Introduction to DogeCoin

Dogecoin is a cryptocurrency created on December 6th, 2013, as a light-hearted alternative to Bitcoin, jokingly created based on a popular internet meme of a Shiba Inu dog named ‘Doge.’

Although Dogecoin was created as a meme currency joke, Dogecoin’s popularity grew due to its humorous image, which immediately attracted the attention of newcomers who wish to invest in cryptocurrencies and don’t want a serious tone like Bitcoin or Ethereum.

Dogecoins are similar to Bitcoin mainly because they are considered the first ‘meme coin’ and are associated with the image of the Shiba Inu dog. The 100 billionth Dogecoin was mined in June 2015.

History and Origins

Dogecoin was created, designed and developed by software engineers Billy Markus and Palmer intentionally to create peer-to-peer electronic currency based on the mechanics of Bitcoin, making it popular as a social symbol. The idea originated from Palmer’s April Fool’s tweet proposing the creation of a ‘meme coin’ based on the Shiba Inu ‘Doge’ meme.

Markus and Palmer thought it was a humorous spin on the meteoric rise of cryptos. It offers crypto enthusiasts, laypeople and meme workers a light-hearted guide to investing in digital coins. After the inception of Dogecoin, people relented to its community-based feature, especially in the application of the Reddit forum.

The Dogecoin community was fast to embrace corporate social responsibility, with projects including a water project in Kenya and even sponsoring a NASCAR driver. These early activities contributed to dogecoin’s cemented status as the ‘people’s cryptocurrency,’ backed by a devoted fan base.

Dogecoin Ecosystem

Overview of the Ecosystem

The entire infrastructure of Dogecoin is based on its decentralized blockchain, community values, and activities, as well as the increasing usage of micropayments and a tipping system. The Dogecoin blockchain is an open-source, peer-to-peer cryptocurrency created on Litecoin’s source code; its transactions are based on PoW.

It is an inherently volatile property due to protocol decentralization and the primary global community that encourages the current price and appreciation through use cases such as tipping, buying, and other micro in classic donations and merchants’ payments. The elements are such online communities and social media platforms as Reddit and Twitter, Doge-related accounts, and the Dogecoin Foundation that contribute to the promotion of the currency.

Some of the RTX integrations are notable, notably by giant organizations like Tesla and AMC and charity campaigns. Payment systems are one of the key components of the ecosystem. They provide support for wallets, exchanges, and merchants’ payment platforms to make the processes trouble-free and allow for the possibility of growing the number of users.

Mining Dogecoin

Mining Dogecoin refers to adding new coins to the Dogecoin’s network while forming blocks in the blockchain. The PoW consensus means that miners solve complicated mathematical problems to ensure transactions, the creation of various blocks, and the receipt of DOGEs. The Dogecoin blockchain mining application uses a script as simple as Bitcoin SHA-256, making it easier to mine Dogecoin.

Mining can be done solo, but joining a mining pool to group up and use computational power to earn rewards is also possible. Most of the time, mining of this digital currency called Dogecoin is done using devices like GPUs and ASICs. Thus, despite its inflationary model with constant block rewards of 10,000 DOGE per minute, it promotes miners’ activity and guarantees transactions’ total supply amount. Mining continues to be used to support the longevity and security of the decentralized blockchain put in place by Dogecoin.

Features of the Dogecoin

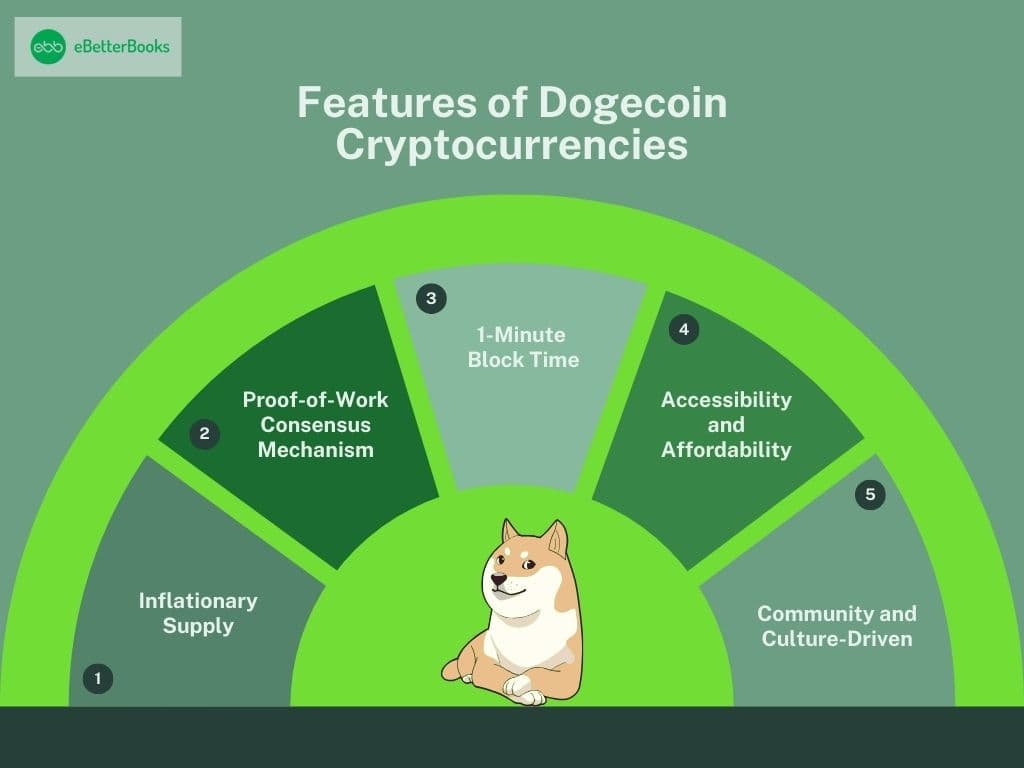

Dogecoin’s unique features include:

- Inflationary Supply: For instance, while there exists a fixed number of bitcoins available that is likely to be controlled and limited, Dogecoins do not have an ultimate number, and they release five billion new coins annually. This inflationary model assists in keeping possible restrainers of credit expansion and the money supply from locking their horns.

- Proof-of-Work (PoW) Consensus Mechanism: Dogecoin’s mining algorithm is slightly similar to Bitcoin’s PoW but light, evolving faster and allowing blocks to be generated faster.

- 1-Minute Block Time: New blocks are added in about a minute, so the transaction time is faster than most other cryptos.

- Accessibility and Affordability: Because of its inflation characteristics, Dogecoin is cost-effective per coin, which encourages more buyers into the market.

- Community and Culture-Driven: The Reddit and Twitter communities are very strong and continue talking about and pushing Dogecoin, which is why it remains relevant today.

Market Performance

Market Cap and Price

Dogecoin is one of the most popular meme coins. Its market cap movements have experienced heavy fluctuations, and the community’s decisions determine its all-time high value. Dogecoin’s market capitalization is over $28 billion, making it one of the top 10 cryptocurrencies by market cap.

Beginning its life as essentially a joke, Dogecoin’s price lingered deep in the red. The all-time low price of Dogecoin was $0.0000869, recorded on May 06, 2015, many years before attention in 2020 and 2021 helped boost its value.

Prominent influencer approval from movie star John Travolta and Elon Musk, together with increased retail inflows, placed DOGE at its highest price paid, approximately $0.7316, recorded on May 08, 2021. Its market capitalization reached $80 billion, which placed Dogecoin as one of the largest cryptocurrencies in the market.

Nevertheless, similar to most traded cryptocurrencies, the price of Dogecoin has faced significant dips after the peak. The highest price is known to move quickly up and down depending on the prevailing trends and social media comments. However, these price shocks place Dogecoin among the most popular other digital assets and currencies by market capitalization.

Trading Volume and Liquidity

Dogecoin is among the most traded cryptocurrencies and always finds a place in the top trading volume charts. Big volumes are important in the crypto market since active demand is needed, and purchases and sales can be made without drastically affecting prices. The trading volume of Dogecoin is over $7 billion, with many exchanges offering DOGE trading pairs.

Memes, viral hashtags, tweets, or any bang on the crypto market boost daily trading volume on Dogecoin, and the current price also can swing quickly. Currently, DOGE is actively traded on major cryptocurrency exchanges everywhere, including Binance, Coinbase, Kraken, and others, to ensure liquidity and reach millions of users.

Dogecoin’s liquidity is also another advantage because it is accepted in almost all centralized and decentralized platforms, and exchanging Dogecoins is not difficult. Doge’s high liquidity and low price make it well-suited for relatively smaller investors or the passive day trader.

Investment and Use Cases

How to Buy and Store Dogecoin

Acquiring and keeping Dogecoin is easy and available, especially to anyone who may want to invest in cryptocurrencies.

Here’s a step-by-step breakdown:

- Choose a Crypto Exchange: Many famous cryptocurrency exchange platforms, such as Binance, Coinbase, Kraken, and Robinhood, accept DOGE. Since there are many scams out there, choosing the right exchange is crucial for security and convenience.

- Create an Account: Once the exchange of choice is chosen, the user must create an account, undergo a know-your-customer check (KYC), and link a payment method, such as a bank, credit card, or PayPal.

- Buy Dogecoin: After creating an account, users can type in Dogecoin’s name and buy it using the money they have in their accounts. Dogecoin usually has its trading pairs involving fiat currencies such as USD or other cryptocurrencies such as BTC.

- Transfer to Wallet: To improve the safety of holding Dogecoin, users can transfer coins from the exchange to the wallet, especially if they are going to hold them.

- Backup Wallet Information: Wallet and keys should be backed up so that nobody has access to private keys except the owner.

- Investment and Use Cases: The results indicated that firm-specific investment potential and risks had significantly positive relationships with total investments.

- Select a Wallet for Storage: A significant effort should be made to ensure Dogecoin’s security. Options include:

- Software Wallets: Mobile applications such as Trust Wallet or Dogecoin Wallet are relatively safe and user-friendly, offering a balance between two opposing approaches.

- Hardware Wallets: Two more hardware wallets, Ledger and Trezor, are more secure and allow one to keep DOGE offline.

- Exchange Wallets: Certainly, exchange wallets are quite convenient but much more dangerous because the exchange controls them.

Investment Potential and Risks Associated with Dogecoin

Hashtag’s investment opportunities and their related risks apply to Dogecoin when investing in a certain digital currency first. Dogecoin has a high potential for growth due to its large online community and increasing adoption. However, Dogecoin is also a highly inflationary cryptocurrency, which can negatively impact its value.

Here’s a breakdown:

Investment Potential:

- Community Appeal: The growth in the price is another aspect; Dogecoin also enjoys a very populated community and continuously attracts the public’s attention, meaning that it still holds promising intentions for future value additions.

- Widespread Acceptance: Some firms allow consumers to use Dogecoin in their transactions, making it more than a joke cryptocurrency. For instance, Tesla permits it for some purchases, and AMC Theaters have incorporated it as a means of payment.

- Celebrity and Social Media Influence: A recent feature in which Elon Musk strongly supported Dogecoin was a testament; this definitely helps its value and is important for buyers who like such trends.

- Short-Term Trading Opportunities: Dogecoin is highly traded and has a very low price, which makes it susceptible to high volatility. This makes it ideal for “day trading” individuals.

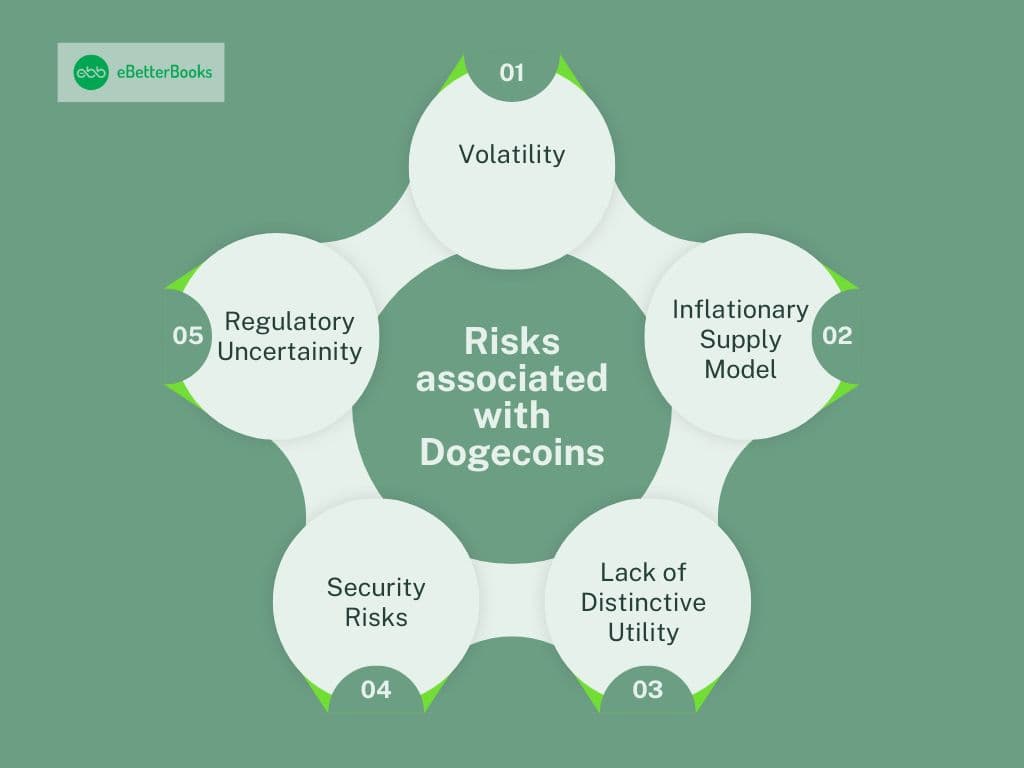

Risks:

- Volatility: Dogecoin is fairly volatile and flammable, which means that its price fluctuates wildly in response to trends, social networks, and market promotions.

- Inflationary Supply Model: One of Bitcoin’s appeals is the strict numismatic limit to its supply, and the never-ending supply of DOGE, 5 billion created per year, hampers DOGE’s long-term value proposition.

- Lack of Distinctive Utility: As many people enjoy using Dogecoin, it has no competitive advantage over other platforms, such as Ethereum.

- Security Risks: However, like all cryptocurrencies, including but not limited to Dogecoin, the owners and those interested in taking advantage of cyberspace risks are always on the lookout. Hence, its storage must be done safely to avoid any losses in their investments.

- Regulatory Uncertainty: New regulators might alter the future of DOGE since governments are looking to implement stringent rules on cryptocurrencies.

Community and Development

Community Engagement and Charity

Dogecoin’s adoption has indeed majorly hinged on its strong community, where individuals are more or less incentivized to collaborate for fun, forgiveness, and, more importantly, for contributing to unique causes, as it is a community-driven currency.

Charitable Initiatives

Dogecoin is a virtual currency that is a humorous take on Bitcoin. Dogecoin can also boast of having donated to several charity projects. Some examples are finning for a water project in Kenya, supporting the communities to get access to clean water, and Doge4Water.

Dogecoin supporters embarked on a donation drive in late 2014 to help the Jamaican bobsled team attend the Winter Olympics, taking $50,000. Dogecoin has also supported NASCAR drivers and other charitable events where people come together to support a cause.

Social Media Engagement

Reddit threads, Twitter, and Discords represent hubs for the Dogecoin community. Within these, people are engaged in discourse and SHIB coins and can coordinate events or staking. This level of activity refreshes the Dogecoin culture to keep people excited and focused.

Celebrities and other personalities freely interact with the users’ group, promoting Dogecoin in the process. Dogecoin, however, has seen a notable spike in its fortunes through the promotion of Elon Musk’s tweets and mentions of the cryptocurrency.

Development and Governance

Despite being a meme coin by inception, the Dogecoin Foundation was revived in 2021 to revitalize the former cryptocurrency project. Decentralized advisors include Ethereum’s founder, Vitalik Buterin, and renewed focus of the foundation is to encourage the advancement of DOGE and keep its source code open.

The Foundation’s primary mission is to safeguard Dogecoin from fraud and decentralized scams, encourage the development and funding of various projects within the Dogecoin community, and promote decentralized governance of the Doge price network.

Dogecoin Foundation and Governance

This Foundation is responsible for providing funding for the query and growth of Dogecoin, as well as offering advice on the same subject. The foundation was first created in 2014 but was later relaunched in 2021 with several famous advisors who are famous today, such as Ethereum’s founder, Vitalik Buterin. The first and foremost purpose is to give a roadmap to Dogecoin and safeguard the well-trade.

Dogecoin brand and the open-source codebase. It also supports other community-based initiatives and ensures Dogecoin’s core is Secure, Decentralized, and, most importantly, fully community-based. The foundation thus works closely with the community to ensure that activities are as transparent as possible and seeks legal and financial help where required.

Among them, there is an important one called Dogecoin Trailmap, which consists of a further development plan and implies improvements in such fields as scalability, security, and using mining pools. Although the Foundation governance system retains the cryptocurrency’s meme-like character, it is strongly focused on promoting the project in the future.

Future Outlook and Trends

The conventional future trends of Dogecoin are influenced by the community and development currently underway mining doge, and the continuing overall cryptocurrency market trend. Here, scalability and integration improvements proposed by the foundation free Dogecoin from critical limitations and help it become a more competitive cryptocurrency.

In addition, with the famous car maker Tesla, ‘American Made Coin,’ and the theatre chain AMC accepting Dogecoin wallets as payment, we are likely to see it used in real-life applications with even more retailers accepting it.

In future developments of decentralized finance (DeFi) and blockchain technologies, Dogecoin can discover new functions and connect with newer innovations. Given that more and more countries pay attention to cryptocurrency operations, regulatory affairs could be the primary determinant of further Dogecoin expansion.

Inflation is inherent in cryptocurrencies since more coins are always being produced at an inflation rate that, more often than not, outdoes the base inflation rate that is commonly recognized by most central economies across the world. But breaking from the current market cap and as the community and the foundation strive to build sturdier footing, Dogecoin is in guarded optimism.

Conclusion

Dogecoin started as a joke and has now become one of the most well-known cryptocurrencies, with a large and dedicated following. Its facilitation of faster transactions, relatively low commission, and application in the tip and microeconomy increase its value.

Founded by the Dogecoin Foundation, the ecosystem aims to decentralize the project, ideas, and development by community members. Dogecoin is both an investment product in a fluctuating market of digital assets and a type of social currency used every day. It still stands as an established and continually emerging player in the environment of other cryptos.

Frequently Asked Questions

What is Dogecoin and How was it Created?

Dogecoin is a cryptocurrency created in 2013 as a fun and light-hearted alternative to Bitcoin, based on the Shiba Inu dog meme. It was designed by software engineers Billy Markus and Palmer to serve as a peer-to-peer currency with a humorous edge.

How can I Buy and Store Dogecoin?

To buy Dogecoin, you can sign up on popular exchanges like Binance, Coinbase, or Kraken. After purchasing, it’s advisable to transfer your Dogecoin to a secure wallet (either a software or hardware wallet) to protect your investment.

What are the Risks of Investing in Dogecoin?

Dogecoin is known for its volatility, meaning its price can fluctuate significantly due to trends or social media influence. Additionally, its inflationary model (with 5 billion coins added annually) could limit its long-term value, making it a risky investment for those looking for stability.

Should I buy Dogecoin or Bitcoin?

Bitcoin is considered a safer, long-term investment with proven value, while Dogecoin is more speculative, popular for short-term trades and driven by trends and community support.