Cryptocurrency is a digital currency that uses cryptography for secure transactions and operates on a decentralized network. Investing in cryptocurrency involves understanding the market, selecting a reliable exchange for buying and selling, and choosing coins based on their unique features. Additionally, it’s important to set up secure wallets for storage, monitor market trends, and manage risks effectively to safeguard your investment.

Key Takeaways

Cryptocurrency is digital, decentralized, and secure via blockchain. Bitcoin and Ethereum are some of the most popular currencies, each with unique functions and values. Use trusted exchanges like Coinbase or Binance to compare fees and security.Secure your assets in hot wallets for trading or cold wallets for long-term safety.Follow market news and set price alerts to stay updated on trends.

What is Cryptocurrency?

Cryptocurrency, also known as crypto-currency or crypto, refers to any type of digital or virtual currency that uses encryption to safeguard transactions. Cryptocurrencies do not have a central issuing or regulatory authority; instead, they employ a decentralized mechanism to record transactions and create new units.

Cryptocurrency is a digital payment mechanism that does not require banks to authenticate transactions. It is a peer-to-peer system that allows anybody, anywhere, to send and receive payments. Instead of carrying physical money and exchanging it in the real world, Bitcoin payments exist solely as digital entries in an online database recording specific transactions. When you move cryptocurrency funds, the transactions are kept in a public ledger. Digital wallets store cryptocurrency.

Cryptocurrency has its moniker because it uses encryption to verify transactions. This means complex code is required to store and transport cryptocurrency data between wallets and public ledgers. Encryption strives to ensure security and safety.

Bitcoin was the first cryptocurrency, launched in 2009, and still the most well-known today. Many people are interested in trading cryptocurrencies for profit, and speculators can occasionally drive up prices dramatically.

How Does Crypto Currency Work?

Cryptocurrencies are supported by a technology known as blockchain, which maintains a tamper-resistant record of transactions and keeps track of who owns what. The use of blockchains addressed a problem faced by previous efforts to create purely digital currencies: preventing people from making copies of their holdings and attempting to spend them twice.

Individual units of cryptocurrencies can be referred to as coins or tokens, depending on how they are used. Some are intended to be units of exchange for goods and services, others are stores of value, and some can be used to participate in specific software programs such as games and financial products.

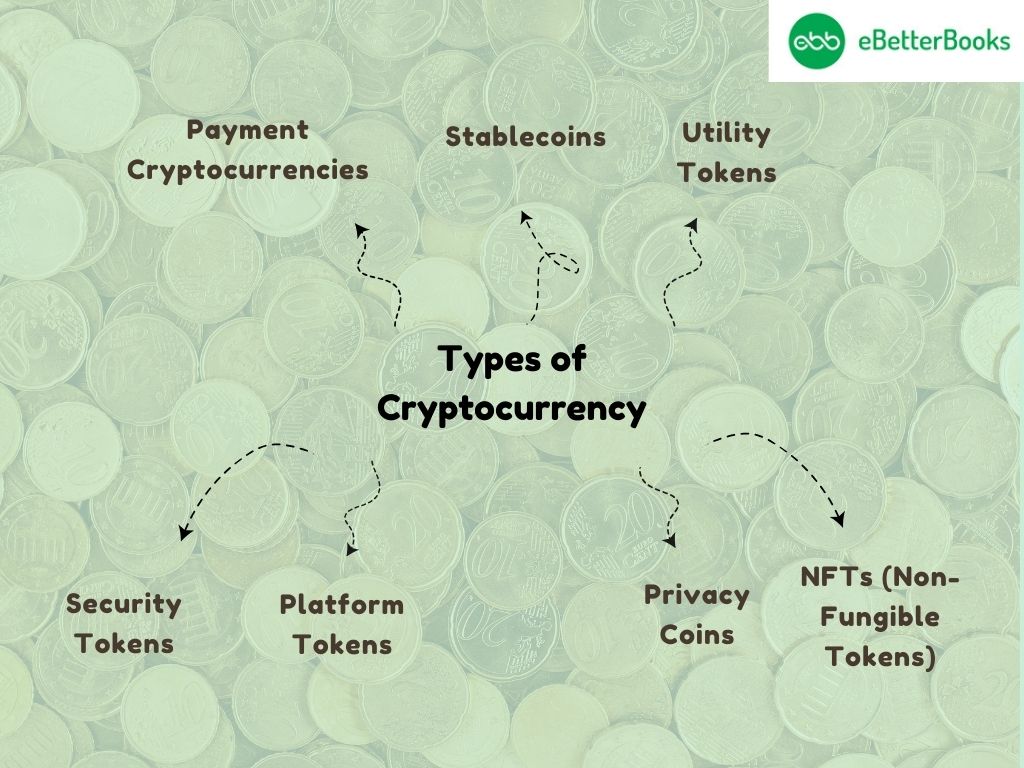

Types of Crypto Currency

Here is the categorization of cryptocurrency under which different kinds of cryptocurrencies come…

| Types of Cryptocurrency | Purpose | Examples | Key Features | Advantages |

Payment Cryptocurrencies | Act as digital alternatives to traditional currencies for direct online transactions. | Bitcoin (BTC), Litecoin (LTC) | Decentralized, often have fixed supply, secure peer-to-peer transfers | Enables global, fast, low-fee transfers. |

Stablecoins | Maintain stable value by pegging to fiat currencies or assets, reducing crypto volatility. | Tether (USDT), USD Coin (USDC) | Pegged to fiat (USD) or commodities (gold); low volatility, often backed by reserves. | Reliable store of value within crypto, ideal for trading stability. |

Utility Tokens | Provide access to services, products, or applications within specific blockchain ecosystems. | Ethereum (ETH), Chainlink (LINK) | Needed for network functions (e.g., gas fees on Ethereum), not intended as currency outside the platform. | Necessary for DApp functionality and network security. |

| Security Tokens | Represent ownership or investment in real-world assets (e.g., stocks, real estate) on the blockchain. | tZERO (TZROP), INX Token | Regulated like traditional securities, it represents an ownership stake, often eligible for dividends or profit-sharing. | Increases transparency and accessibility for asset ownership |

Platform Tokens | Power decentralized ecosystems by enabling transactions and DApp functions | Solana (SOL), Cardano (ADA) | Used for transaction fees, staking, network security, and running applications on blockchain platforms. | Drives the development of DApp ecosystems; versatile in use cases |

Privacy Coins | Prioritize user privacy by concealing transaction details for secure, confidential transfers. | Monero (XMR), Zcash (ZEC) | Use cryptographic techniques to hide transaction amounts and participant identities. | Provides a high level of financial privacy and confidentiality. |

NFTs (Non-Fungible Tokens) | Represent unique digital assets, like art, music, or virtual goods, on a blockchain. | CryptoPunks, Bored Ape Yacht Club | Unique, indivisible tokens that verify ownership and authenticity of digital or physical assets | Enable true ownership of digital goods, transferable and collectible. |

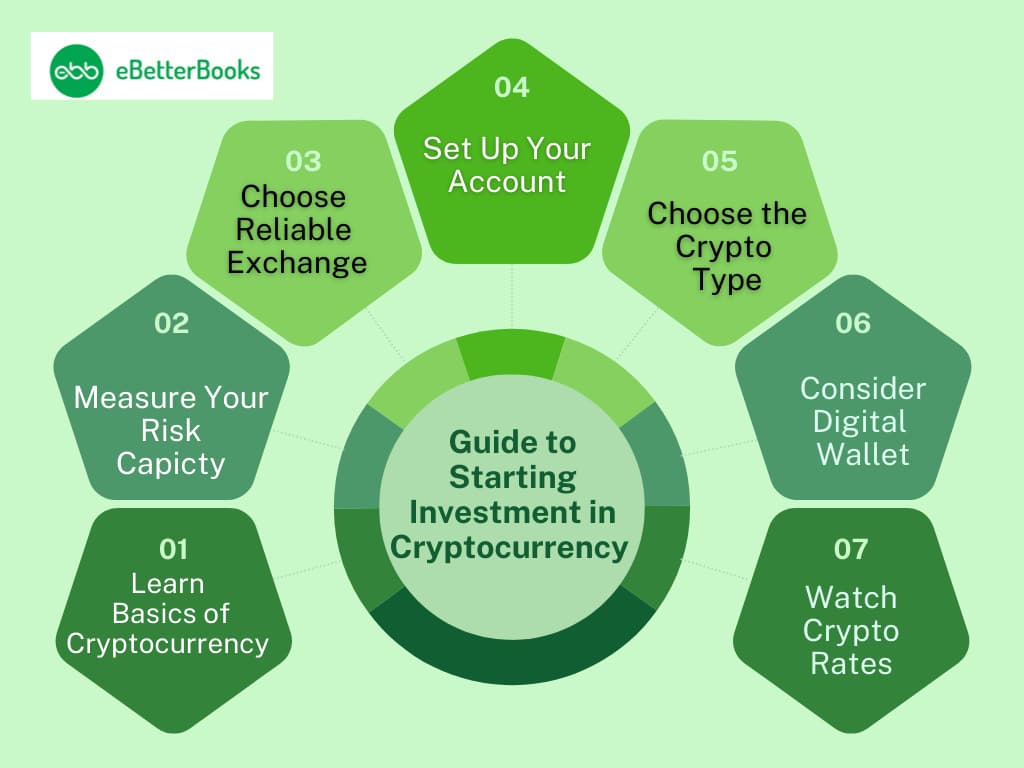

Guide to Starting Investment in Cryptocurrency

Here is the step-by-step process of investing in cryptocurrency:

01. Learn the Basics of Cryptocurrency

Before investing any money in cryptocurrency, take some time to understand what it is. Cryptocurrency is digital money that works outside of traditional financial systems. Instead of banks or governments, these digital assets rely on technology—specifically, blockchain.

What is Blockchain?

Think of the blockchain as a digital ledger that records all transactions. It’s distributed throughout a network of computers, making it extremely secure and nearly impossible to hack into.

Types of Cryptocurrency: While Bitcoin and Ethereum are the most well-known, there are thousands of other cryptocurrencies, each serving a specific function. Some are primarily used to make payments, while others are linked to real-world assets.

02. Measure Your Risk-Bearing Capacity

Cryptocurrencies are still relatively new and extremely volatile assets that can fluctuate significantly in value in a single day. While the long-term trend has been positive, there is still skepticism and opportunism in these markets.

As a result, the first concept is to invest only the amount of capital you are willing to lose if the market declines. Before investing in cryptocurrency, you should ensure that you have enough emergency savings. When you’re ready to invest, limit it to 5% of your portfolio.

03. Choose a Reliable Bitcoin Exchange

Cryptocurrency must be purchased via an exchange or investing platform, such as Coinbase, Gemini, or Kraken. When choosing an exchange, you may want to consider security, fees, trading volume, minimum investment requirements, and the varieties of cryptocurrency accessible for purchase on that platform.

- Look for reliable crypto exchanges that can help you. Some of the most popular options include Coinbase, Binance, Kraken, and Gemini. Always choose the exchange platform that can provide security and reliability for your investment.

- Check your security fee and transaction fee, then compare transaction fees, withdrawal fees, and what security features they offer, like two-factor authentication (2FA) and asset insurance.

04. Set Up Your Account

After you’ve settled on an exchange, you’ll need to create an account. Most platforms will require you to go through an identity verification process, similar to how banks verify your identity when you open a new account.

Complete KYC Verification: To comply with Know Your Customer (KYC) regulations, you will most likely be asked to upload identification documents such as a driver’s license or passport. This may take several hours or days.

Enable additional security features. Once your account has been created, make sure it is secure. Use two-factor authentication (2FA) and avoid reusing passwords from other accounts.

05. Choose the Crypto Type that Suits You

Now comes the exciting part: selecting your first cryptocurrency. Many people start with Bitcoin since it is the most established, while others are drawn to Ethereum because of its numerous applications.

Conduct your research: Each coin has unique qualities. Some are intended for everyday transactions, while others power decentralized apps (DApps). Before making a decision, research your possibilities.

Consider diversification. Consider investing in many cryptocurrencies to diversify your risk. A combination of dependable options (such as Bitcoin) and smaller, perhaps higher-growth currencies may help balance your portfolio.

06. Consider the Storage and Digital Wallet Choices

Cryptocurrency is entirely digital. Thus, you should save your coins in a digital location. One option is to keep them on the same platform as you invest. Today, many novice cryptocurrency investors favor this strategy. Simply choose a platform that will be in charge of the custody and security of your assets. Such platforms are regulated, have robust security against hackers and cyber threats, and are financially insured.

There

- Hot wallets: Most exchanges provide online wallets. They are handy for ordinary trade, but they are also vulnerable to hacking.

- Cold Wallets: For maximum security, use a crypto hardware wallet. These are offline devices that store your cryptocurrency keys and keep them safe from online threats. Hardware wallets are ideal for long-term cryptocurrency holders.

07. Keep an Eye on Cryptocurrency Exchange Rates

The bitcoin market is quite volatile. Thus, it is prudent to stay updated. You may set price alerts, follow market news, and keep track of the projects you’ve invested in.

Set Price Alerts: Use the price alert features offered by exchanges and apps. This way, you’ll be notified when your selected cryptocurrency reaches a specific price point.

Stay up to date with market news. Technological improvements, laws, and even social media activity all have an impact on cryptocurrency markets. Following cryptocurrency news may help you predict future events.

Wrapping Up…

Investing in cryptocurrency offers significant opportunities but comes with inherent risks due to its volatility and evolving nature. By understanding the basics, selecting the right cryptocurrency, using trusted exchanges, and employing secure storage solutions, you can position yourself for informed and secure investments.

It’s essential to stay updated on market trends, follow expert recommendations, and start with an amount you’re comfortable losing. With proper research, diversification, and risk management, cryptocurrency can serve as a valuable addition to a well-rounded investment portfolio. Always remember cautious planning and continuous learning are key to navigating this dynamic space effectively.

Frequently Asked Questions (FAQs)!

Is crypto a good investment?

As with other aspects of personal finance, the answer is, “It depends.” Cryptocurrency may be a decent investment for people who can handle the volatility and understand what they are purchasing. To avoid large losses, you should thoroughly investigate the cryptocurrency you intend to buy.

What is the best cryptocurrency for beginners?

Bitcoin is the ideal cryptocurrency for novices to invest in. It is one of the most simple cryptocurrencies on the market, and its widespread adoption ensures its long-term viability. It can be an excellent starting point for learning more about cryptocurrencies and determining how much volatility you can tolerate.

How much should you invest in cryptocurrency?

Some experts propose investing between 1% and 5% of your net worth. When deciding how much of your portfolio to invest in cryptocurrency, it’s critical to restrict your overall exposure to it. You should never invest more than you can afford to lose. While having a minor exposure to cryptocurrency may improve the risk-adjusted return profile of a diversified portfolio, the overall amount to invest in cryptocurrency should be determined by your overall investment portfolio and risk tolerance.

What do I need to know before buying cryptocurrency?

Cryptocurrency is a dangerous investment, so keep your eyes open for any traps. Digital currency is volatile; it is mostly unregulated, and there are numerous questions about how this new type of cash will evolve in the future.