Introduction to Litecoin (LTC)

Litecoin (LTC) or Litexoin is a peer-to-peer cryptocurrency created by Charlie Lee, a former Google employee, with a total supply of 84 million coins, four times more than Bitcoin’s max supply. Litecoin is in a special category as it is one of the oldest cryptocurrencies that can be trusted.

Litecoin uses the memory-intensive Scrypt proof-of-work mining algorithm, allowing consumer-grade hardware like GPUs to mine those coins. Called “silver to the Bitcoin’s gold,” Litecoin underlines work with high speed and low cost, which makes it popular among both large investors and end-users.

Even though it is considered a peer to Bitcoin, Litecoin offers much quicker block generation, lower fees, and enhanced network security making it one of the leaders in the industry. Litecoin has lower transaction fees than Bitcoin and can be used as a digital currency on the web.

Litecoin Network and Technology

Network Insights

Litecoin, similar to Bitcoin, uses the secure and open PoW consensus mechanism to provide users with a safe and reliable environment for their transactions. The Scrypt Algorithm stands on behalf of Litecoin rather than Bitcoin’s SHA-256 algorithm.

Scrypt is memory-oriented, so this hashing algorithm is more suitable for individual miners than central ones, which can no longer dominate the process with the help of ASICs. Litecoin’s Scrypt hashing algorithm prevents ASIC miners from mining those coins making it more accessible to individual miners.

Litecoin has one of the fastest block generation times, it’s also important to note that Litecoin’s transaction confirmation block time is about 2.5 minutes on average, compared to Bitcoin’s 10 minutes. This reduced block time means that transactions can be confirmed much faster than using Litecoin making it more effective to use.

Technological Upgrades

Similar to other cryptocurrencies, Litecoin (LTC) is a progressing asset, experiencing technological updates with some frequency. Another remarkable modern development is the installation of the MimbleWimble protocol in the current currency – this improves transaction anonymity and transaction capacity.

Privacy features are integrated into Litecoin’s system so that users with better security preferences would be drawn towards the currency without compromising its ability to remain as secure, public, and accountable as Bitcoin.

Litecoin’s approach of continually seeking ways to improve its network makes it one of the most reliable coins in the current growing market cap of cryptocurrencies.

Litecoin (LTC) History and Development Overview

A Brief History of Litecoin

“Litecoin blockchain was introduced in 2011 by, Charlie Lee, a former Google employee who desired to create a “light” version of Bitcoin. Litecoin developers intended its purpose to represent a cryptocurrency that could provide shorter transaction time and lower fees for the intended litecoin use.

Since its inception, Litecoin has easily remained one of the best-performing altcoins by constantly introducing new solutions to the existing market and heavily investing in its community. Litecoin is one of the most widely accepted cryptocurrencies, and in most of its history, it ranked among the top 10 cryptocurrencies by market capitalization.

Timeline of Key Milestones

- 2011: It started in October and used the Scrypt algorithm for easier mining as compared to other BTC mines.

- 2013: It became an altcoin with a $1 billion market cap.

- 2017: They put into effect the Segregated Witness (SegWit) upgrade for improved scalability and were the first to conduct the first Lightning Network transaction.

- 2018: Benefits that were offered with the use of Aliant Payment Systems to facilitate merchant participation.

- 2019: Starting working on the MimbleWimble-based confidential transactions to enhance privacy and coin trade ability.

- 2021: It reached a high of more than $ 400 during the time of the market boosting it into the list of prominent cryptos.

- 2023: Successfully worked through its second halving cycle and expanded its ecosystem through integration across other industries.

Changes in Litecoin confirm concern on the part of the project team to develop new functionality and not be stale in the cryptocurrency market.

Litecoin Price and Market Data

Litecoin (LTC) Price

Litecoin price has been quite resistant and has grown immensely in the market for years now. Today, Litecoin price movements correspond to its market demands trading volume, current circulating supply amount, technology, and other macroeconomic factors affordances.

In the past, Litecoin has largely shifted in tandem with other prominent cryptocurrencies such as Bitcoin to register spectacular highs in bulls’ mints as well as bear’s dips. The market capitalization of Litecoin (LTC) is $5,344,999,726 and the fully diluted valuation (FDV) of Litecoin (LTC) is $5,973,058,709.

Market Fluctuation

There are always reasons behind the Litecoin fluctuations and the factors that can affect the highest and price of litecoin, it include; usage and customer acceptance are critical factors, as higher utilization and acceptance litecoin price naturally lead to added value.

Besides, certain factors such as economic factors, regulations, and technological changes may affect the highest price paid out of Litecoin. However, while Bitcoin is labeled as a store of value, or “digital gold,” Litecoin focuses on becoming a form of fiat currency, that is easily transferable through an easy-to-use payment protocol.

This positioning makes it ideal for investment given that the search for diversification apart from its value appreciation capability is well catered for.

Buying and Trading

How to Buy Litecoin (LTC)

The purchase of Litecoin is quite easy because it is listed in many exchanges that deal with digital currencies. To purchase Litecoin, a user must first decide which of the many available exchanges such as Binance, Coinbase, or Kraken, to use, that deals with Litecoin.

Following the registration a user is then allowed to deposit his/her cash either in the traditional money such as US dollars or Euro or he/she can deposit with other that is with the digital money commonly known as Bitcoins or Ethereum.

After the fund addition, a user can make an order to buy Litecoin at the lowest price or prevailing market rate or place a limit order to buy at total maximum supply or a specific rate. Just like the buying of Litecoin, its storage is equally crucial.

To be precise, investors can decide to use hot wallets to ease their usage, but this exposes them to exploitation, or cold wallets that are stationary and thus secure. Some of the most common types of wallets are hardware wallets; Ledger, Trezor, and some other software wallets such as Trust Wallet and Exodus.

How Does Litecoin is Traded?

LTC tokens can be traded on centralized crypto exchanges, such as Binance. The most active trading pair LTC/USDT has a trading volume of $38,180,062. Litecoin can be bought and traded on various cryptocurrency exchanges, with a circulating supply of 75.17 M LTC and a max supply of 84 M LTC.

By now, debates have risen as to whether Litecoin should be used as a long-term investment or as a trading tool. This brings into focus the LTC holdings’ long-term investors who see the currency as an excellent store of wealth based on combined strength of its technological prowess and strategic market positioning.

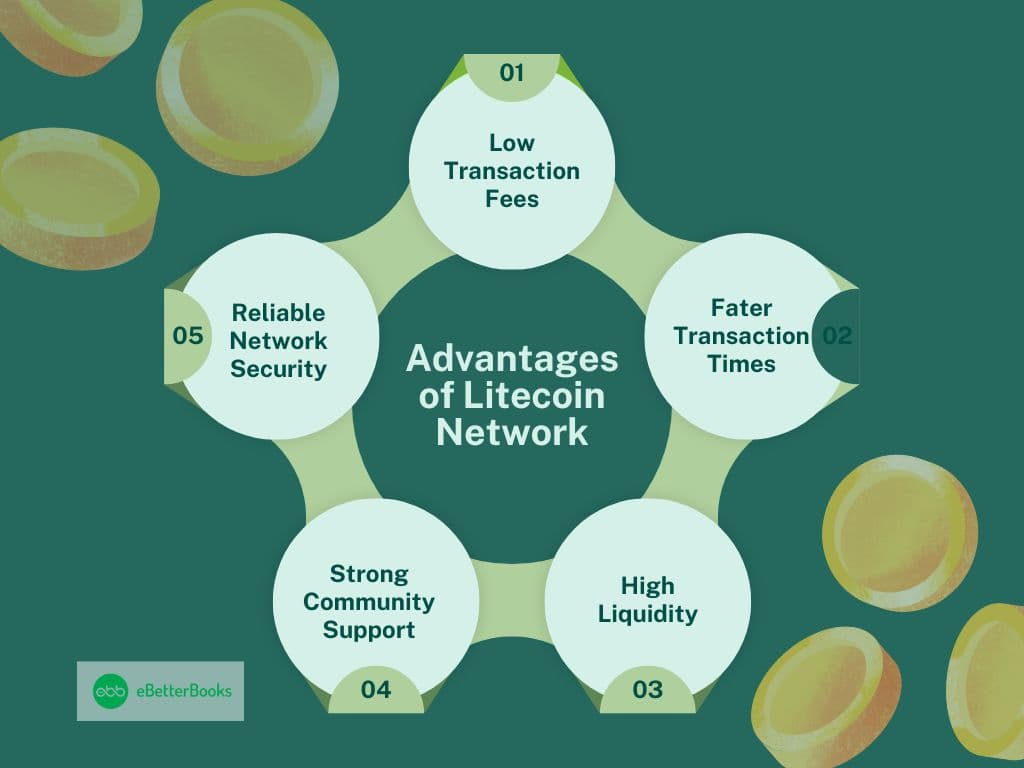

Advantages of Litecoin

Below are the advantages of Litecoin:

- Low Transaction Fees: Recommended for both small and big payments with low charges.

- Faster Transaction Times: A block reward generation time of 2.5 minutes also means that confirmations occur faster than in Bitcoin.

- High Liquidity: Available on virtually all the available Crypto exchanges.

- Strong Community Support: Supported by an enthusiastic audience and continuous developers’ work.

- Reliable Network Security: Resistance to attacks and solid structures that have been well approved.

Challenges of Litecoin

There are a few challenges also, which are listed below:

- Increased Competition: More effective cryptocurrencies with new properties becoming a threat.

- Limited Traditional Adoption: Mainstream financial systems integration – slow process.

- Market Volatility: Volatility inhibits risk-averse investors because of general shifts in the price level.

- Technological Limitations: Slightly inferior in some innovative measures as compared to rivals.

Litecoin Use Cases and Applications

Litecoin is one of the most widely accepted cryptocurrencies, with more than 2,000 merchants across the globe accepting LTC for payments. Its main benefits are its speed and low fees, making it an attractive, usable alternative to Bitcoin. Since recognizing the need for the promotion of its ecosystem of applications, Litecoin continues to make deals with payment processors.

It is used by most e-shopping platforms and processed by payment gateways such as BitPay, to facilitate purchase. LitePay and integration with gaming platforms have been some of the successful partnerships that have given Litecoin a utility in the real world.

Some of the applications of Blockchain include; P2P transfer of electronic cash, cross-border transfer of funds, and micro transactions across several sectors. Also, Litecoin has a very active developer base.

This section’s frequent new versions and minor modifications, like the addition of MimbleWimble for better anonymity, reflect its concern for development according to users’ requirements and emerging technologies.

Litecoin Security and Mining

The security of Litecoin originates from its dynamic, peer-to-peer network created based off of blockchain and advanced, uncrackable cryptographic design. This is decentralized networking which makes the network strong since it has nodes worldwide without a single central governing point.

The mining procedure that is run with the help of the Scrypt cryptographic algorithm, helps to confirm transactions and to include them in the list of block reward effectively. While SHA-256 is dominated by high-speed Bitcoin mining machines, Scrypt is memory-bound, thus decentralized.

As for Litecoin itself, the design adopted speaks against double-spending along with 51% attacks, to some level. Once a transaction is confirmed, the data is coded and hard to change; the hash rate and decentralized miners make it very hard for someone to corrupt the system.

Regarding storage, we have hardware wallets (Ledger, Trezar), software wallets (Exodus, Trust Wallet), and paper wallets that give the best protection to the assets. These options guarantee the security of Litecoin assets.

Litecoin Community and Adoption

Litecoin is dependent on and sustained by the people in the Litecoin community known as Litecoin Core Development Team which includes developers, miners, enthusiasts as well as investors.

The community is open and united with the common vision and goal of extending the utility of Litecoin in the real world and the development of the Litecoin protocol.

Litecoin Foundation

The Litecoin Foundation is a non-profit organization that aims to advance Litecoin and promote its adoption. The Litecoin Foundation was created in 2017 and is solely responsible for the Litecoin protocol with a primary mission to ensure the Litecoin cryptocurrency is adopted worldwide.

This non-profit organization is based in Singapore and it provides funding for diverse projects like technical enhancements, new software engineer merchants cooperation, and educational outreach. Via partnerships with various firms and payment gateways in developing countries, the Litecoin Foundation has expanded the application of LTC more so in online retail stores, and other P2P transactions.

These and the rest have put Litecoin on a strong pedestal, especially in its aim and determination to promote a healthy developer ecosystem and partnerships.

Future Outlook for Litecoin Network

Despite some drawbacks in its current status, improved and developed Litecoin has a bright future in the current market cap. Considering technological advances and widening collaboration, it is expected that Litecoin’s value will increase its effectiveness for P2P payments and e-commerce.

However as it becomes clear to anyone who delves into cryptocurrency, the industry is constantly growing and developing, and Litecoin will need to adapt to new developments if it is to retain its standing.

Due to its stable performance, Litecoin has qualifications for a more significant role in the altcoins market not only as the means of payment but also as the object of investment.

Conclusion

Litecoin is a peer-to-peer cryptocurrency with a strong potential for growth and adoption. Its fast transaction times, low fees, and strong community make it an attractive option for users and investors.

Litecoin today remains an important asset for payments and investments due to its constantly growing ecosystem as well as its practical use in the real world. Its ability to fit in technology and the current price and market cap trends is enough to make it among the best altcoins.

FAQs

What Makes Litecoin Different from Bitcoin?

Litecoin offers faster transaction times (about 2.5 minutes per block), lower transaction fees, and uses the Scrypt mining algorithm instead of Bitcoin’s SHA-256, making it more accessible for individual miners.

How can I Buy Litecoin?

You can buy Litecoin on major exchanges like Binance, Coinbase, or Kraken by registering, depositing funds (either fiat like USD or other cryptocurrencies), and placing an order for Litecoin.

What are the Security Features of Litecoin?

Litecoin’s security comes from its decentralized, peer-to-peer network and the Scrypt algorithm, which helps prevent attacks like double-spending and 51% attacks. It also supports hardware, software, and paper wallets for secure storage.