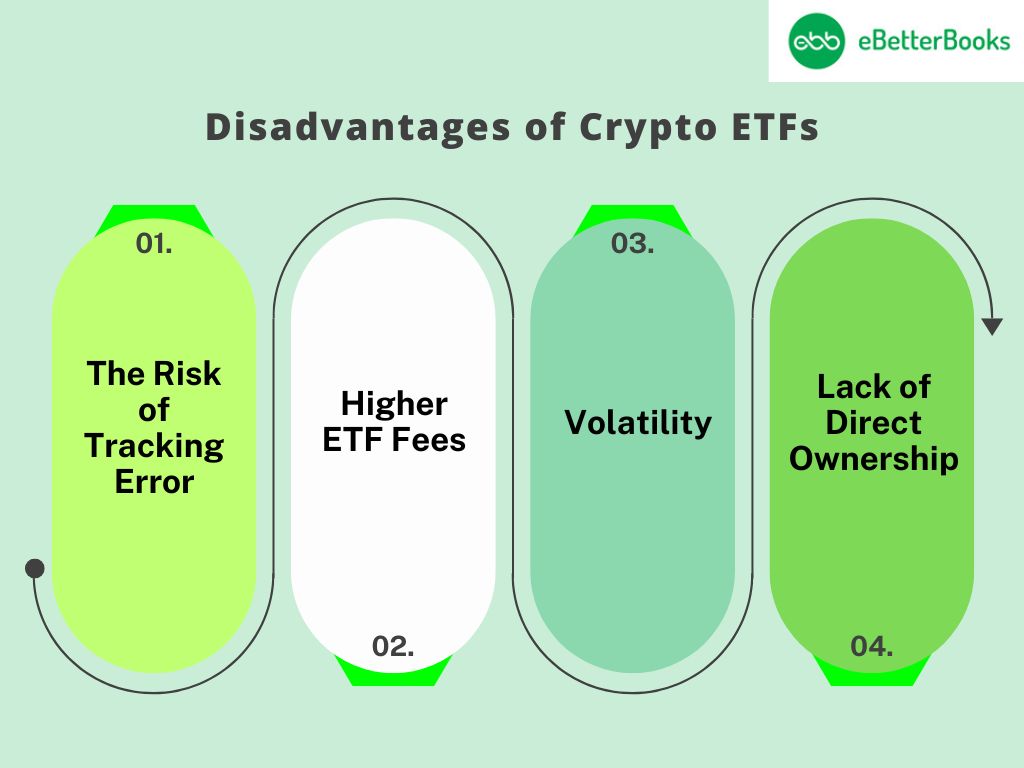

Disadvantages of Crypto ETFs

They are relatively new investments, and it is still uncertain how the regulatory systems governing the entire industry will develop. Since there is bound to be a proliferation of more Crypto ETFs for trade, it is advisable to know the problems that may arise from it.

The Risk of Tracking Error

The cryptocurrency ETFs move up and down at a moderate pace and do not mimic the price of the relevant cryptocurrency. This is even the case with ETFs that rely on futures contracts as instruments to mirror cryptocurrencies, which have to manage their contracts’ expiration.

Higher ETF Fees

As it would be seen, through trading in crypto ETFs, investors are saved from the various costs that may be incurred in directly owning other forms of digital assets and currencies but this comes with fees that are associated with trading in such ETFs. These active management means that crypto ETFs generally are likely to have larger expense ratios compared to other standardized ETFs out there. For example, in the ProShares Bitcoin Strategy ETF’s expense ratio is 0.95%. For instance, the expense ratio of the SPDR S&P 500 ETF is lower at 0.09%.614

Volatility

While cryptocurrency ETFs make some of what is involved in the trading of digital assets and currencies less complicated, they are susceptible to the volatility that characterizes the crypto market. This means more risk to you – something that is even more of a concern if you are more used to lower volatility of standard ETFs.

Lack of Direct Ownership

Holders of crypto ETFs do not own the investments they hold in their possession. Of course, there’s convenience in purchasing crypto ETFs but remember that you won’t have direct control or access to the cryptocurrency itself and the decentralized and anonymous nature of the crypto have no bearing on the shareholders of the ETFs.

Alternatives to Cryptocurrency ETFs

Besides investing in cryptocurrency futures ETFs and spot ETFs, investors can place their cash in several other ETF-like crypto products. Let’s dig into these options.

Crypto Trusts

While the SEC has only reluctantly approved a handful of crypto ETFs, a similar product has already been available for years: bitcoin investment trusts. These are closed-end funds that are close in structure to the spot crypto ETFs proposed for launch. They have bitcoins for investors, and their shares are in the market for over the counter business.

But these are not ETFs. They are available only for institutional investors, qualified purchasers and Trilogy Associates who are high net worth investors but not the common investor. Some have a relatively high minimum investment and each time an investor decides to buy shares, he has to do so with a lockup period involved.

Crypto ETPs

ETFs are one type of Exchange Traded Products (ETPs). Crypto ETPs when mentioned, refers on the other hand to the ETPs that hold the debt securities that are floated by special purpose vehicles, SPVs that in turn own the crypto assets. Here, the SPV applies the crypto as security to launch the ETPs that are then offered on the marketplace.

Crypto ETPs are also regulated by the Securities Act of 1933 and are less regulated compared to Crypto ETFs. Spot Crypto ETPs, as mentioned earlier, are not investment companies governed by the Investment Company Act of 1940. Therefore, owners of ETF shares do not enjoy the rights that are generally associated with the ownership of shares.

Another difference is that Crypto ETF shares can be created and redeemed in the market and assist the price of the share to float to the NAV of the Crypto ETF. Crypto ETPs are often closed-end funds with a finite number of shares that float on the market with price fluctuations that can differ from the cost of the underlying crypto asset.

Bottom Line

Crypto ETFs are an exciting and viable investment offer for market players interested in investing in cryptocurrencies. In return, as much as these come with principles such as the most efficient portfolio diversification, they bear with them risks such as cryptocurrency volatility and market sentiments. Like with any investment opportunity crypto ETFs should be approached in a balanced and informed manner.